Forex Signals US Session Brief, Oct 16 – The Soft Data Keeps Coming From All Over the Globe

Today, we saw a number of important economic report being released from Europe and North america. It kicked off with the inflation report coming out of Britain this morning. Inflation has been one of the aspects of the UK economy which has been holding up well recently, despite the services, manufacturing and construction falling into contraction. Although, inflation cooled off in August, which increased fears of a slowdown. But, today’s CPI report calmed the nerves ad headline CPI remained unchanged at 1.7%, while core PCI jumped 2 points to 1.7% from 1.5%, which are decent levels.

The Eurozne CPI (consumer price index) report was released 30 minutes later. This was the final reading and it showed that headline inflation ticked lower to 0.8% from 0.9% in the first reading for September, but at least core CPI remained unchanged at 1.0%. Canadian inflation was more mixed, with monthly CPI coming at -0.4% and yearly CPI remaining at 1.9% against 2.1% expected. Although, the other inflation measures such as rimmed mean and median CPI moved higher. The US retail sales closed the streak of data and September’s figures were negative, which should effect some members of the FED when this month’s meeting comes, but numbers for August were revised higher.

The European Session

- UK CPI Inflation Report – UK Inflation report was released this morning. CPI YoY was expected to tick higher to 1.8%, but remained unchanged at 1.7%. UK September CPI MoM missed estimates as well, showing a 0.1% growth against +0.2% expected. Although core CPI moved higher to 1.7% as expected, from 1.5% previously.

- UK PPI Inflation Report – The producer price index PPI output MoM came in at -0.1% vs +0.1% expected. PPI output YoY also ticked lower to 1.2% against 1.3% expected. PPI input MoM comes at -0.8% against +0.2% expected, PPI input YoY -2.8% vs -1.7% expected. August HPI beat expectations coming at 1.3% vs 0.6% YoY expected, prior stood at 0.7%but was revised to +0.8%.

- UK Employment Report – The final Eurozone consumer price index CPI YoY inflation was released after the UK inflation report. CPI ticked lower to 0.8% from 0.9% in the first estimate. Core CPI remained unchanged though at 1.0% which takes some of the heat off the softer headline CPI. CPI MoM ticked higher to 0.2% as expected, from 0.1% previously. So, softer headline inflation but core inflation at least remained unchanged.

- Will Germany Induce Some Fiscal Stimulus into the Economy? – We have heard rumours lately that Germany might start a fiscal stimulus programme to help the economy. Today we heard such rumours again from Bloomberg, citing German officials as saying that they are preparing for stimulus measures if the economy and GDP figures continue to take a hit. Now is the time more than ever to inject some cash into the European economy.

- Brexit Roundup – Today we heard many comments on Brexit, some of which contradict each other.

France’s European Affairs Minister, Amélie de Montchalin

- Brexit agreement is possible

- UK has made new Brexit proposals

- Insists that all outcomes are still possible on Brexit

ITV Political Editor, Robert Peston

- DUP said to be unlikely to support anything that is negotiable

Bloomberg Citing a UK Official

- UK government said to be downbeat on chances of a Brexit deal

- DUP is holding up progress and that chances of a Brexit deal are low

DUP Lawmaker, Sammy Wilson

- No amount of money would offset damage to the Union

Bloomberg Again

- EU said to see Brexit deal as impossible unless the UK moves

- Technical Brexit negotiations said to have reached an impasse

- Brexit negotiations may collapse amid DUP resistance towards a deal

- Fate of Brexit negotiations said to hinge on a move from London now

The US Session

- US Retail Sales – US retail sales were expected to increase by 0.3% for September, while core sales were expected to increase by 0.2%. Retail sales missed expectations, declining by 0.3% in September. Core sales also turned negative declining by 0.1%. The previous headline sales stood at +0.4% but were revised higher to +0.6%. Previous core sales excluding autos which stood at 0.0% were also revised higher to +0.2%. This is the first decline seen in seven months and these are some weak numbers. The revisions mitigate a bit of the pain but the report comes at a delicate time ahead of the Oct 30 FOMC meeting and might tilt some voters towards supporting a cut.

