WTI Crude Hits $65.4 Amid Trade Talks and OPEC+ Supply Risks: What’s Next?

WTI crude oil futures are holding firm around $65.40 per barrel—a level not seen in over two months—as investors digest...

Quick overview

- WTI crude oil futures are stable around $65.40 per barrel as U.S.–China trade talks show signs of progress.

- Geopolitical tensions, particularly regarding Russia–Ukraine and U.S.–Iran, continue to support crude prices as a hedge against uncertainty.

- Saudi Arabia is pushing OPEC+ to increase oil output, raising concerns about potential oversupply if demand does not meet expectations.

- Technically, WTI crude is in a bullish trend, with a potential breakout above $65.62 leading to new monthly highs.

WTI crude oil futures are holding firm around $65.40 per barrel—a level not seen in over two months—as investors digest the latest developments in U.S.–China trade talks. High-level discussions that began Monday in London are continuing today, with early signals pointing to progress.

U.S. Treasury Secretary Scott Bessent called the meeting “good,” while Commerce Secretary Howard Lutnick described it as “fruitful,” helping ease concerns about global trade tensions impacting energy demand.

While markets welcomed this diplomatic thaw, other factors continue to influence oil sentiment. Tensions surrounding the Russia–Ukraine conflict remain unresolved, and uncertainty looms over a potential U.S.–Iran nuclear agreement. These unresolved geopolitical risks are adding a layer of support for crude prices, reinforcing oil’s role as a hedge against uncertainty.

Supply Risks Linger as OPEC+ Faces Pressure

While the demand side gains some clarity, the supply outlook is becoming increasingly complex. Saudi Arabia has urged OPEC+ to increase output by at least 411,000 barrels per day starting in August, with a potential follow-up increase in September.

This call for greater production is raising concerns among traders about a possible oversupply later this year, especially if global demand fails to match expectations. The OPEC+ response to Saudi Arabia’s proposal will be closely watched in upcoming meetings.

Still, prices remain supported in the near term, with bulls defending critical levels just above $65.00.

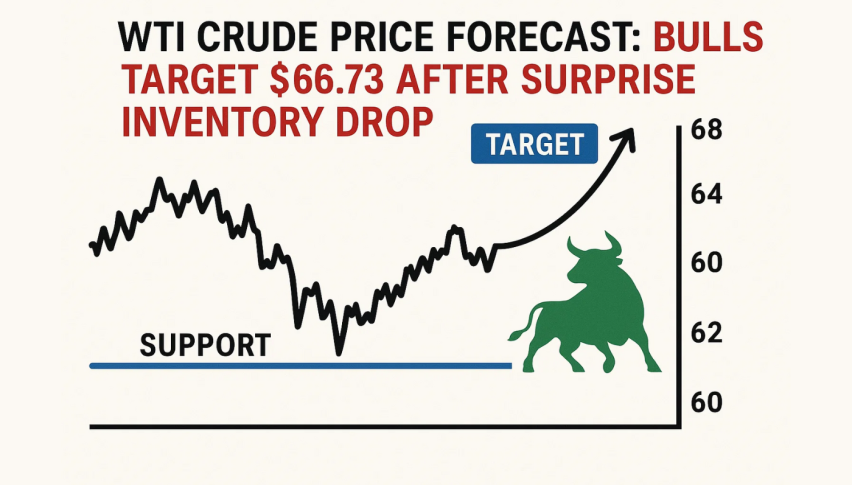

WTI Crude Oil Technical Picture: Bulls Eye $66.73 Next

From a chart perspective, WTI Crude (USOIL) is holding within a healthy ascending trendline pattern on the 2-hour chart, reflecting strong buyer interest on dips. After breaking past $64.47 on June 7, the price briefly touched $65.62 and is now consolidating below that resistance.

A bullish engulfing candle on June 6 marked the recent shift in trend, and the RSI at 66.44 confirms momentum remains on the bulls’ side—though some consolidation may be needed before a clean breakout.

Trade Setup:

- Entry (long): On 2-hour close above $65.62

- Stop-loss: Below $65.00 or under trendline

- Target 1: $66.20

- Target 2: $66.73

- Note: Avoid chasing breakouts without volume confirmation

Unless the trendline breaks, the structure remains bullish. A confirmed move above $65.62 could open the path toward fresh monthly highs.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account