Forex Signals Brief May 20: Geopolitical Tensions, RB Rate Cut and Canada CPI Drive Sentiment

Today markets will focus on the RBA rate 25 bps cut and the CPI inflation report from Canada for April, but also global tensions will...

Quick overview

- Markets are focused on the RBA's expected 25 bps rate cut and Canada's CPI inflation report for April amid ongoing global tensions.

- U.S. equities experienced a late comeback after initial sharp declines, with the NASDAQ and S&P 500 finishing slightly higher.

- Geopolitical risks, particularly the Israel-Gaza conflict and U.S.-Russia relations, are contributing to market caution.

- Cryptocurrencies saw a strong performance, with Bitcoin rising above $105K and Ethereum benefiting from its recent upgrade.

Today markets will focus on the RBA rate 25 bps cut and the CPI inflation report from Canada for April, but also global tensions will continue to weigh on the investor sentiment.

Quiet Start to the Week

The new trading week began with sharp market volatility triggered by Moody’s unexpected downgrade of U.S. government debt late Friday. This prompted a risk-off tone across global financial markets. The U.S. dollar initially dropped sharply across the board, stocks opened weaker, and Treasury yields spiked as bond prices tumbled. However, as the session progressed, the dollar clawed back some losses against most currencies—except the Japanese yen, where weakness persisted.

In fixed income, U.S. bonds staged a notable rebound after an early plunge. The 30-year Treasury yield had opened at 5.007%, briefly breaching the critical 5% threshold, but eventually fell back to 4.904% amid strong late-day demand.

Stocks Stage Late Comeback

U.S. equities followed a similar pattern, opening sharply lower before mounting an impressive intraday recovery. The NASDAQ, which had been down over 270 points at its worst, finished the day marginally higher by 0.02%. The S&P 500 added 5.22 points (+0.09%) after reversing a significant 62-point decline, extending its winning streak to six consecutive sessions.

Geopolitical Risks Add to Market Caution

Tensions in the Middle East and Russia-West Relations

Geopolitical developments dominated headlines. Concerns flared over the escalating Israel-Gaza conflict after Israeli Finance Minister Bezalel Smotrich told Sky News Arabia that Israel aims to push Gaza’s population southward—potentially out of the territory altogether.

Elsewhere, attention turned to a notable phone call between Russian President Vladimir Putin and former U.S. President Donald Trump. Trump described the conversation as “very well received” and suggested that Russia is open to expanding post-war trade ties with the U.S. He also noted that ceasefire talks between Russia and Ukraine were being considered, possibly hosted by the Vatican. According to the Kremlin, the discussion focused on reestablishing U.S.-Russia diplomatic and economic relations.

Today’s Economic Highlights: May 20–24, 2025

RBA Poised for Another Rate Cut

Markets are currently pricing in a 98% probability that the Reserve Bank of Australia (RBA) will lower its benchmark cash rate by 25 basis points to 3.85% at its next policy meeting. Only a 2% chance is being assigned to rates remaining at the current 4.10%. While the RBA had cut rates at its February meeting, policymakers appeared cautious in April, opting to hold steady.

Canada CPI Inflation Report

Fresh inflation data due Tuesday will likely shape the final decision. March CPI showed cooling price pressures: headline inflation eased to 2.3% year-over-year, and core inflation dropped to 2.2%. Meeting minutes released by the Bank of Canada reveal that officials remain divided on how aggressively to ease policy. While some members favored patience due to inflation uncertainty beyond April, others argued for immediate action, citing persistent economic softness, stable inflation expectations, and delayed transmission of past rate hikes.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD falling below 1.11, and stock markets continuing upward. The moves weren’t too big, but we opened 37 trading signals in total, finishing the week with 25 winning signals and 12 losing ones.

Gold Prices Remains Stuck Between MAs

Gold endured a volatile week. After plunging below $3,120 during European hours, the metal rebounded sharply, recovering nearly $120 to settle near $3,200 by the weekend. Still, gold has struggled to retest its April peak of nearly $3,500—suggesting caution persists among traders amid a tilt toward risk assets.

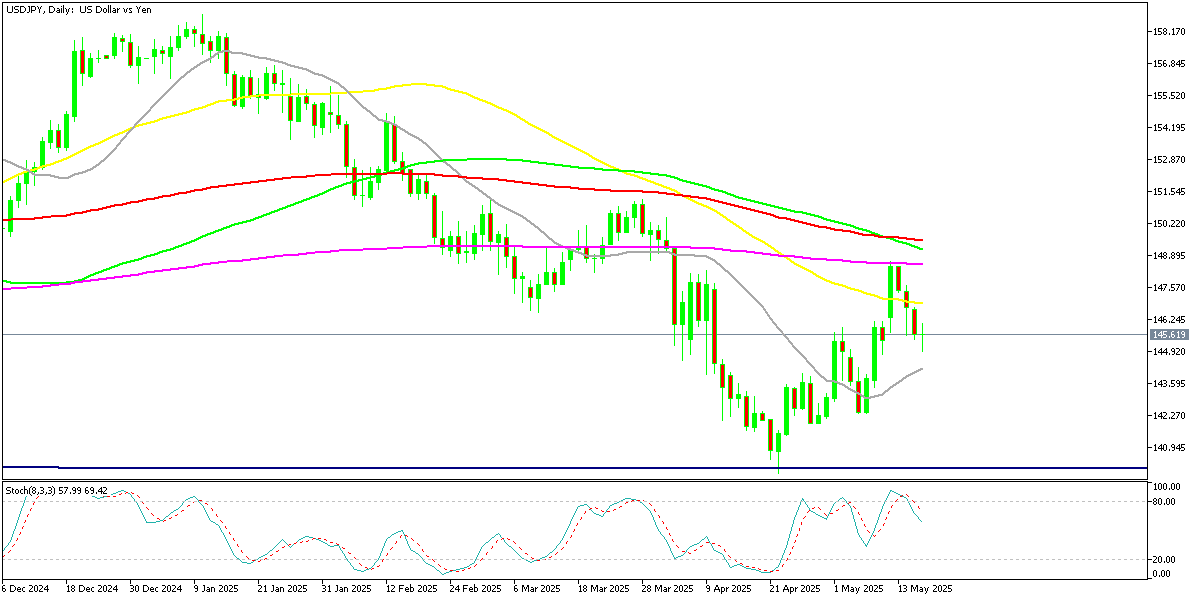

Dollar-Yen Reversal Gains Strength

The USD/JPY pair regained strong upward momentum after dipping below 140.00. It surged past 146.00 before running into some resistance near the 200-day moving average at 148.50. While a bout of profit-taking slowed the advance, the pair remains structurally bullish. Recent dips are being seen by many as fresh entry points for traders betting on continued dollar strength.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Returns Above $105K

Crypto assets had a strong showing this week. Bitcoin jumped 6% to climb above $103,850, marking its highest level since February. Optimism over global trade—particularly improving U.S.-UK and U.S.-China relations—helped lift sentiment across risk assets, including cryptocurrencies.

BTC/USD – Weekly chart

Ethereum Tests MAs after Rebound Following Pectra Upgrade

Ethereum also surged, climbing over 20% from its April low of $1,475 to surpass $2,200. The rally was powered by the rollout of Ethereum’s “Pectra” upgrade, which improved wallet integration and staking functionality—further bolstering investor confidence in the broader digital asset space.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account