Keep Buying USD/JPY As BOJ Remains Accommodative

The Bank of Japan pledged to keep the monetary policy loose which will keep the JPY bearish further ahead this year

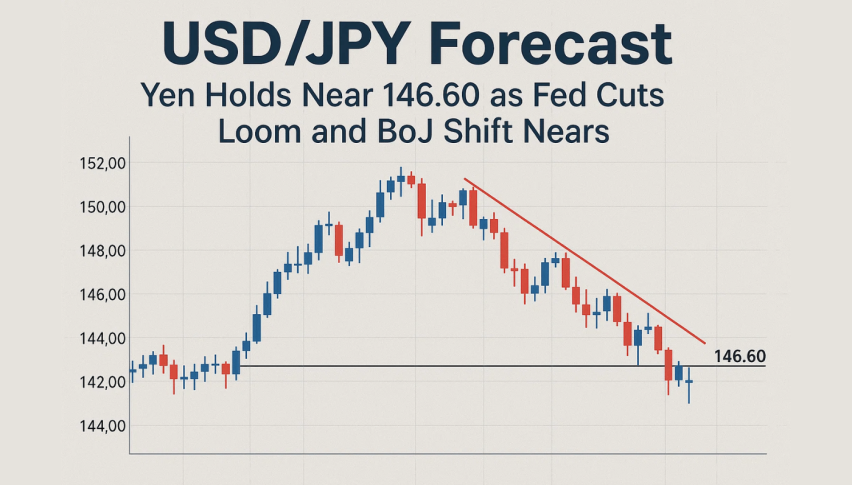

Prices have been surging in Europe, the US, and most of the world, which has led to a hawkish reversal from central banks. Most major central banks have been increasing interest rates, with the European Central Bank planning to do so in July, while the Bank of Japan (BOJ) doesn’t have any plans to start raising rates.

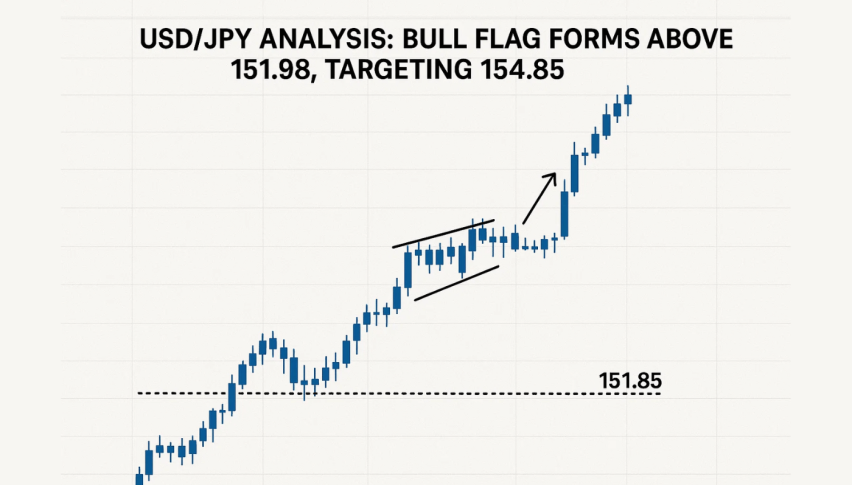

USD/JPY H4 Chart – MAs Acting As Support

USD/JPY bouncing off the 20 SMA

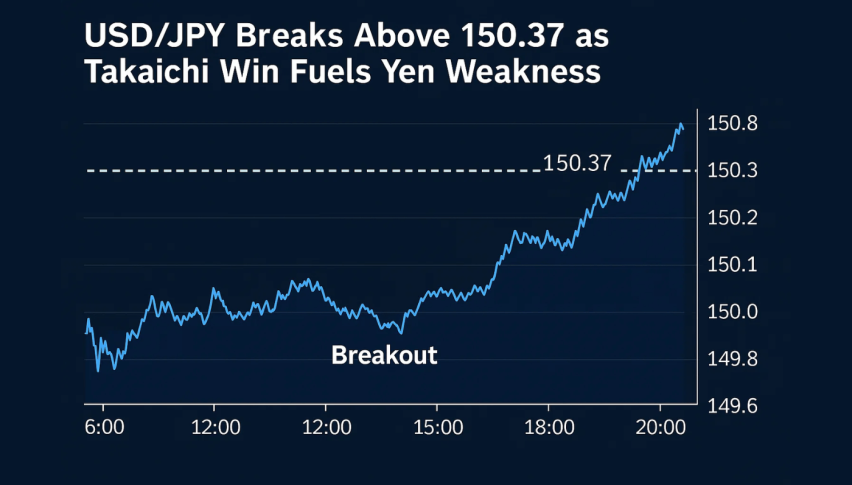

That has been keeping the JPY on the back foot sending it on a strong bearish trend against all currencies. Since May in particular, the decline in the JPY has been picking up an incredible pace, pushing USD/JPY above 133. Overnight we saw a pullback, but the 20 SMA (gray) held as support on the H4 chart and we decided to open a buy signal above that moving average, as the price started to bounce higher. BOJ’s Kuroda pledged to keep the policy accommodative, which is another bearish factor for the JPY.

Remarks by BOJ governor, Haruhiko Kuroda

- We have to continue monetary easing to support economic recovery

- Monetary policy aimed at achieving 2% inflation in a stable, sustainable manner

- Current 2% inflation is simply caused by higher energy prices, and will not be sustainable

- Unless Fed raises rates much faster than suggested, the dollar not so much affected by US-Japan rate differentials

- Important for the exchange rate to move stably reflecting fundamentals

- Various macroeconomic models show that a weak yen is a positive thing

- Rapid weakening in the yen over a short period of time is undesirable

He is adamant that the current easy policy is the right one and it isn’t the key reason why the yen has been weak in the past few months. I’m sure everyone is rolling their eyes but hey, Kuroda has got a job to do. The fact that the BOJ remains in no position to tweak policy speaks volumes about the underlying problems in Japan for roughly two decades now. And policy/rates divergence is definitely a key factor driving the latest moves in the market, in spite of what Kuroda & co. might say otherwise.

Reuters reported yesterday, citing sources familiar with the matter, that the BOJ will consider downgrading its assessment of factory output at its policy meeting this month, as supply chain disruptions caused by lockdowns in China take a toll on the economy. Adding that the central bank may warn of heightened risks to the global landscape and exports as the situation in China and the Russia-Ukraine conflict cloud the outlook.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account