A Tough But Profitable Year – 2016 Yearly Analysis

We've made it through another year. 2016 is now history, but it´s been an emotional year full of forex events. It hasn't been the easiest time, but we have added some more guns to our trading arsenal.

The investor sentiment has shifted from negative to positive quite a few times and the forex market has followed suit, but our trading strategies have kept us afloat and ensured a good profit in 2016 in this roller coaster of a market.

During 2016 we had to employ all sorts of strategies. Long and short-term trading strategies, such as scalping, fundamental and technical strategies have all been included in our forex trading textbook this year.

All these strategies have resulted in 731 forex signals this year, 220 of which were long-term signals while the other 511 were short-term signals, compared to last year when we made just above 4,000 pips and pledged to increase the profit this year. We kept that promise since our forex signals brought us 4,907 pips.

We only had one losing month this year, February, which was the time when the financial markets went through a panic period, but we recovered well. All the other months have been really profitable for us, despite some of the most important political changes we have seen since the fall of the Iron Curtain in Eastern Europe.

No one would believe this at the beginning of 2016, but Brexit happened and Trump won the US presidential elections. Now, a year later, the world is a little different, the global economy is a little better off, but our performance has remained consistent.

Let´s celebrate the pips we made in 2016

Forex Signals

When it comes to forex signals, I can say that I can almost remember everything that we went through this year. How can I forget the panic which engulfed the financial markets in February that nearly sparked another global crisis… or Brexit? We lost some pips in February, but we made double that amount in June when Britons voted to leave the EU, although we had to bet against the world.

In fact, we couldn’t ask for a better start to this year when we closed January with an 818 pip profit. But, the market had other ideas. A dark cloud of doubt cruised over the financial markets in the first few days of February and it didn't take long before everyone started panicking.

Cash flows into safe haven currencies, such as the JPY, when into panic mode, so although this major currency has been the weakest link in 2015, in February 2016 the Yen was the biggest winner. We opened a couple of long-term signals as this forex pair slid down, hoping that the 116, 115 and 110 support levels would hold, but the price went through them like a knife through butter.

We got our hands cut trying to catch that falling knife, so we had to give back to the market about half the pips we made in January. However, we altered our trading strategy and got back on our feet in no time, so by the end of May, we were more than 1,500 pips in green.

In June, Brexit was the winner… but as we mentioned above we took the opposite direction, betting against the Euro and the Pound in the last trading session before the referendum. By morning the next day, we received 400 pips profit from those two long-term forex signals. Didn't feel right to bet against the world, but someone has to be the devil´s advocate.

July to October was pretty straight forward for us. Our profit was steady at around 400 pips a month, so our yearly profit kept accumulating. Luckily for us, the 700 pip GBP flash crash in October didn´t get us. Or perhaps it was us being stubborn not to go against GBP/USD for whatever until Brexit actually happens. Only then the long-term GBP trend may shift upwards.

We continued with the same performance in November and December, despite the huge shock after Trump´s triumph. We sold EUR/USD before the elections day since all polls were putting Clinton ahead, but she lost and the forex market went mental for a few trading sessions.

Our forex signal survived the 300 pip jump in the first hours after the elections. Then, as the hours and days past, the market finally saw something that's been in front of us; Trump is positive for the Buck, period, at least in the near term.

We got some more pips from that EUR/USD signal, but still far from its potential. Nonetheless, we made 968 pips in the last two months, ending 2017 with 4,907 pips in our forex account. The amount of money you guys have made from our forex signals depends on the account size, but if you're using 10 times leverage… then your account must be about 5 times bigger now and that's if you have only traded the same amount in every trade as the first day.

Let´s say you had a $10,000 account on January 1st. If you used 10 times leverage on the first trade, that means you'd be making/losing $10/pip. A 5,000 pip profit means $50,000 profit by now.

But, the trade size increases as the account gets bigger, so if you´re only readjusting your positions at the end of each month, the geometrical progression increases your profit even further.

After making 800 pips in January (which means $8,000 extra on your forex account), in February you´re trading nearly double that amount, so the profits/losses would be in kind. In this case, which is how forex traders really trade, by now your account would be about 50 times as large.

