Crude Chaos: Oil Prices Surge and Retreat – WTI at $70 on ME Escalation

The energy market was sent into a tailspin as the Middle East edged closer to full-blown conflict, driving oil to dramatic highs before...

Quick overview

- Geopolitical tensions between Israel and Iran have caused significant volatility in the oil market, with crude prices surging and then retreating amid escalating conflict.

- After a brief moment of relief due to potential diplomatic talks, another Israeli strike on Iranian media infrastructure reignited fears, pushing oil prices back above $70 per barrel.

- The ongoing conflict highlights the fragility of the Middle East's geopolitical landscape, leading to uncertainty in global energy markets.

- Traders are closely monitoring developments, as the oil market is expected to remain volatile due to alternating headlines of de-escalation and retaliation.

The energy market was sent into a tailspin as the Middle East edged closer to full-blown conflict, driving oil to dramatic highs before retreating.

Rising Conflict Reignites Oil Market Fears

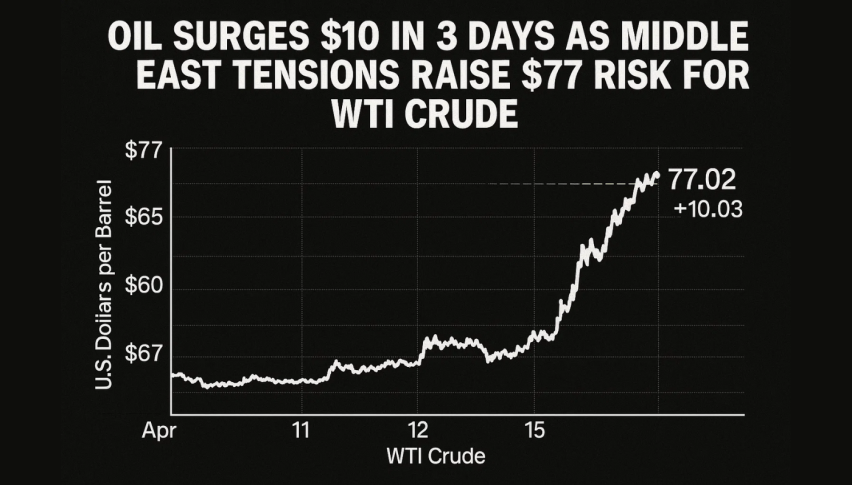

Global energy markets were jolted last week as geopolitical tensions between Israel and Iran escalated rapidly, triggering one of the most volatile oil trading periods in months. What began as a gradual risk buildup turned into outright market panic when Israeli airstrikes targeted Iranian installations late Friday, setting off a surge in crude oil prices and fears of an expanded regional war.

The strikes caused an immediate market reaction. West Texas Intermediate (WTI) crude leapt from under $70 per barrel to as high as $77.60 intraday—breaking above its 200-day simple moving average for the first time in months. Brent crude followed the same trajectory, closing the session at approximately $78.55 per barrel. This marked a single-day jump of nearly 12%, fueled by traders pricing in the risk of serious supply disruptions, especially through the Strait of Hormuz—a vital artery that handles close to 20% of global oil shipments.

Hopes for De-escalation Spur a Sharp Reversal

However, the weekend brought a brief moment of relief. Diplomatic sources revealed that Iran, through backchannels involving Arab intermediaries and European officials, had sent messages to both Israel and the United States suggesting an openness to reduce hostilities and re-engage in talks over its nuclear program. This report, first broken by The Wall Street Journal, was seen as a potential turning point in a week otherwise dominated by threats and retaliation.

WTI Crude Chart Daily – The 200 SMA Has Turned Into Support Now

Markets responded swiftly to the possibility of diplomacy taking hold. Crude prices reversed much of their gains, with WTI falling below $68 per barrel. Gold, another safe-haven asset that had risen in parallel with oil, also retreated as risk sentiment began to stabilize. But the calm was short-lived.

Another Strike Pushes Oil Back Above $70

In a sudden turn, Israel launched another attack—this time targeting Iran’s state media infrastructure. Reports confirmed that the Iranian Broadcasting Corporation was bombed, with some footage broadcast live, marking a sharp escalation. This move was interpreted as symbolic and provocative, shifting away from mere military containment to broader psychological warfare.

Iran’s response was swift and ominous. According to Iranian state media, the country was preparing for what it described as “the largest and most intense missile attack in history on Israeli soil.” Any hope for diplomatic de-escalation appeared to evaporate as the rhetoric turned toward open confrontation.

Crude prices quickly surged again in response to this latest development. WTI rose by approximately $2.50, climbing back above $70 per barrel as traders braced for further military responses and potential threats to oil flow through the Gulf. The renewed spike underscored just how sensitive markets remain to every twist in the rapidly evolving conflict.

Conclusion: Volatility Likely to Persist

The Israel-Iran conflict has brought the Middle East’s geopolitical fragility back into sharp focus for global markets. With oil prices now being whipsawed by alternating headlines of de-escalation and retaliation, uncertainty reigns. While brief lulls in aggression may offer moments of market relief, the underlying tensions are far from resolved.

As both sides appear unwilling to back down—and with the United States delicately balancing diplomacy and deterrence—the oil market is likely to remain volatile in the days ahead. Traders and policymakers alike will be watching closely, not just for further strikes or retaliations, but also for any serious attempt at negotiation. Until then, crude prices are expected to continue their unpredictable ride, driven as much by headlines as by fundamentals.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account