Overview of the Pre-FOMC Trading

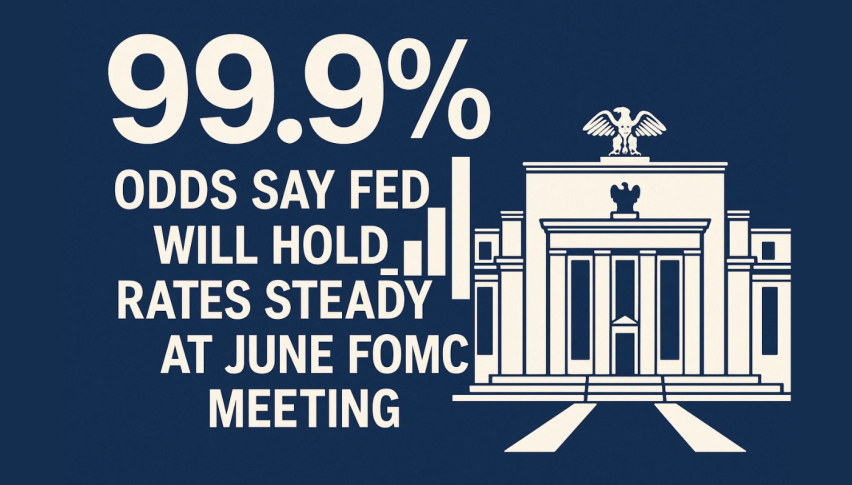

Since we’re expecting the FOMC press conference and subsequent statement this week, the first trading day is always important. Apart from that, the Federal Reserve will be releasing its rate decision as well. Even though I am not expecting any change in interest rate, it’s worth monitoring this decision for further clues about US Dollar movements.

What will my trading be like this Monday?

In my opinion, you can expect today to be what’s called a ‘clam trading day’ with thin trading volume because there are very few high-impact economic events. Traders will prefer to stay away from the market, and making major trading decisions until Wednesday (aka FOMC day). Let’s focus on the fundamentals that we need to consider.

China’s industrial production and Fixed Asset Investment are the main economic events worth watching today. Chinese National Bureau of Statistics is about to release their figures in the early trading session, and this can impact the currency markets, oil prices, and even the stock markets. As China is a developed economy, even slight shifts in economic status can influence the global markets. It will also impact the West Texas Intermediate (WTI) oil prices and represents growth in the global economy. Thus, ultimately increases demand for the commodity.

In relation to other economies, particularly the UK and Japan, there is not much to comment from their low-key events aren’t having much effect on the market. The UK economy is releasing CB Leading Index, whereas the Japanese ministry of finance will release BSI Manufacturing Index. And concerning the Aussies’ market, most of the banks will remain closed in the observance of the Queen’s birthday. So, for now, I don’t see any fundamentals which will impact the US dollar… choppy trades and limited movements can be expected.

Potential Trading Opportunity:

I’m looking to pocket 30 -50 pips today by trading the USD/JPY pair. It has a triangle setup in the H4 chart and is trading below the trend line resistance of 107.180 – as well as the 50 periods EMA. I will consider taking trades below 107.100 and 106.250 with a target of 105.750. Lastly, I expect the pair to trade in a trading range of 107.850 – 105.750.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account