WTI Crude Oil, Is This the Start of a New Trend?

The WTI crude oil surged more than 90 pips and placed a daily high at $55.04 in the late European trading session. What a great trade opportunity that was, but we just missed it. Never mind, we will have some more trade opportunities come our way.

If you are looking for a reason behind this huge bullish move, let me help you with this.

The organization of petroleum exporting countries (OPEC) reconfirmed that they are committed to cut oil output and they anticipated the assent of the deal is likely to be even higher.

Guys, we should always value any remarks from the OPEC because as per the recent assessments, more than 80% of the world's WTI crude oil resources are located in OPEC Member Countries. The Middle East takes a lead on having 65% of total reserves.

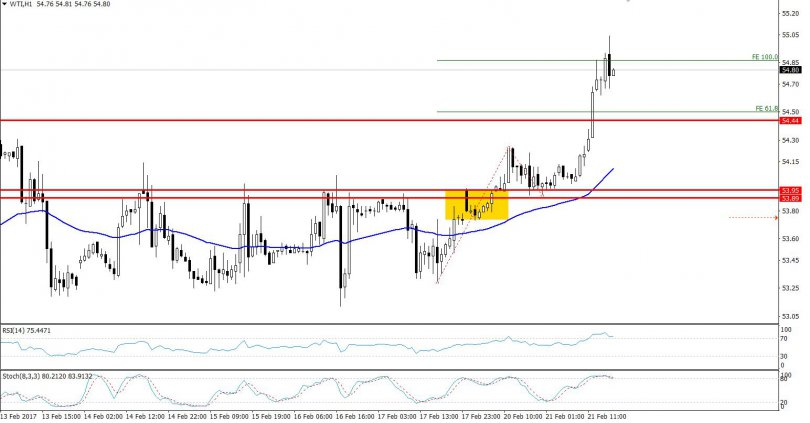

At the moment, the Black Gold is trading at $54.77 right below a major resistance level of $54.90. The leading indicators, especially the RSI (Relative Strength Index) is holding at 75. It shows that the oil is trading in an overbought territory. It also shows that the buyers are exhausted by the fact that sellers are looming around the area.

Moreover, we may see some profit taking in the commodity which is likely to push the black gold deeper towards 61.8% Fibonacci retracement level of $54.35. In my opinion, having a sell position below $55.95 will be an idea. The stop loss needs to be above $55.10 along with the 1st take profit at $54.60 and the 2nd take profit at $54.35.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account