Most of our profit this year came from EUR/USD and GBP/USD since about half of our signals were in these two forex pairs. But, NZD/USD and AUD/USD were not far behind. We also made 111 pips from USD/JPY which is good enough considering the pain this pair put us through in February. So, we had a pretty good year after all and our win/loss ratio remained the same as last year at 71:29.

The market this week

Last year ended with a pretty positive feeling around the markets. The FED had just raised interest rates for the first time in about a decade which meant the US economy was heading in the right direction. The ECB (European Central Bank), on the other hand, increased its monetary easing programme, which meant that the Eurozone economy would head in the right direction soon.

At least, that´s how the market took it when the ECB cut interest rates further last December. Euro pairs surged more than five cents. In fact, the Eurozone economy did head in the right direction this year and the EZ economic data we saw in 2016 strongly supports this view.

But, of course, nothing is that easy or that straight forward when it comes to the global economy. The financial markets entered a dangerous period of panic in February for a number of reasons: the US winter slowdown, low oil prices, and low inflation/deflation in some places like Japan and, of course, worries about the Chinese economy.

All these elements spurred a downward spiral and the world nearly ended up in another global crisis. Then, the politics kicked in and the forex market never looked at the economics again, partly due to a notable improvement in the global economy. All the major economies of the globe entered another phase this year, with inflation and GDP picking up nicely.

But, you can never have a moment of peace in this business. Just as the global economy improved, the Brits decided to screw it all up in June when they voted to leave the European Union. That brought back to attention the dark clouds of a possible EU breakup.

The Pound lost about a fifth of its value the next day and in the next few months, the losses extended to about a quarter. Subsequently, the UK economy shrank due to devaluation in the housing sector, so it slipped to the 6th place in global ranking (from 5th), which has now been taken by France. Before I forget, GBP suffered another flash crash during an October night but it recuperated quickly.

The next event to follow was the long-awaited and much-discussed OPEC meeting. After months of negotiations and spy games, the cartel finally decided to cut oil output and they convinced non-OPEC oil producers to join in as well. Oil prices are better off now and inflation has picked up as a result of this, so this has been a positive event, despite having to pay a bit more at the petrol stations for the gallons in my tank.

That was not all, though, the biggest surprise was yet to come. The US presidential elections were supposed to be a straightforward event, with Clinton far ahead in all polls. But the UK elections last year and Brexit earlier this year taught us not to bet our house on these polls. It didn´t take long before the voters threw the polls in the rubbish bin once again, this time with the US voters.

Donald Trump won the US elections and will be the next US president in a few days, but contrary to the market consensus beforehand, his presidency is more likely to be positive for the US economy and the global economy in the short term. An ambitious fiscal stimulus plan, better market sentiment, lower taxes and less regulation are supposed to give the global economy another push. Adding to that the fact that Republicans took the senate as well which means that, unlike Obama, Trump´s car won´t have mud on its wheels – everything falls in place. It all starts to make sense now, hence the USD surge in the last several weeks.

The FED had to close this year again in a similar fashion as in 2015. They promised to hike the interest rates two to four times this year, but only increased them once by another 25 bps (basis points). Again, they promised more hikes for next year, but we´ll see if they´ll keep the word this time.

Economic data

At the beginning of this year, the economic data was pretty disappointing. Inflation reports from Europe kept missing expectations as it remained around 0-0.1% and Japan was tasting deflation again.

The US economy was not doing much better either. After a great spring/summer period in 2015, the US economy entered a vegetative state during late autumn and it got worse during winter. It spilled into the first several months of this year, too.

On the other side of the globe, the Chinese economy was suffering as well as the GDP and manufacturing data continuously disappointed. As if it wasn´t enough, the emerging markets were suffering too due to low commodity prices and weak demand from big/developed economies.

But somehow, the whole picture became brighter as spring arrived and the global economic data improved further during the year. Japan finally crawled itself out of deflation, the Eurozone inflation moved closer to 1% from being flat a year ago, while the services and manufacturing reports have impressed as well, especially in the last few months.

