Daily Crypto Signals: Bitcoin and XRP Navigate Turbulent Market, Government Shutdown Delays ETF Approvals

Bitcoin reclaimed the $114,000 mark following Friday's historic $15 billion futures liquidation event, though multiple headwinds including

Quick overview

- Bitcoin reclaimed the $114,000 mark after a historic $15 billion futures liquidation event, but faces challenges from US-China trade tensions and a weak job market.

- XRP experienced a 66% recovery from its crash low of $1.58, regaining $75 billion in market value as traders show confidence in further upside potential.

- The cryptocurrency market remains unstable due to economic uncertainties and regulatory issues, with the US government shutdown delaying crypto ETF applications.

- Concerns have been raised about centralized exchanges underreporting liquidations, particularly Binance, which could impact market transparency.

Bitcoin BTC/USD reclaimed the $114,000 mark following Friday’s historic $15 billion futures liquidation event, though multiple headwinds including US-China trade tensions and weak job market data could delay a push toward $125,000. XRP XRP/USD staged a dramatic 66% recovery from its $1.58 crash low, regaining $75 billion in market value as oversold technical indicators suggest further upside potential.

Crypto Market Developments

This week, the cryptocurrency market was very unstable because of general economic uncertainties and problems with regulations. California passed new rules to protect AI chatbots that might affect decentralized social media and gaming sites. The measure will go into effect in January 2026. The US government is still shut down for the third week, which has put about 16 crypto ETF applications on hold. This means that the Securities and Exchange Commission can’t make final judgments on regulatory approvals that were supposed to happen this month.

A big problem came out when Hyperliquid CEO Jeff Yan and CoinGlass, a data company, said they were worried that centralized exchanges, especially Binance, would be dramatically undercounting liquidations. Yan’s research shows that Binance’s data reporting system only records the last liquidation order for every second, which could lead to 100 times less reporting during burst liquidation events. The market saw $16.7 billion in long liquidations and $2.456 billion in short liquidations on Friday alone. This was the biggest liquidation event in cryptocurrency history.

Bitcoin’s Resilience Amid Multiple Headwinds

After Friday’s flash meltdown, which took $19 billion from the market as a whole and $15 billion from Bitcoin futures open interest, Bitcoin showed a lot of strength. Within 48 hours, the main cryptocurrency had recovered to the $114,000 mark, showing that long-term investors were still strong despite the terrible liquidation event. This recovery shows that Bitcoin’s basic attraction as a limited asset continues to draw in purchasers when prices drop, and institutional interest is strong even though prices are volatile in the short term.

But there are a number of things that could keep Bitcoin from rising to the $125,000 mark for weeks or even months. Investors are less willing to take risks in all asset classes because they are worried about the US labor market getting weaker. In September, only 17,000 new jobs were added. Trade tensions between the US and China are another worry. A temporary tariff truce is slated to end on November 10, and there are rising worries that things could get worse.

Traders are still very careful in the Bitcoin futures markets. Negative financing rates at Binance show that there is more chance of losing money with a counterparty. Some evidence suggests that a big market maker may have gone out of business following Friday’s crisis. The current government shutdown has made things much more difficult by delaying the publication of important economic statistics. This has left the Federal Reserve’s prognosis unclear before Chair Jerome Powell’s scheduled speech.

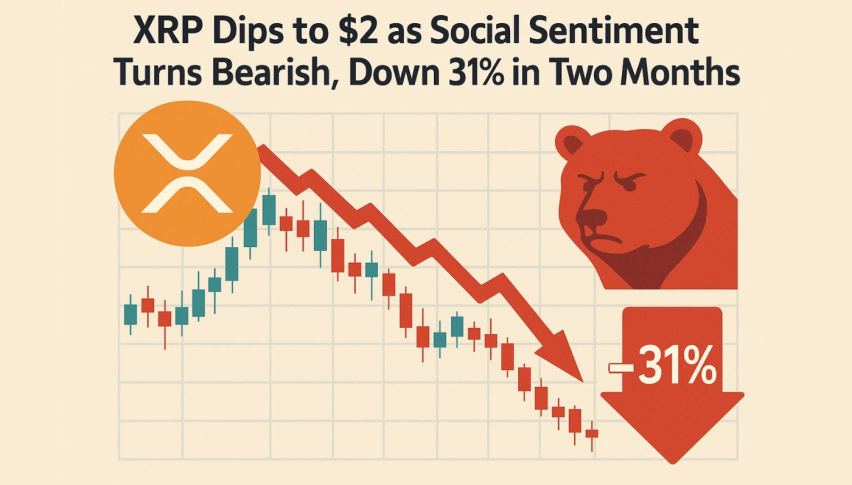

XRP’s Dramatic Recovery and Bullish Technical Setup

The native token of Ripple XRP made a great comeback after falling to $1.58 on Friday, the lowest level in 10 months, when President Trump said he would put 100% tariffs on Chinese goods. The altcoin has risen 66% from its crash lows and regained $75 billion in market value. This is because traders are aggressively buying the dip, which shows that they are confident that the market will move again soon. In the last 24 hours, trading volume rose by more than 35% to $11.5 billion, and derivatives trading volume rose by 44% to $12.2 billion. This shows that institutions are becoming involved in the recovery.

Technical indications show that XRP’s upward trend could keep going from where it is now. The Stochastic RSI achieved a very low level of 8 on the weekly chart, which has been a sign of big price gains in the past. XRP has hit local bottoms before macro movements higher when it was oversold earlier, including in November-December 2024 and June-August 2025, when it rose 486% and 91%, respectively.

XRP has to break over the $2.70–$2.80 resistance level, which is a key area where about 3.8 billion XRP tokens were bought. After that, it can aim for the $2.88–$2.95 supply zone, which is where the 50-day and 100-day moving averages are right now. Analysts are keeping a close eye on the weekly closing above the 2025 uptrend line as a sign that XRP is still ready for more positive momentum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account