Block Inc. (SQ) Stock Poised for 40% Upside? Inverse Head Shoulders Pattern Signals Potential Bullish Move

Block Inc. (SQ) continues to assert its dominance in the fintech sector, underpinned by its robust integration with cryptocurrency through Cash App, which enables users to buy, sell, and hold Bitcoin. The company’s strategic focus on blockchain technology and decentralized finance (DeFi) initiatives positions it favorably in the current crypto bull run. With increased user adoption of Bitcoin and expanding DeFi infrastructure, SQ could experience significant upside potential, aligning with broader market momentum in the crypto space.

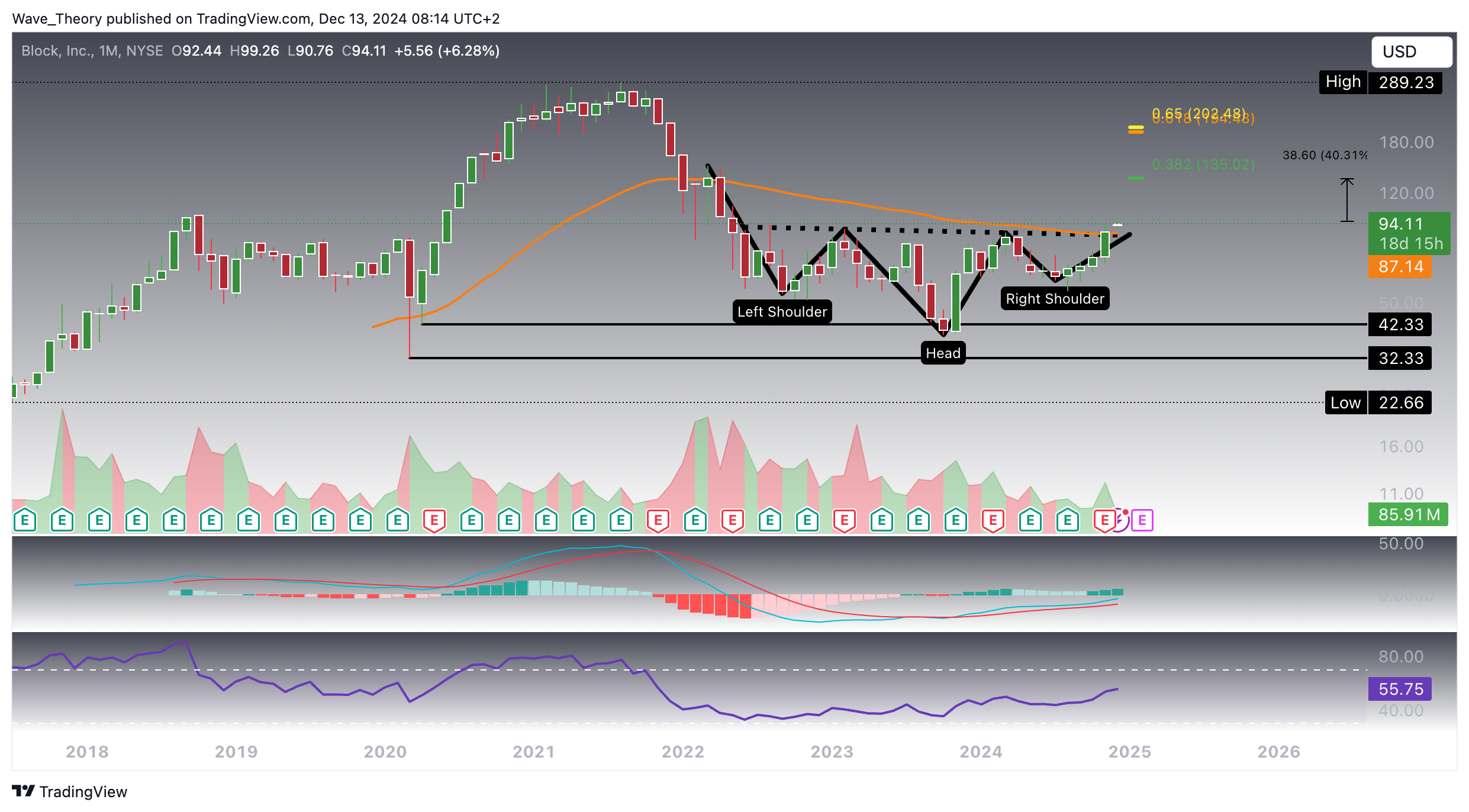

Inverse Head and Shoulders Pattern Signals Bullish Reversal for Block Inc. (SQ) on Monthly Chart

An inverse head and shoulders pattern has emerged on Block Inc. (SQ)’s monthly chart, signaling potential for a bullish reversal after a two-year downtrend. The stock bounced off key support between $32.3 and $42.3, subsequently testing the 50-month EMA at $87, where it initially faced rejection but is now breaking through. This bullish breakout could propel the stock toward the next significant Fibonacci resistance at $135, representing a 40% upside. If SQ surpasses this level, further momentum could push it toward the golden ratio at $200.

The technical indicators also support a bullish outlook:

- MACD: The MACD lines have crossed bullishly, and the histogram has been ticking higher for the past three months.

- RSI: The RSI remains neutral, neither overbought nor oversold, indicating room for upward movement.

On the downside, the 50-month EMA at $87 now serves as strong support for SQ, making it a key level to watch.

The Block Stock Has Surged By 155 %

Since its bullish bounce, Block Inc. (SQ) has rallied approximately 155%, marking an impressive recovery. However, despite this significant surge, the EMAs have yet to confirm a golden crossover, signaling that the mid-term trend remains bearish. The MACD lines have crossed bullishly, and the RSI is approaching overbought levels, suggesting the momentum may be slowing. Additionally, the MACD histogram has started to tick bearishly lower this week, indicating potential near-term weakness. A pullback to the 50-month EMA at $87 could be likely before SQ targets the next major Fibonacci resistance at $135.

Daily Chart: SQ Trends Within A Parallel Upward Channel

On the daily chart, SQ is trending within a well-defined parallel upward channel. However, indicators are signaling a potential shift to the downside. The MACD lines have crossed bearishly, with the histogram trending lower, and the RSI is showing a bearish divergence—both warning signs of weakening momentum.

If SQ experiences a deeper correction, it could find key Fibonacci support levels at $82 and $72. These levels are further reinforced by the 50-day and 200-day EMAs, which provide additional layers of support in the event of a sharper pullback.

The EMAs, on the other hand, have formed a golden crossover some time ago, confirming the trend bullishly in the short- to medium term.

Block

4H-Chart Shows Bearish Divergence and Bullish Trend for SQ: Similar to Daily Chart

The 4-hour chart mirrors the daily setup, with bearish signals in the MACD and a bearish divergence in the RSI, both pointing to potential near-term weakness. Despite this, the EMAs have crossed bullishly, maintaining the overall bullish trend. While the trend suggests further upside in the coming weeks, near-term downside pressure could persist before the next leg higher materializes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account