Besides inflation, the labour market has improved immensely, both in Europe and the US. The consumer and investor sentiment has picked up too, but the wages remain subdued for some reason.

Well, this is the first real wave of global economic improvement since the 2008 GFC (global financial crisis) so I don´t expect wages to pick up at the same pace as the rest of the economy since they are the last thing to go up after everything else. But generally, the global economy is in a much better place at the end of 2016 than it was a year ago.

Pair analysis

In a yearly review such as this one, the only forex charts to look at are the weekly or monthly charts and the only forex pairs which portray the general picture are USD/JPY and EUR/USD, so let´s have a look at them.

As you can see from the monthly USD/JPY chart below, this forex pair reached its zenith by the middle of 2105 and it traded in a 500 pips range most of the last year, mostly above the 120 level. This year though started the way it did, and the weakest currency in the last four years turned into the strongest one, at least until November.

As JPY strengthened, USD/JPY declined; it lost about 10 cents at first, but the 111 level kept it afloat for some time. Then, the second wave of USD/JPY selloff took this pair as low as 105. Brexit sparked the third selling wave and the priced reached 99 for a moment, but 100 remained as the ultimate support level.

That´s close to the 50% Fibonacci retracement level, but more than that, it was the importance of this massive level that kept sellers at bay. After attempting many times to break below this during summer and autumn, the sellers finally gave up when Trump won the US elections. Now this forex pair is about 17 cents higher and still pointing north.

The 2016 H1 losses have almost been erased now

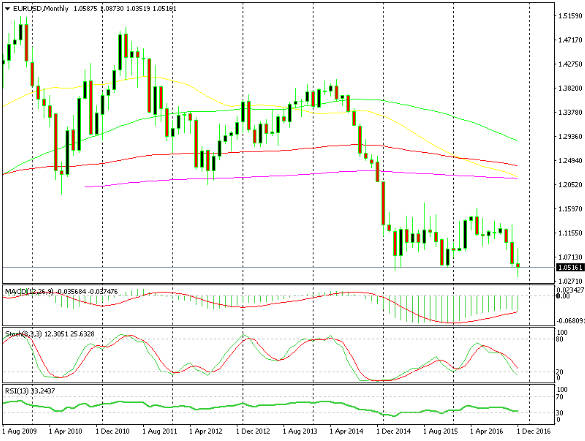

Looking at the bigger picture of EUR/USD, we can say that the 35 cent downtrend which started in 2014 was officially over as we entered 2016. It traded in a 10 cent range most of the last year, which was exactly what it did this year as well. 1.0520 was the bottom and 1.14-15 was the top.

But similarly to USD/JPY, this pair started waking up when Donald Trump won the elections. It kept sliding for the last several weeks of the year and it finally broke below that support level which stretches from 1.0520 all the way to 1.0460s.

We can say that the range of the past two years is now broken and that support level has turned into resistance now. The stochastic and RSI indicators are already oversold on the weekly and monthly chart so we might see a retracement period in the coming weeks/months, but the 100 smooth moving average (100 SMA) in green which is hanging around the 1.1050 level will place a lid yet another time to this pair, if we do get up there.

So, that would be the best place to open a long-term sell forex signal, but 1.07 and 1.08 might also offer some good trading opportunities if we can´t reach that far up.

The previous support has now turned into resistance

We can trust the green line on this chart

Week in Conclusion

So, here goes another year. We made it through with a nice 4,907 pip profit but it hasn´t been easy. We expected the central banks to be in the centre stage this year but politics snatched it from them, as politics usually do.

A new world order is underway with Britain out of the EU and Trump as the next US president. OPEC also was in the spotlight for a period of time, apart from the February market crash.

That´s how working in forex is like, you expect something from your cards but you don´t even get to use them as all these events shuffle the cards all the time. 2017 is expected to be positive for the Buck and probably the Euro if the Eurozone recovery continues, while the GBP and the Yen are likely to lose more value and we will post an editorial for the year ahead, but judging from this year, we expect the unexpected.

Anyway, we will be here throughout next year as we´ve done all these years, so we will be together for better and for worse whatever happens in the forex market. Hopefully, we will increase our yearly profit further in 2017.