Morning Brief, Apr 8 – Top Trade Setups in Forex Today

The US Dollar Index marked its highest close in a month on Friday. It continues to hit against $97.50. The Dollar Index has advanced in....

The Greenback eased slightly against other major currencies after Federal Reserve officials showed caution over the global growth outlook.

The economic calendar remains light in the absence of any top-tier events.

Japanese consumer confidence softened to 40.5 vs. 41.5 over the global economic slowdown.

Dollar Index – USD

The US Dollar Index marked its highest close in a month on Friday. It continues to hit against $97.50. The Dollar Index has advanced in 9 of the past 11 weeks over the four interest rate hikes, but after a change in monetary policy tone, the dollar’s bullish momentum has weakened.

But finally, investors jumped in to support the dollar after the US economy reported better labor market conditions than before. The US employers hired more workers than forecast in March. It boosts the interest rate hike sentiment.

The technical indicators are still bullish. There’s a 50 periods EMA and bullish trendline which are supporting the pair around $97.20.

On the upper side, the index may face resistance around 97.70. While the violation of 97.20 may lead the dollar towards 96.95.

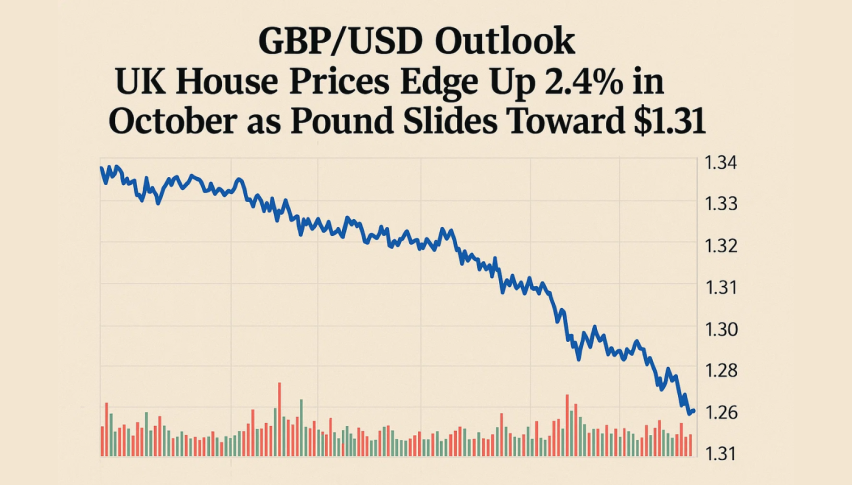

GBP/USD – Sideways Range in Play

The British Pound has traded bullish to place a high around 1.3070 during the previous session. It lost about 0.5% against the dollar, outperforming the Euro and Yen over the streak.

Over the past few days, GBP/USD was confined to a $1.300 to $1.3200 trading range. On the 4-hour chart, GBP/USD is trading bullish after testing a strong support level at $1.2990. For the moment, the pair is trading near $1.3045, and it may face an immediate resistance near $1.3060 and $1.3125 along with support near $1.2995.

GBP/USD – Trade Plan

Today, the idea is to stay bearish below $1.3145 with a stop above $1.3175 and a take profit of $1.2950.

USD/CAD -Bearish Trendline Offering a Short Trade

The commodity currency weakened against the Greenback over a strong bearish rally in crude oil. The bullish trend in USD/CAD was triggered by a stronger dollar, especially after better than expected labor market figures.

On the 4-hour chart, USD/CAD is holding below a bearish trendline which is extending strong resistance near $1.3390.

The pair is consolidating in a narrow trading range of $1.3396 – $1.3304. While the overbought RSI is suggesting strong odds of a bearish reversal below $1.3400 today.

USD/CAD – Trade Plan

Today, the idea is to stay bearish below $1.3400 with a stop above $1.3430 and take profit around $1.3340.

Good luck and stay tuned for more updates!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account