Forex Signals Brief for February 8: USD Resumes the Course After Powell Leaves It to the Data

Yesterday’s Market Wrap

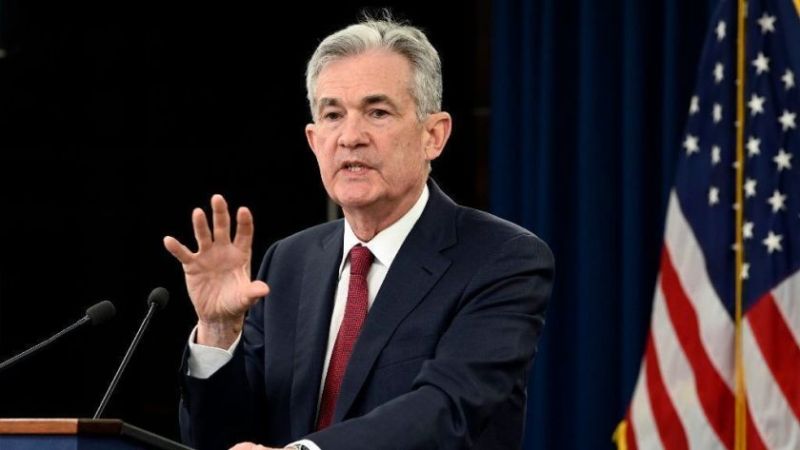

The USD retreat seems to have ended with January, since it has been making some decent gains since Friday last week and FED’s Jerome Powell didn’t change the course of the recent days yesterday. After the impressive services and employment report for January which was released yesterday, markets concluded that the FED might continue with rate hikes and push the terminal top above 5%.

Although traders were on hold yesterday as FED chairman Powell was expected to speak at the Economic Club of Washington DC. Powell didn’t change his tone at first, and the market liked that, which sent the USD 100 pips lower and risk trades higher. Later though, he said they could hike interest rates further if the economic numbers come strong. “The reality is that we’re going to react to the data,” he said. “We may well have to do more than what markets are expecting.” The USD reversed higher and resumed the bullish trend that it started last week.

Today’s Market Expectations

Today the economic calendar is light, although there are a couple of FOMC members speaking later on. First, US President Biden might hold a speech. Italian retail sales were released a while ago, showing a decline in January, while in the US session, Crude Oil Inventories are expected to show a 2.1 million barrel build-up. FOMC Members Waller, Williams and Barr speak, which might stir the sentiment a bit.

Forex Signals Update

Yesterday the trade was simple during most of the day, buy the USD and sell all risk assets. We saw a reversal during Powell’s speech in the afternoon, but which caught us on the wrong side in USD/CAD, but we closed the day with four winning forex signals besides that trade.

The 200 SMA Rejecting GOLD?

Gold seems to have turned bearish after making a very strong rally since the middle of November. The bullish momentum has faded and buyers don’t seem to be strong enough to reverse the course. yesterday we saw a retest of the 200 SMA (purple) on the H4 chart, but buyers failed again and the decline resumed.

XAU/USD – H4 chart

USD/CHF Resumes Downtrend

USD/CHF continues to remain bearish as the highs keep getting lower. Buyers have pushed the price above the 200 SMA (purple) on the H4 chart, but sellers have prevailed and eventually the downtrend has continued. We saw a move above this moving average on Monday, but yesterday USD/CHF returned below it again and the decline continued.

USD/CHF – H4 chart

Cryptocurrency Update

The retreat we saw in cryptocurrencies over the weekend might have come to an end since we saw some decent gains yesterday. Overall, they continue to display bullish momentum, as they keep the gains after the bearish reversal in risk currencies in the second half of last week, as dips keep finding buying pressure.

Is the Retreat Over for BITCOIN?

Bitcoin seems to have ended the retreating phase, after bouncing off the ascending trend line yesterday. The price was slipping lower over the weekend, but BTC remained well-supported by moving averages which continue to act as support. The pullback stopped at the 100 SMA (green) on the H4 chart and the price is reversing higher.

BTC/USD – 240 minute chart

ETHEREUM Bouncing Off the 20 SMA

Ethereum has been trading sideways for the last two weeks after the bullish run last month, but the lows keep getting higher so it seems like the buying pressure is picking up again, which is pushing the price above $1,700. The 20 SMA (gray) held as support on the daily chart, which shows decent buying pressure.