The

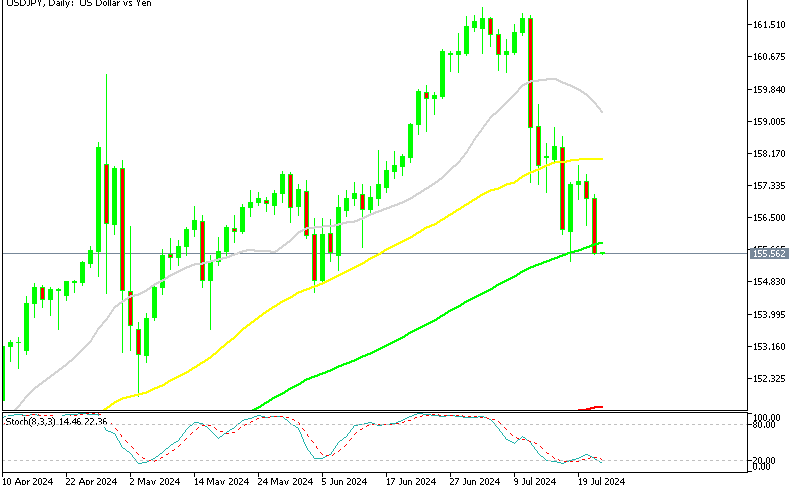

USD/JPY pair continued its decline after local equity markets reopened on a sour note after a long hiatus, provoking a fresh rush to safety in the Japanese Yen. The local currency also benefited from an upward revision to the country’s final manufacturing PMI for December, which was revised to 48.9 from 48.8 previously. Furthermore, Japanese Prime Minister Fumio Kishida’s statements on the price objective aided the yen’s recovery.

According to the Nikkei Asian Review, PM Kishida stated in a previous interview that “the Japanese government must engage with the next Bank of Japan governor on whether to rewrite the joint agreement setting a 2% inflation target.” Nevertheless, the pair paid little attention to the Bank of Japan’s (BoJ) emergency bond-buying operation, carried out for the fourth consecutive session on Wednesday to defend the yield goal. The decline in the US dollar, combined with a new decrease in Treasury bond yields, is putting downward pressure on the USD/JPY pair.

The US dollar’s recovery has stalled amid an upbeat market environment as traders prepare for new market activity ahead of the US ISM Manufacturing PMI and Fed Minutes, which are coming later this Wednesday.

The

USD/JPY pair faced strong negative pressure in the previous sessions to return to the main bearish channel and begins today with another decline to break the 130 barriers, opening the way to keep the bearish bias on an intraday and short-term basis, trying to make the bearish trend dominant in the upcoming sessions.

On the lower side, USD/JPY is expected to target 128.90, accompanied by 127.85 levels. The EMA50 supports the projected decrease, which will continue to be valid unless the price breaks and holds above 130.55 since breaking this level may initially force the price to test 132.35 regions before any new negative effort. Today’s trading range is likely between 128.60 support and 130.50 resistance.

Today’s projected trend: bullish above 130.50