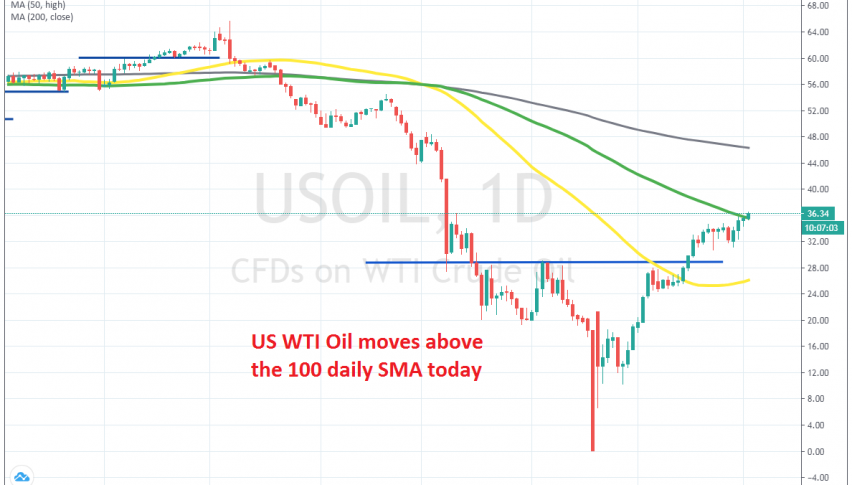

Crude Oil Keeps Grinding Higher Above the 100 Daily SMA

Crude Oil has been bullish for more than a month now and it just broke above the 100 daily SMA

Crude Oil seems to have left behind the rough times of the last three months. At some point in April, US WTI crude fell to $-37 as Saudis flooded the market with cheap Oil, leaving no storage space for US producers, who were paying money to give it away.

But the reverse was quite swift too, towards the middle of April, and Crude Oil came back from the dead. Although, the resistance level around $28 held again in the first attempt, this time being aided by the 50 SMA (yellow) on the daily chart.

That moving average was eventually broken, as was the resistance zone, and buyers pushed Oil to $35, where it found resistance throughout last week. In the last two days of the previous week, we saw a bullish move in Oil which took the price above the resistance, but the 100 SMA (green) turned into resistance now.

Although, after two days, US crude has finally crawled above this moving average. So, buyers remain in charge and we will try to pick a place to go long on Oil, probably after a pullback on smaller time-frames. OPEC+ is planning on extending the output cuts, which pushed Oil higher today and should keep it bullish in the coming weeks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account