WTI Crude Oil Rose Amid Supply Cuts & Gradually Improving Demand

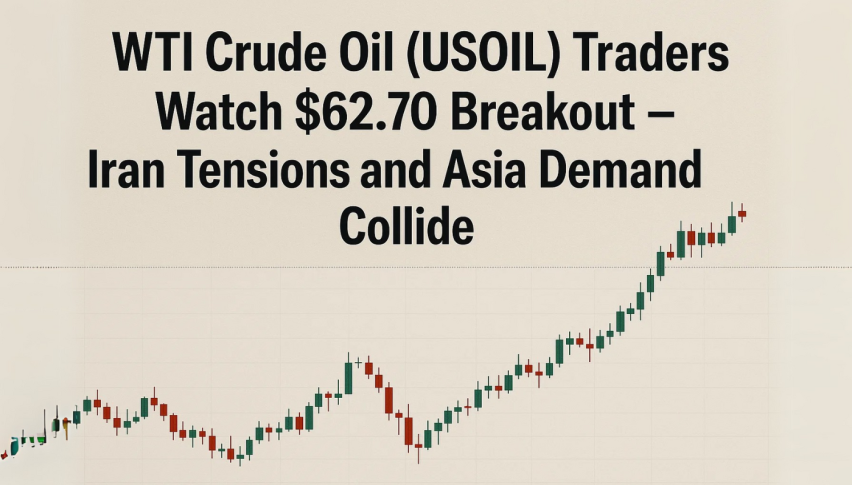

The U.S. oil bullish trend continues to dominate the market but recently, the oil is trading within the sideways range, holding mostly below

WTI crude oil prices rose as investors did not face any disappointment during the last day of the WTI futures June contract on Tuesday. Also, the oil price recovery could also be attributed to the American Petroleum Association, which reported a surprise crude inventory draw of 4.8 million barrels for the week ending May 15 on Tuesday. Moreover, the recovery in China’s economy after easing lockdown also bolstered the demand for crude oil and contributed to gains. At press time, crude oil is currently trading at 31.80 and consolidating in the range between 31.59 and 32.30.

WTI futures increased 0.16% to $32.01, recovering some of its losses from earlier in the session. The prices of crude oil were further bolstered by the signals of China’s return to work like before the crisis days, which increased the demand for crude oil and contributed to the oil gains. The reason for the oil prices rally could also be attributed to some of the Middle East countries cutting additional supply.

On the negative side, the overnight losses in crude oil were bolstered by the fears of a full-fledged trade war between China and the United States. The recent Aussie-Sino tension also disturbed investor confidence as China imposed 80% tariffs on Australian barley which weighed on the oil prices earlier. Moreover, the reason for overnight bearish pullback could also be attributed to Trump’s push for an investigation into China’s role in global coronavirus (COVID-19) outbreak.

Daily Support and Resistance

S1 29.36

S2 30.62

S3 31.26

Pivot Point 31.89

R1 32.53

R2 33.15

R3 34.42

US oil’s bullish trend continues to dominate the market but recently, oil is trading within a sideways range, holding mostly below 32.94 area. On the lower side, support stays at 31.15 level. A bearish breakout of 31.16 level can extend selling until 30.40. Bearish bias can dominate today.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account