Vodafone CEO Remuneration Controversy Sends Share Price Slipping Lower

Vodafone South Africa shares slipped on Tuesday, as investors reacted to fresh corporate disclosures following a long holiday weekend and...

Quick overview

- Vodafone South Africa's shares fell about 3% to 132 ZAC following a bearish gap after a holiday weekend.

- CEO Shameel Joosub's significant pay increase of 15.2% to R71.1 million has drawn scrutiny from investors.

- The stock's recent rally, which peaked at 140 ZAC, may have led to profit-taking amid concerns over executive compensation.

- The next few trading sessions will be crucial in determining if the recent decline is a temporary setback or the start of a deeper correction.

Vodafone South Africa shares slipped on Tuesday, as investors reacted to fresh corporate disclosures following a long holiday weekend and a sharp executive pay increase.

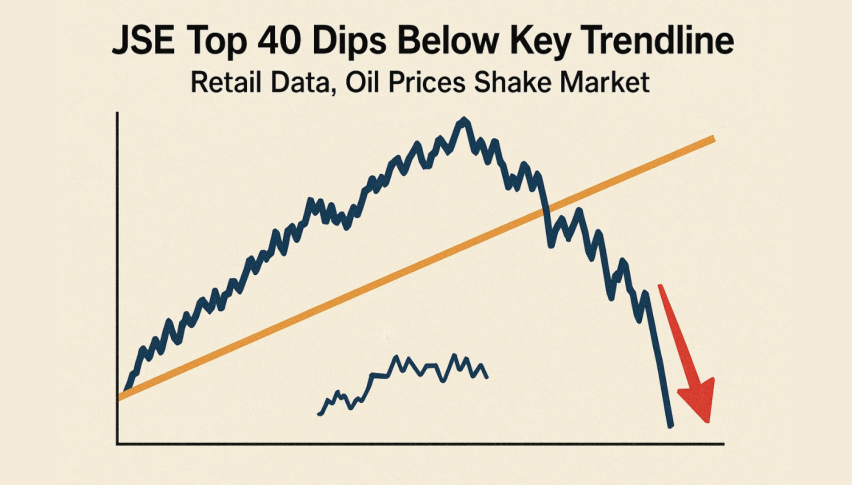

Vodafone Rally Loses Steam After Holiday Gap-Down

Since finding a bottom around 86 ZAC in April 2024, shares of Vodafone South Africa have enjoyed a strong upward trend. The stock climbed steadily over the following weeks, peaking at 140 ZAC by mid-May, marking a solid 63% rally. Investors had been encouraged by technical momentum and a recovery narrative that took hold through the second quarter.

However, after spending most of June consolidating near its highs, Vodafone shares opened sharply lower this week. Tuesday marked the first trading session after an extended bank holiday in South Africa, and traders returned to find a bearish gap on the charts.

Shares continued their slide throughout the session, falling about 3% to 132 ZAC. The move came amid growing attention around internal corporate developments, particularly surrounding the company’s leadership compensation.

CEO Compensation Under Spotlight

According to Vodacom Group’s newly released integrated annual report for the financial year ending March 31, 2025, CEO Shameel Joosub received a significant pay increase. His total pre-tax compensation reached R71.1 million (approximately $3.95 million), reflecting a 15.2% rise from the previous year.

Vodacom stated that a substantial portion—R25.1 million—came from long-term incentives, marking the most significant contributor to his annual earnings. Based on South Africa’s top tax bracket of 45%, the implied tax owed to the South African Revenue Service (SARS) was estimated at R32 million, while the net income after taxes was reported to be around R39.1 million.

While executive compensation hikes are not unusual in the corporate world, the timing of the release and the substantial increase appeared to unsettle some investors. Amid a mixed economic backdrop and public sensitivity to executive pay, particularly in essential service sectors, the reaction on the JSE was swift.

Investor Sentiment and Technical Outlook

The reaction to Joosub’s compensation may not be the only factor driving the selloff, but it has certainly drawn fresh scrutiny to Vodacom’s governance and transparency. Some traders may have also viewed the earlier rally as overextended, with profit-taking exacerbated by the long weekend’s illiquid conditions.

VODJ Share Price Chart Daily – The Trend Remains Upward

From a technical perspective, the 132 ZAC level now acts as an important short-term support zone. Should the price break below this level, it could open the door to further downside corrections. Conversely, any sign of stabilization or positive operational updates could help restore confidence.

Conclusion: Vodafone South Africa’s stock faced a sharp pullback this week as corporate disclosures, particularly concerning the CEO’s sizeable pay increase, drew investor attention. While the broader uptrend since April remains intact for now, sentiment has clearly cooled. The next few sessions may prove critical in determining whether the recent drop is just a pause in the rally—or the beginning of a deeper correction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account