South Africa Budget 2025: VAT Increase Lingers, GDP Still Low Amid Hidden Taxes

South Africa's 2018 budget attempts to sustain a vulnerable economy in the face of protracted low growth and political impasse, but it lacks

Quick overview

- South Africa's 2025 budget aims to stabilize a fragile economy amid slow growth and political gridlock, with GDP growth projected at just 0.6% for 2024.

- The budget faced delays due to political disputes, particularly over a proposed VAT increase, which was ultimately scrapped.

- Instead of bold reforms, the government opted for less controversial measures like fiscal drag and increased excise duties to generate revenue.

- Analysts express skepticism about the budget's effectiveness, citing ongoing political paralysis and rising public debt as barriers to meaningful economic improvement.

South Africa’s 2018 budget attempts to sustain a vulnerable economy in the face of protracted low growth and political impasse, but it lacks fundamental reforms and clear growth drive.

Growth Projections Paint a Grey Picture

South Africa’s economic outlook remains underwhelming, with GDP growth for 2024 now forecast at just 0.6%. This marks a slight drop from the 0.7% pace seen in 2023. While banking and real estate have provided modest support, deeper structural issues continue to drag down broader performance. Persistent energy shortages, crumbling logistics infrastructure, and low investor confidence have left the economy vulnerable and uninspired.

The third quarter is expected to register a contraction, reflecting the ongoing weakness in consumer demand and industrial activity. Economists warn that without aggressive reform, the nation risks slipping further behind its emerging market peers.

Budget 2025: Delays, Disputes, and a Narrow Fiscal Tightrope

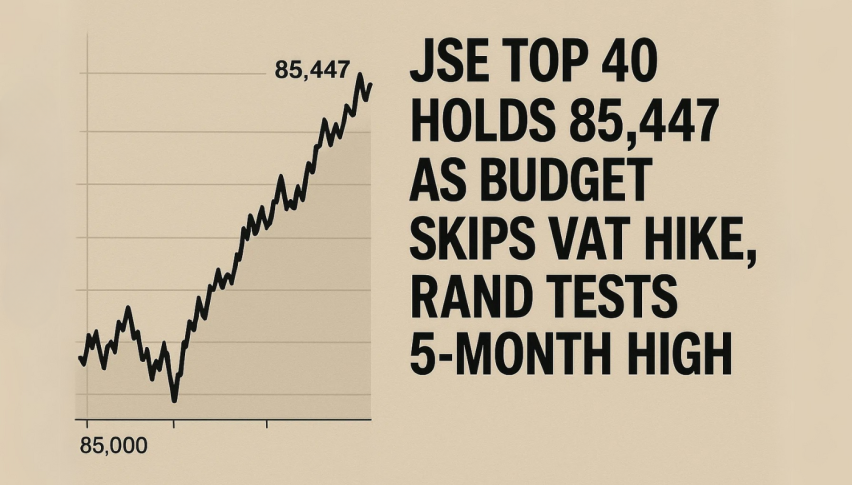

Finance Minister Enoch Godongwana finally delivered the much-anticipated 2025 Budget Speech on Wednesday after two major delays. The initial postponement followed a court challenge, while the second was the result of political infighting—particularly over a controversial proposal to raise the value-added tax (VAT). That plan, which would have hiked VAT by 0.5%, was ultimately scrapped amid coalition resistance.

Instead of a VAT increase, the Treasury leaned on less politically sensitive alternatives. Notably, it introduced fiscal drag—choosing not to adjust income tax brackets for inflation—thereby generating an estimated R49.4 billion over the next three years. Additionally, the government has raised excise duties on alcohol and tobacco and removed inflation indexing from medical tax credits, projected to bring in another R5.8 billion. Fuel levies will also be raised in line with inflation, a move designed to spread the tax burden without triggering political backlash.

SAPO Saved from Collapse as UIF Steps In

One of the headline items in the budget was a rescue package for the South African Post Office (SAPO), which has long teetered on the edge of insolvency. After reporting a staggering operating loss of R2.17 billion in 2024, SAPO has secured a critical R381 million bailout from the Unemployment Insurance Fund (UIF). The funds will be distributed over six months through the Temporary Employer-Employee Relief Scheme (TERS).

Employment and Labour Minister Nomakhosazana Meth confirmed the intervention, noting that the deal aims to preserve around 6,000 jobs and jumpstart the post office’s long-overdue turnaround strategy. A Memorandum of Agreement signed between the UIF and SAPO outlines a framework for operational recovery and workforce retention.

Mixed Reception from Analysts

While the budget succeeded in averting immediate crises—including SAPO’s collapse—many experts remain skeptical of its broader direction. Anchor Capital economist Casey Sprake noted that the decision to rely on indirect fiscal measures, such as bracket creep and levy hikes, instead of more robust reforms, highlights ongoing political paralysis.

Analysts argue that the budget reflects a continuation of policy inertia rather than a shift toward dynamic economic management. With public debt still rising and service delivery strained, there is little confidence that the 2025 fiscal roadmap will alter South Africa’s economic trajectory in any meaningful way.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account