A Great Opportunity to Short the Retrace in WTI Crude

Crude Oil turned bullish in October, as the sentiment improved in financial markets due to comment about the Phase One deal between US and China. The trend has been bullish throughout the last few months of 2019 and the decision by OPEC+ to cut production further in December sent US WTI surging higher.

Geopolitical tensions in the Middle East also gave crude Oil another push higher in the first week of this year, on fears of a possible production disruption. But, after the US didn’t follow through with attacks the situation improved and crude Oil made a massive bearish reversal.

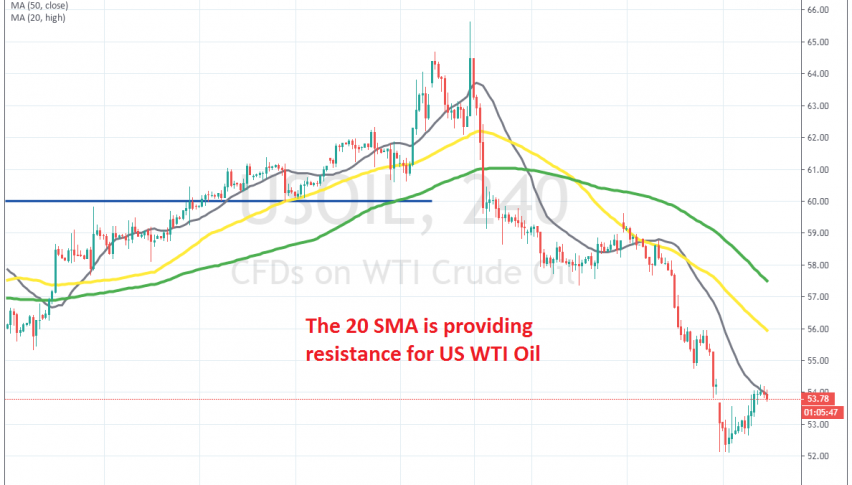

The corona-virus outbreak in China hurt the sentiment further in the last couple of weeks, which accelerated the decline further. Although, we have been seeing a retrace higher in the last couple of days, but the retrace seems complete now, which presents us with a good selling opportunity. WTI crude Oil has reached the 20 SMA (grey) on the H4 chart, which seems to be providing resistance now.

The stochastic indicator is overbought on this time-frame, telling us that the retrace is complete and the last two candlesticks have closed as doji/hammer, which are reversing signals. We decided to open a long term sell forex signals, shorting WTI below the 20 SMA, with a stop above $55 and a take profit target above the previous low. Now, let’s see if the bearish trend will resume again.