Gold Finally Broke Out Of The Range, But Is There More Upside Potential Or Are We Heading Back Down?

My colleague Arslan, who is in charge of Gold analysis, suggested in an earlier update that it would be a fairly easy trade to buy gold around $1125 and target the top of the range.

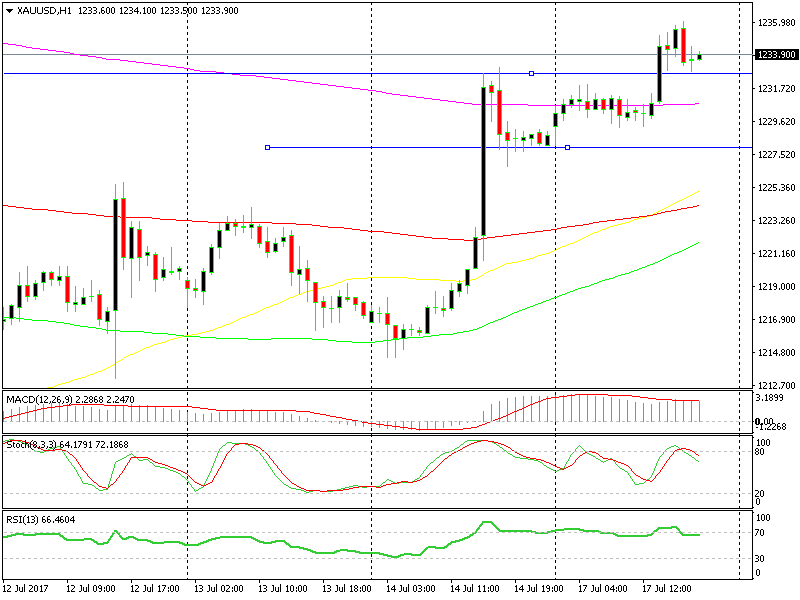

Arslan had spotted a range between $1128 and $1132 which was formed in late US session on Friday and continued into this morning.

The range was finally broken this morning

The range was finally broken this morning

Though the signal missed the entry point and didn´t get triggered, the Gold broke the range on the top side as Arslan had predicted.

Now, the top of that range has turned into support and rejected the price twice in the last few hours. Do you think we should go long around these levels?

Well, we can play the top side with long term signals a few times, hoping that the upper line of the range will keep providing support.

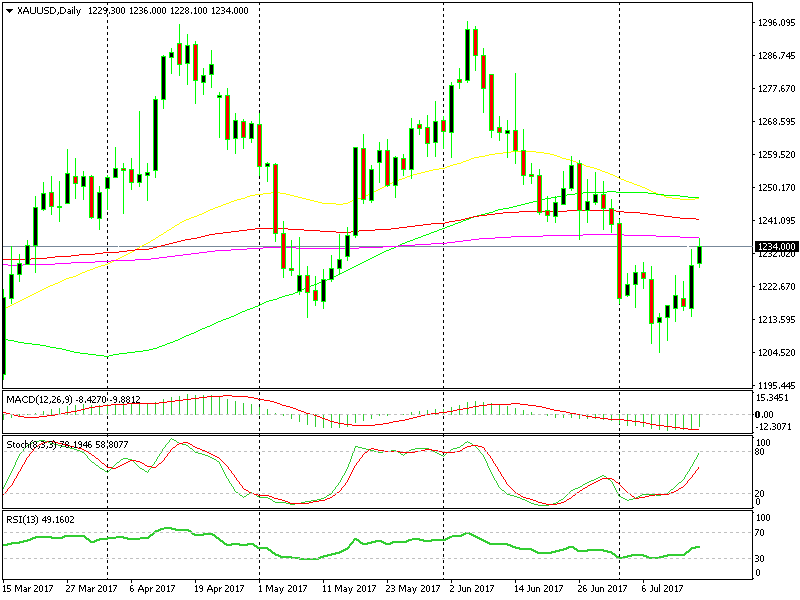

But, switching to the daily gold chart, we can see that we´re banging our heads against the 200 SMA (purple) which has previously acted as support and has now turned into a resistance.

The daily gold chart looks bearish though

The daily gold chart looks bearish though

That moving average stands around $1136.30-40 at the moment and the stochastic indicator is almost overbought. It will probably become very overbought when today´s daily candlestick closes at 23:00 GMT, so the upside is at risk.

In fact, the chart setup looks pretty bearish; the bigger trend, which started in early June, is down and the retrace higher is coming to an end.

On the other hand, the fundamentals are still pointing upward, with the USD still on the defensive since Friday when US inflation missed expectations. Forex is full of dilemmas and this is one of them, but the downside looks more favorable on the daily chart.

If you decide to sell close to the 200 SMA, then the stop loss must be above the 200 SMA obviously, to give it some room to breathe.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account