- Canadian CPI Inflation – The inflation report from Canada was released at the same time as the US retail sales report. Headline inflation for September missed expectations of -0.3% and instead declined by 0.4%. This is the third negative reading in the last four months and the CAD lost around 20 pips immediately after the release. CPI YoY remained unchanged 1.9% against a jump to 2.1% expected. But, median CPI ticked higher to 2.2% as expected from 2.1% previously. Common CPI also ticked higher to 1.9% against 1.8% expected and previous. Trimmed mean CPI moved to 2.1% as expected as well, from 2.0% previously. The big drag on the headline came after a 10.0% YoY fall in gasoline prices. Excluding gasoline, the CPI was up 2.4%, much higher than it seems.

- More Brexit Comments – EU’s Donald Tusk said just a while ago that we will know in 7-8 hours when Brexit may happen. But, DUP leader Arlene Foster says sources suggesting deal are ‘talking nonsense’. Important day today for Brexit.

Trades in Sight

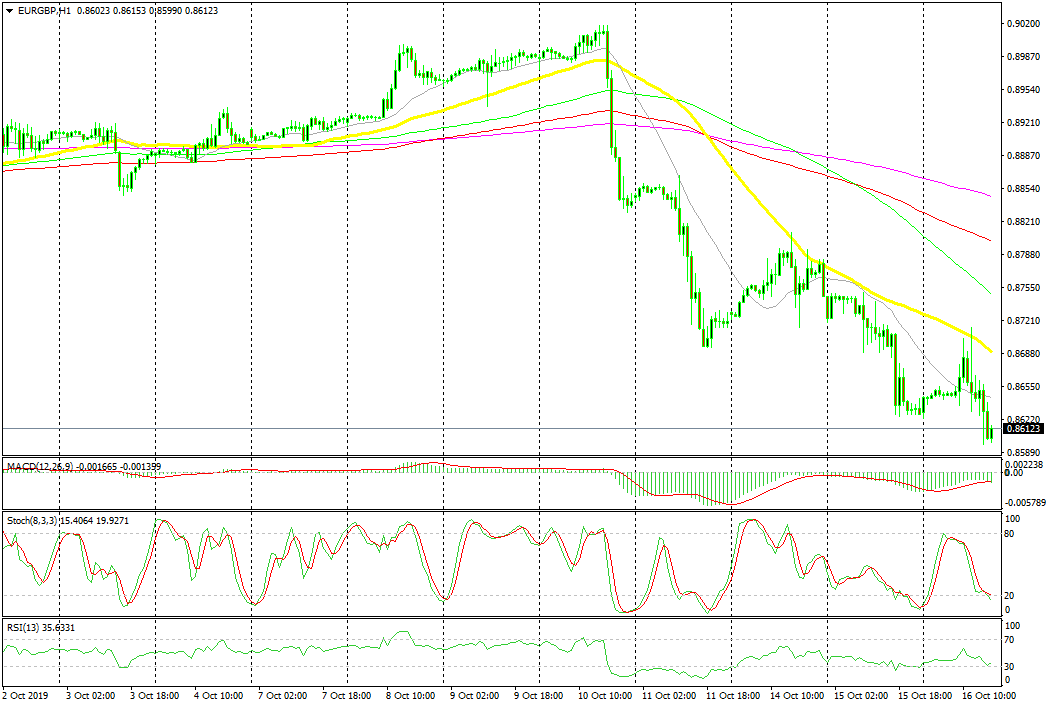

Bullish EUR/GBP

- The trend has turned bearish

- The 50 SMA is pushing the price down

- In case of a Brexit deal, the GBP will rally higher

The 50 SMA keeps pushing EUR/GBP lower

EUR/GBP has heeb bullish for months, but it turned bearish last week after rumours of a possible Brexit deal. The rumours are still being heard and despite the uncertainty and contradiction, the situation has improved for the GBP. The 50 SMA is also doing a good job on the H1 chart, providing resistance on pullbacks higher. If a Brexit deal is reached,then the Euro will rally but the GBP will rally harder, which would be negative for this pair, so we are keeping a bearish bias.

In Conclusion

The sentiment remains positive in financial markets today, as safe havens have turned bearish again. But, Commodity Dollars are still sliding, which means that we’re going through a phase of USD strength right now. Let’s see how long this can continue.