USDCAD Grinds Above 1.37 in A Straight Line

USDCAD has been increasing on a very solid trend since early October and yesterday this pair moved above 1.37 after the FOMC meeting minutes

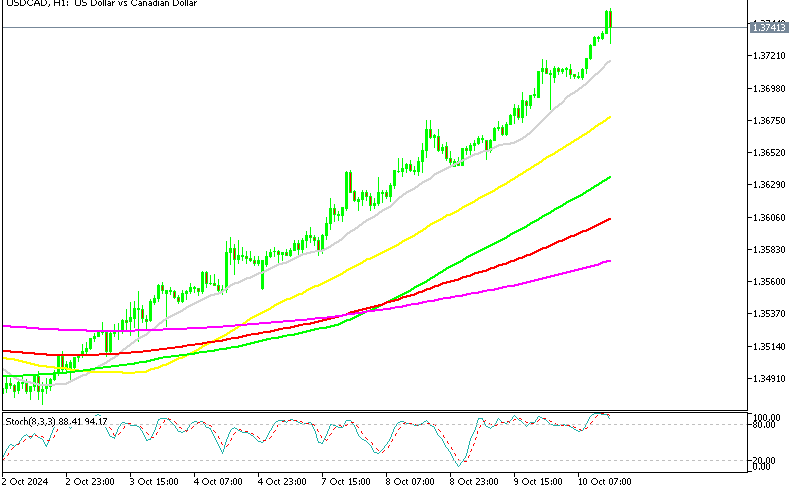

USDCAD has been increasing on a very solid trend since early October and yesterday this pair moved above 1.37 after the FOMC meeting minutes. The uptrend has been very straightforward, with the 20 SMA acting as support on the H1 chart, which shows that the buying pressure is very strong.

USD/CAD Chart H1 – The 20 SMA Pushing the Price Higher

USD/CAD Rises Despite Oil Price Increase in October

The recent surge in crude oil prices, which pushed WTI above $78, hasn’t provided a boost to the Canadian dollar (CAD), highlighting a bullish trend in the USD/CAD pair. This is largely due to the Bank of Canada’s (BoC) dovish outlook as it navigates weaker economic indicators and falling inflation. The decline in oil prices as tensions in the Middle East stabilize has also undercut any remaining support for the CAD. Despite soft CAD fundamentals, the strong U.S. job market, as emphasized by last week’s employment report, has bolstered the USD. This has led the Federal Reserve to reduce expectations of a November rate cut by 50 basis points.

CAD Weakness Amid Canada Economic Strains

The Canadian economy is feeling the strain of rising interest rates, with fewer jobs available and a housing sector under pressure. Although the BoC was initially anticipated to cut rates by 50 bps on October 23, weak economic conditions and Canada’s current 2.0% inflation rate suggest that rate reductions may be necessary to alleviate pressures on the economy. A quicker cut could help ease the downturn, though this expectation had been only partially priced in by the market.

Market Signals on USD/CAD

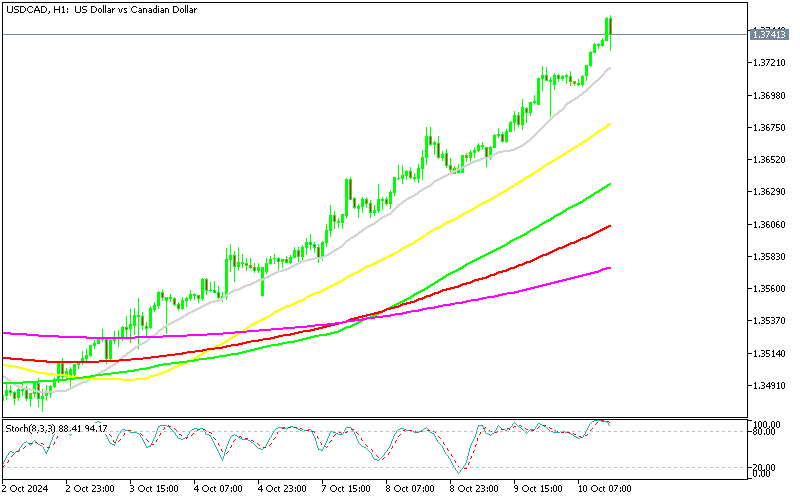

Despite the oil price rally and recent signs of Chinese stimulus, the USD/CAD has held strong, suggesting that the market is discounting the CAD’s fundamentals. With seven days of continuous gains, USD/CAD is demonstrating significant upward momentum, and the 209-day SMA remains a reliable technical support level. The strength in USD/CAD points to the market’s clear preference for USD in the face of uncertain global conditions and signals ongoing bullish sentiment.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account