EUR/USD Signal Heads Toward TP Target, After FED Members Confirm Tapering

Earlier this week the FED chairman Jerome Powell looked to be forced into accepting to start tightening the monetary policy and the taper process. But, with inflation above 5% for several months now and employment surging, as well as manufacturing, he had no other option. Powell announced that the FED would start decreasing purchases by $20 billion a month, starting from December.

That sent the USD higher and EUR/USD lower, with the trend continuing to be so. We decided to sell this forex pair earlier today during the pullback to the 50 SMA on the H4 chart. Now that FED members Mester and George have made comments on pro tapering process, they have confirmed the hawkish bias and EUR/USD has reversed lower, heading toward our take profit target. Below are their comments and the new home sales from the US.

EUR/USD H4 Chart Setup

EUR/USD reversing at the 50 SMA again today

US new home sales data for August 2021

- August new home sales 740K vs 714K expected

- July new home sales were 708K

- Single-family home sales +1.5% m/m

- Prior single-family sales +1.0% (revised to +6.4%)

- Median prices $390,900

- Average prices $443,200

- 6.1 months of supply

Sales in the midwest fell to the lowest since 2014 but that’s going to bounce back and help to lift the index.

Comments from the KC Fed President

- Criteria for bond taper has been met

- Return to normal should allow continued growth and moderating inflation but some changes from pandemic may persist

- Fed will face a complicated discussion about the size of the balance sheet after taper

George is a voter next year and is taking a more hawkish stance. You can see confidence in the ‘transitory’ inflation narrative waning.

FED Mester Comments:

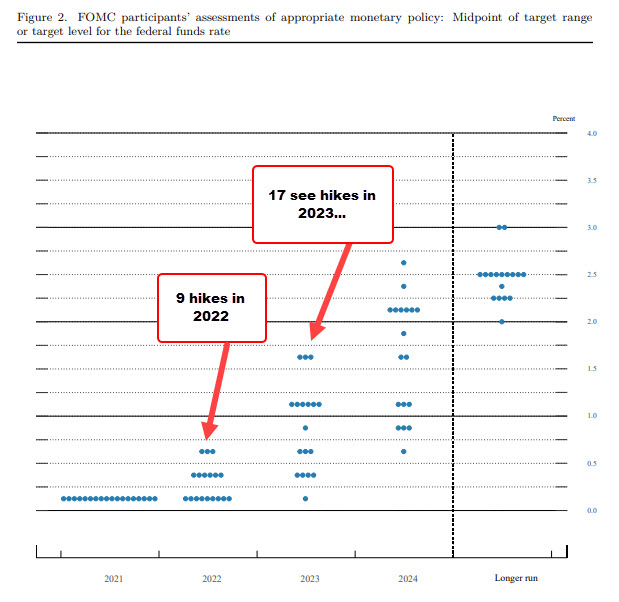

FED Interest Rate Dot Plot

Other comments:

Other comments:- Sees conditions for rate liftoff met by the end of 2022

- Inflation risks on the upside exceed those on the negative

- Sees 5.5% GDP growth this year

- Sees 3.75-4.0% GDP growth in the US next year

- Inflation will be a little more than 2% in the next years

- Supports November taper that concludes in H1

- After liftoff, we’ll need accommodative policy for a little while

- Sees unemployment around 4.75% at the end of this year and 4.0% at the end of 2022

- QE not as effective as it used to be so they can slow down buying

- Fiscal policy is expected to be a drag next year but we’ll have to see what happens

- If inflation is not consistent with Fed goals we’ll take action

- Fed doesn’t want to see inflation expectations move above levels of 2% over time

- Majority of higher inflation is caused by pent up demand and reopening of the economy

GDP forecasts are notable, they’ve been coming down in the last month or two on supply chain issues. Mester is a vote next year and said she sees the conditions for a hike in 2022. Of course, that could certainly change but we know she’s one of those dots now.