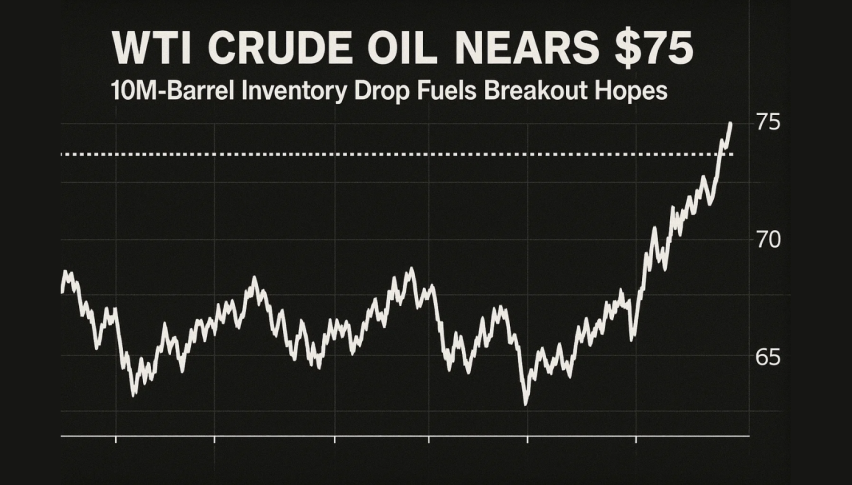

Strikes and Supply Fears Drive Oil Prices – WTI 10% Up Weekly, Is $80 Next?

Oil prices surged sharply this week after dipping on Monday, as escalating conflict between Iran and Israel rattled markets and revived...

Quick overview

- Oil prices surged this week due to escalating tensions between Iran and Israel, with WTI crude rising to an intraday high of $77.60.

- Despite a brief pullback on Monday, WTI rebounded to close around $75.30, indicating a shift in market sentiment towards sustained risk pricing.

- Crude oil inventories fell significantly by 11.473 million barrels, the largest decline in months, suggesting increased refinery activity or export demand.

- The ongoing geopolitical conflict and tightening supply at key delivery points like Cushing are likely to keep oil markets volatile in the near term.

Live USOIL Chart

Oil prices surged sharply this week after dipping on Monday, as escalating conflict between Iran and Israel rattled markets and revived supply fears.

Geopolitical Risk Roils Oil Markets

Crude oil has been caught in one of its most volatile stretches in months, triggered by intensifying geopolitical tensions in the Middle East. The catalyst was a series of Israeli airstrikes on Iranian infrastructure last Friday, which sparked fears of broader regional escalation. The attacks turned simmering concerns into full-blown panic in global energy markets.

The rapid market response drove West Texas Intermediate (WTI) crude above its 200-day simple moving average, a key technical resistance level. WTI spiked from under $70 per barrel to an intraday high of $77.60, while Brent crude climbed to $78.55, both marking gains of around 12% in a single session.

Monday Pullback and Fresh Upside

Despite the sharp rally, oil prices pulled back at the start of the week. WTI briefly dipped below $70, finding support near the 200-SMA on the daily chart. However, Tuesday’s session saw renewed buying momentum, with WTI rebounding to close around $75.30, up nearly 3% on the day.

Traders remain highly sensitive to the ongoing Iran-Israel confrontation. As both sides launched additional missile attacks, concerns mounted over the security of critical oil infrastructure and key shipping lanes like the Strait of Hormuz, which handles nearly 20% of global oil flows.

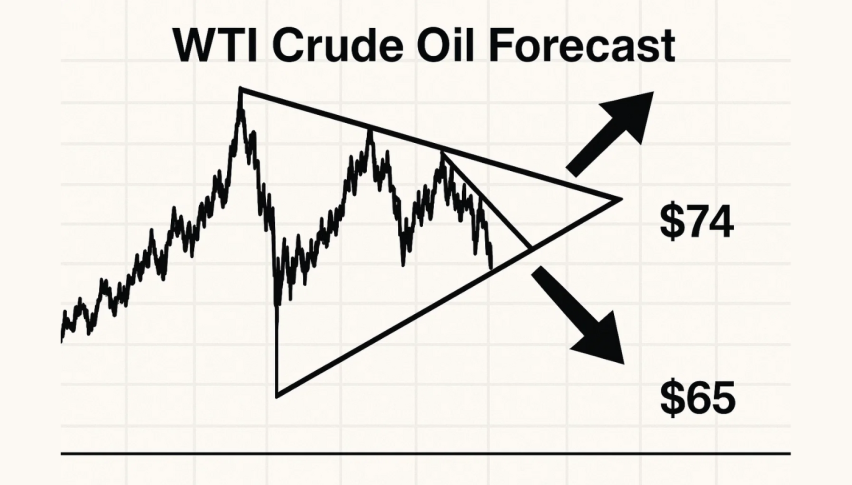

Technical and Sentiment Shifts – Next Target the 200 Weekly SMA at $80?

The fact that WTI reclaimed levels above the 200-SMA and continued to hold above $75 suggests a shift in market sentiment toward more sustained risk pricing. As long as geopolitical tensions dominate headlines, oil may remain elevated even in the face of softer demand signals elsewhere.

Conclusion: With conflict escalation far from resolved, and critical infrastructure increasingly at risk, oil markets are likely to remain volatile in the near term. Any signs of de-escalation could quickly reverse gains, but for now, traders are positioning for the possibility of major supply disruptions. The situation remains fluid and highly sensitive to political developments.

EIA Weekly Oil Inventory Data – Key Highlights

Crude Oil Inventories:

- Fell by -11.473 million barrels, a massive drawdown compared to the -1.794 million expected.

- This is the largest weekly crude inventory decline in months, pointing to increased refinery activity or export demand.

Gasoline Inventories:

- Rose by +0.209 million barrels, below the forecast of +0.627 million.

- Suggests gasoline demand remains firm as the summer driving season begins, keeping builds modest.

Distillate Inventories:

- Increased by +0.514 million barrels, slightly above the +0.440 million estimate.

- Reflects steady industrial and transport fuel demand, with supply outpacing consumption slightly.

Cushing Hub (OK) Inventories:

- Fell by -0.995 million barrels, more than double the -0.403 million draw seen last week.

- Indicates tightening supply at the key WTI delivery point, which can influence benchmark crude prices.

The sharp crude oil draw is likely to support oil prices in the near term, reinforcing concerns of tightening supply just as global demand picks up. While gasoline and distillate builds reflect balanced downstream markets, the continued decline at Cushing hints at broader regional supply constraints. Markets will now look for follow-through in next week’s data to confirm whether this marks the beginning of a sustained trend.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account