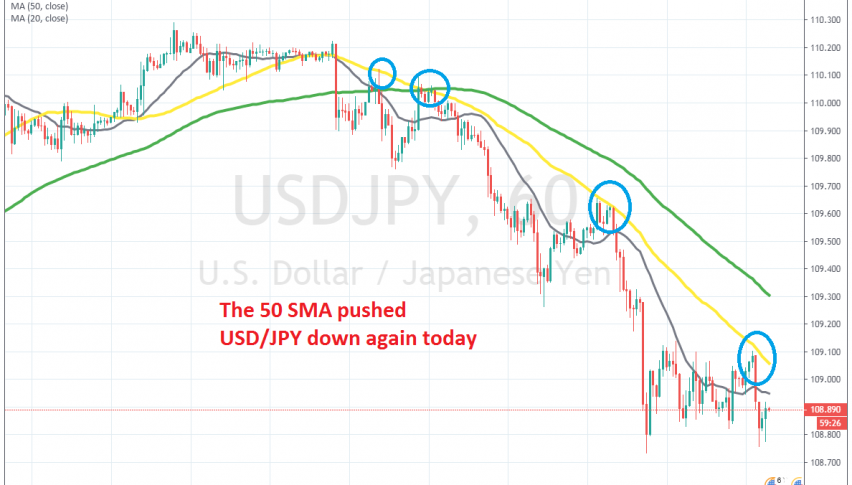

The 50 SMA Keeps USD/JPY Down, Despite Kuroda Pledging to Keep Easing

USD/JPY was consolidating in the last few sessions, but it resumed the downtrend once the 50 SMA caught up on H1 chart

The Governor of the Bank of Japan was commenting earlier at the Japanese Parliament. He made the usual comments, about low inflation and the willingness from the BOJ to keep easing the monetary policy until they achieve their inflation goal, which will take a long time. Below are some of his main comments:

- Will continue with easing to achieve inflation target

- Policy is aimed at BOJ’s objectives, not to help government’s fiscal policy

- Monetary policy is to achieve price stability and financial system stability

- It is important for the government to maintain trust in its finances

But, the JPY continues to be bullish and USD/JPY reversed down earlier today. We saw a retrace in the last couple of sessions, which looked more like a consolidation, which also shows that the pressure is on the downside, since buyers can’t form a proper pullback. Once the 50 SMA (yellow) caught up with the price on the H1 chart, the downtrend resumed. We didn’t sell, since we were already short on EUR/JPY, so we booked profit on that trade.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account