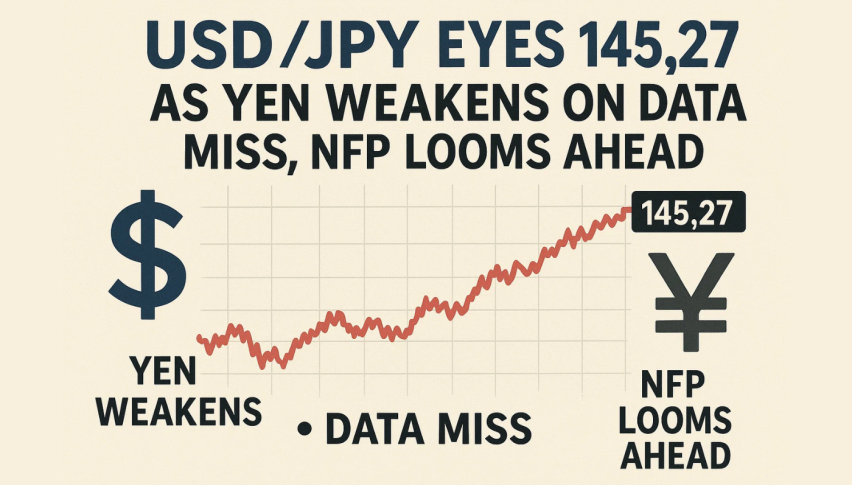

USD/JPY Eyes 145.27 as Yen Weakens on Data Miss, NFP Looms Ahead

The Japanese Yen remained on the back foot early Friday as traders digested a disappointing Household Spending report alongside...

Quick overview

- The Japanese Yen weakened due to a disappointing Household Spending report and a drop in real wages, raising concerns about consumer purchasing power and potential economic contraction.

- Easing tensions between the U.S. and China have diminished the Yen's safe-haven appeal, as market sentiment improved following a productive phone call between the two countries' leaders.

- Expectations for a potential interest rate hike by the Bank of Japan in 2025 are providing some support for the Yen, contrasting with growing expectations for rate cuts by the Federal Reserve.

- Technically, USD/JPY is showing bullish signals, trading near critical resistance levels, with traders advised to watch for potential breakout opportunities or signs of exhaustion.

The Japanese Yen remained on the back foot early Friday as traders digested a disappointing Household Spending report alongside another concerning drop in real wages. According to the latest data, household spending in Japan declined by 1.8% month-over-month and slipped 0.1% year-over-year in April, completely reversing March’s encouraging 2.1% gain.

Making matters worse, Japan’s inflation-adjusted wages fell for a fourth consecutive month in April, as rising prices continued to outpace wage growth. This persistent squeeze on consumer purchasing power is particularly troubling since private consumption accounts for more than half of Japan’s GDP, raising concerns about potential economic contraction.

Geopolitical Shifts Adding Pressure

Adding to the Yen’s weakness, easing tensions between the U.S. and China have eroded the currency’s traditional safe-haven appeal. Market sentiment improved noticeably after U.S. President Donald Trump and Chinese President Xi Jinping held what was described as a “productive” phone call on Thursday.

The leaders agreed that officials from both countries will meet soon for additional talks to address the ongoing trade war, providing modest tailwinds for risk assets including the U.S. Dollar.

Policy Tug-of-War Creating Currency Tension

Despite the Yen’s recent struggles, expectations that the Bank of Japan might raise interest rates again in 2025 are helping to limit further downside. This stands in contrast to growing market expectations for potential rate cuts by the Federal Reserve amid signs of slowing U.S. growth and persistent fiscal uncertainty.

Interestingly, the U.S. Treasury Department has actually encouraged the Bank of Japan to continue with monetary policy normalization. In its exchange-rate report to Congress on Thursday, the Treasury argued that tightening would “support a healthier exchange rate and facilitate needed structural adjustments in trade flows”.

Adding another layer to this complex relationship, Japan appears to be softening its stance on the 25% U.S. auto tariff. Reports indicate Japan is proposing a flexible framework to reduce tariff rates based on countries’ contributions to the U.S. auto industry, with Japan’s chief tariff negotiator currently in Washington for the fifth round of discussions.

USD/JPY Technical Analysis: Bullish Signals Emerging

From a technical perspective, USD/JPY has pushed above a descending trendline and is now trading just under the critical resistance level at ¥144.42. A bullish ascending triangle has formed on the 2-hour chart, highlighting growing upward pressure. The 50-period EMA at ¥143.51 now functions as dynamic support, with MACD turning higher and confirming a bullish crossover.

Key Levels to Watch:

- Resistance: ¥144.42, followed by ¥145.27 and ¥146.10

- Support: ¥143.51 (EMA) and ¥142.78 (trendline base)

A clean break above ¥144.42 could trigger a move toward ¥145.27, particularly if the upcoming U.S. Nonfarm Payrolls report disappoints expectations. Conversely, a failed breakout would shift focus back to ¥142.78. Traders should monitor rejection candles near resistance for signs of exhaustion, while bullish confirmation may offer attractive short-term entry points.

All eyes now turn to today’s crucial U.S. NFP report, which could determine the next significant move in this currency pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account