Will We See Cardano (ADA) Reclaim $2 Level Soon?

Potential Ethereum killer Cardano (ADA) is having a bullish start to Wednesday after exhibiting weak moves through the past few sessions.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Potential Ethereum killer Cardano (ADA) is having a bullish start to Wednesday after exhibiting weak moves through the past few sessions. After sliding down to the $1 level during the crypto market crash a couple of weeks ago, ADA has been on a rather challenging path towards recovery and reclaiming of the key $2 level.

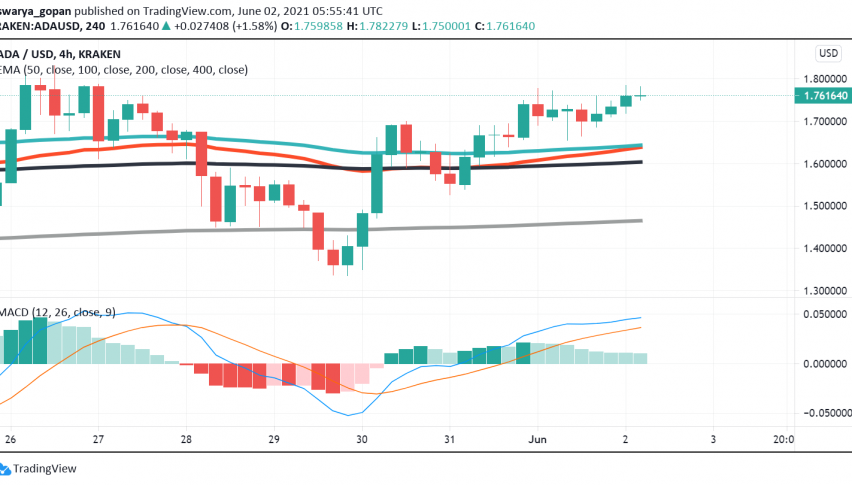

However, things seem to be looking up for Cardano at the moment, At the time of writing, ADA/USD is trading at around $1.76, with the next key level sitting not too far away. What’s encouraging is that its price appears to be making higher lows lately – a promising sign that the bullish momentum is gaining strength.

Leading crypto trader and analyst Michael van de Poppe recenty posted a video explaning why he remains bullish on Cardano, as he expressed optimism that its price could soar to as high as $5 soon, making it the fourth largest cryptocurrency by market cap. The analyst mentioned the key resistance at $1.80 level, just below which the ADA/USD is trading at present, and hoped that a break above this could power an uptrend all the way to $3.35.

Key Levels to Watch

The moving averages and the MACD indicator on the H4 chart of ADA/USD are suggesting a bullish bias, offering some hope that buying pressure could be building up in the near-term. The price recently broke out of a triangle pattern being formed by some of the moving averages to the higher side, further reinforcing expectations of a stronger uptrend soon.

As we mentioned above, the next key level of interest to watch is the resistance at the $1.80 level. Once the $1.80 level is crossed, buyers are likely to face some challenge as they attempt to overtake the $1.90 level and make their way to $2.00 and beyond.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account