TSLA Stock Slips on Political Drama—Is Tesla Dip a Buy Before Robotaxi Day?

Tesla (NASDAQ: TSLA) has been on a volatile but ultimately upward trajectory, with recent political tension, production halts and robotaxi..

Quick overview

- Tesla stock has experienced significant volatility, surging over 60% from April lows to June highs before facing a nearly 20% drop due to political tensions.

- Recent geopolitical issues and a temporary production halt at the Austin Gigafactory have contributed to a bearish trend in Tesla shares.

- Investors are closely watching the upcoming robotaxi rollout scheduled for June 22, which could be a pivotal moment for Tesla's future and its stock performance.

- Despite recent challenges, Tesla's long-term trajectory remains upward, with potential for significant market impact from the robotaxi launch.

Live TSLA Chart

[[TSLA-graph]]Tesla (NASDAQ: TSLA) has been on a volatile but ultimately upward trajectory, with recent political tension, production halts, and robotaxi optimism shaping its journey.

From April Lows to June Highs: Tesla’s Wild Ride

After bottoming near the $220 level in early April, Tesla stock embarked on a dramatic rally, surging over 60% in just two months. Investors cheered signs of a global trade recovery, stronger sentiment in the EV space, and renewed enthusiasm around autonomous driving innovations. Shares hit a recent high of $335.50, rebounding sharply from the previous week’s turbulence.

However, the road hasn’t been smooth. Earlier this month, a very public falling-out between CEO Elon Musk and U.S. President Donald Trump created a cloud of uncertainty that spooked investors. Though the dispute lacked policy specifics, it was enough to send Tesla shares tumbling nearly 20% in a single week — one of the biggest drops for the stock this year.

Gap Down on Tuesday: Production Pause and Geopolitics Weigh

After last week’s impressive recovery, Tesla shares opened Tuesday with a bearish gap, later sliding as much as 3.5% to a session low of $313.80. Broader market weakness due to renewed geopolitical tension between Iran and Israel added to the pressure.

TSLA Stock Chart Monthly – The Larger Trend Remains Upward

Another factor in Tuesday’s pullback: news broke that Tesla will temporarily halt production of the Cybertruck and Model Y vehicles at its Austin Gigafactory during the week of June 30. While the company framed the pause as a routine maintenance measure, investors reacted cautiously.

Eyes on June 22: Robotaxi Rollout Could Be a Game Changer

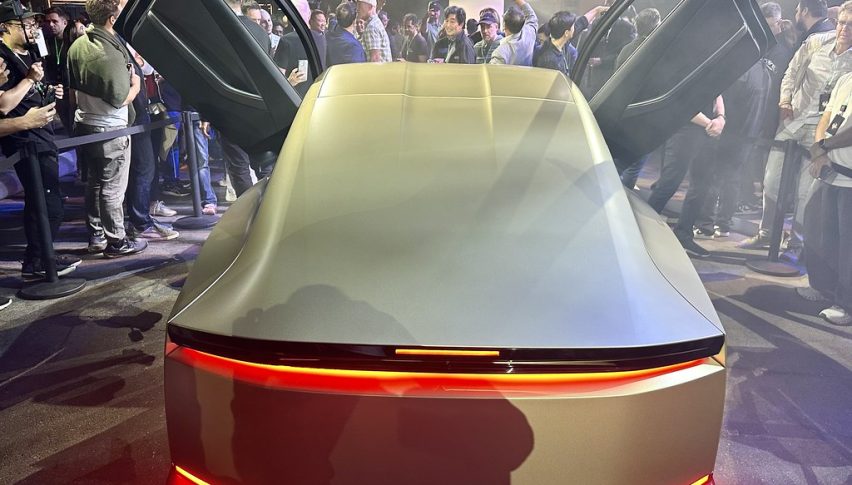

Despite the temporary dip, many investors remain focused on the high-stakes launch of Tesla’s robotaxi service, which Musk has “tentatively” scheduled for June 22 in Austin, Texas.

According to Musk, Tesla plans to start the service with 10 to 20 vehicles, expanding the autonomous fleet in the months that follow. This launch represents the first major step toward Tesla’s vision for a self-driving future — and could inject much-needed momentum into the company’s sales and earnings outlook.

Given that Tesla is betting heavily on autonomy as its next growth pillar, many see the robotaxi event as potentially market-moving. If it proceeds smoothly, analysts suggest the stock could retest its all-time high of $488.50. With the dip potentially providing a technical entry, bulls are watching closely for confirmation.

Conclusion: A Dip or a Setup?

Tesla remains one of the most closely watched names in the market. Between political noise, macro tensions, and operational pivots, the stock continues to trade with high volatility but high potential. The coming week could prove pivotal: June 22’s robotaxi event might not only shape Tesla’s future — it could reshape the electric vehicle narrative entirely.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account