The USDCHF Trades 0.43% Lower As The SNB Indicate 3 Cuts In 2024!

USDCHF –Swiss Franc The Worst Performing Currency For Tuesday!

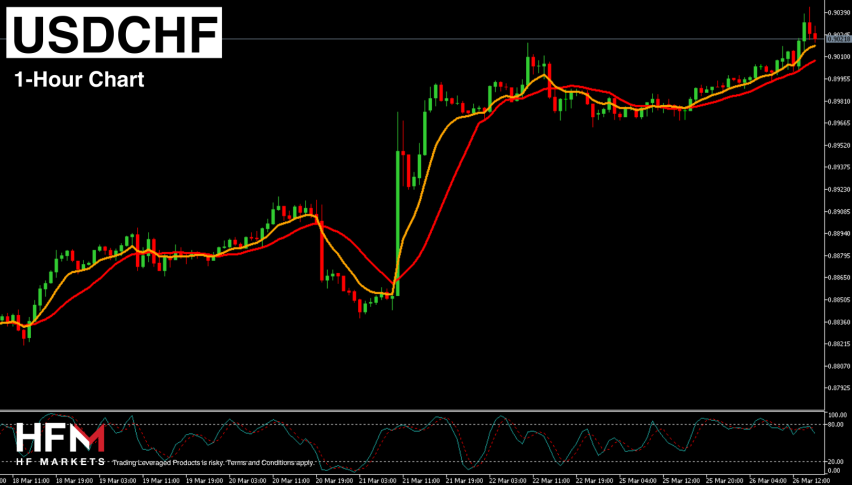

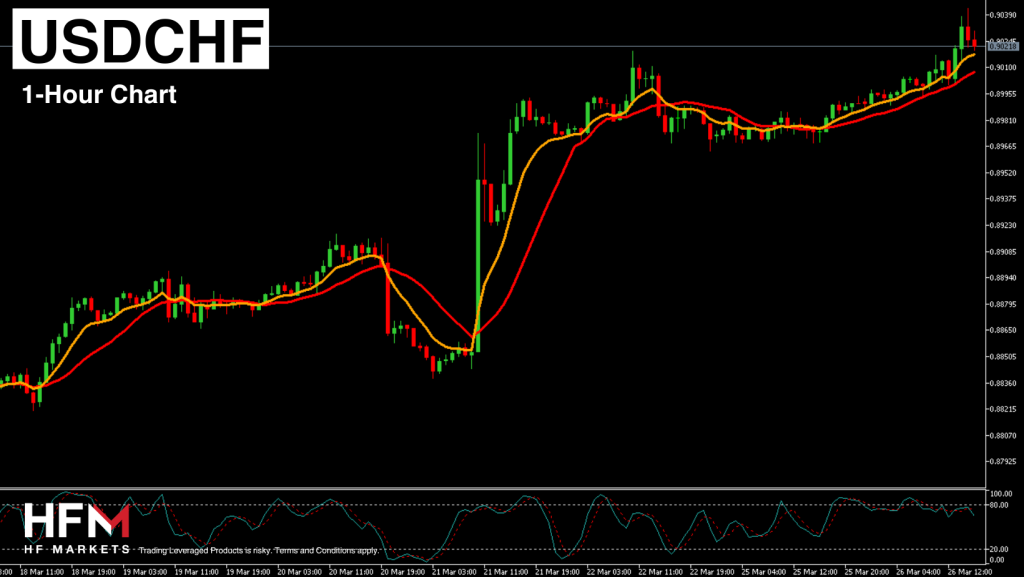

The US Dollar is trading with no clear direction within the first two sessions of the day. However, the Swiss Franc is the worst performing currency of the day resulting in a clear direction for the asset. The USDCHF is forming its third consecutive week of bullish price movement. The price of the exchange rate trades above the regression channel and above the main price sentiment lines. Both these elements point towards buyers controlling the market, which makes sense considering the Swiss National Bank has just cut rates. However, a concern is also that Oscillators are “overpriced” and the latest impulse wave matches previous waves before forming a retracement. For this reason, technical analysis points towards a retracement but continued control from buyers of the Dollar.

The strengthening of the US Dollar may be attributed to the Swiss National Bank’s decision to cut borrowing costs by 25 basis points, contrary to analysts’ expectations of no change from the 1.75% rate. The accompanying statement highlighted persistently low inflation, with forecasts for the consumer price index revised downward from 1.9% to 1.4% by the end of 2025. Investors anticipate at least two more interest rate cuts by the year’s end. The President of the Chicago Federal Reserve Bank, Mr Goolsbee, in an interview, also said that overall inflation is decreasing, but in the housing market remains quite serious, and noted that he believes in the likelihood of continued price growth, which will open the possibility of easing monetary policy in the coming months. Another factor is the rise in the US Bond Yields which is known to support the Dollar in the short-term.

Meanwhile, the US Dollar Index, though initially trading lower than the day’s opening price, has been gaining bullish momentum over the past three hours. Positive Durable Goods Orders data supports the US Dollar, but other indicators, like the CB Consumer Confidence, fell below expectations. Technical analysis, utilizing the 75-Bar EMA and the RSI on a 15-Bar Period, suggests upward price movement for the USDCHF pair since early March 21st.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account