GBP/USD Eyes Uptrend: Will Buying Momentum Push Price Above $1.2950 Today?

GBP/USD holds above $1.2948 as markets await U.S. election results and key economic data. Could this support level signal a bullish breakout

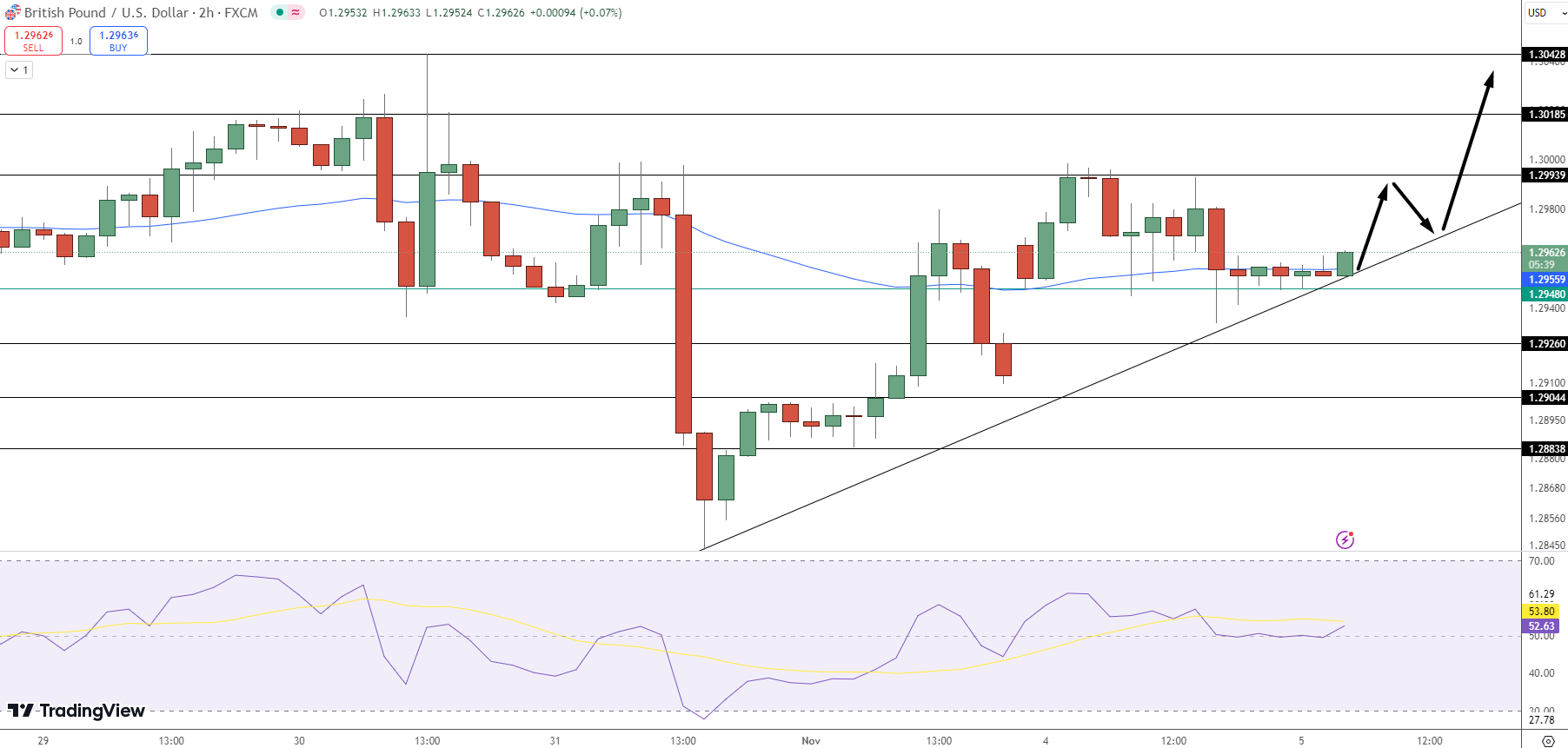

The GBP/USD pair is trading around $1.2963, showing resilience as it holds above a critical support level at $1.2948. This level acts as a pivotal point for the pair, reinforced by an upward trendline, creating a base that could fuel bullish momentum.

With the U.S. presidential election underway, the market is in a state of cautious anticipation, as results may influence near-term price movements for GBP/USD. Additionally, a series of economic indicators are scheduled, adding further weight to traders’ decisions.

GBP/USD holds steady near 1.2950 as traders await US presidential election result

— Market info (@allmarketinfo) November 5, 2024

Market Indecision and Technical Indicators

In the lead-up to the election results, the 2-hour chart reveals a pattern of Doji and spinning top candlesticks, highlighting market indecision. However, the appearance of a bullish engulfing candle on this timeframe indicates a potential shift toward an uptrend, as buyers seem to gain control over the direction. The 50-day Exponential Moving Average (EMA), which currently aligns with the price near $1.2948, adds another layer of support, enhancing the likelihood of a bullish breakout if this level holds.

The Relative Strength Index (RSI) is positioned slightly above 50, suggesting moderate buying interest. This technical indicator, paired with a recent bullish crossover of the 50-day EMA, leans in favor of a potential upward trajectory. Should the pair break above $1.2963, traders can look toward immediate resistance at $1.2999, followed by a secondary target at $1.3044, marking areas that could pose challenges in the near term.

https://twitter.com/LearnerDamie_/status/1853432755092169034

Upcoming Data and Key Levels to Watch

Alongside the election, several economic data points are scheduled to be released, adding volatility potential.

The U.K. BRC Retail Sales report showed a modest increase of 0.3% year-over-year, below the forecast of 1.4%, indicating slower consumer spending growth.

Meanwhile, the U.S. is set to release the ISM Services PMI, Final Services PMI, and trade balance data, each of which could sway the pair as investors digest economic health indicators.

Key Insights for GBP/USD Trading:

-

Support and Pivot Level: $1.2948, reinforced by the 50-day EMA and trendline.

-

Resistance Levels: Immediate resistance at $1.2999, with a secondary target at $1.3044.

-

Technical Indicators: RSI above 50 and a bullish crossover on the 50-day EMA signal potential upside momentum.

As the GBP/USD pair hovers near these levels, traders should monitor election outcomes closely, as results may dictate whether the pair can maintain its position above $1.2948 or if a downward shift is imminent.

If support holds, a bullish continuation toward $1.2999 and beyond is feasible, contingent on favorable election results and economic data.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account