5 Best MAS Regulated Forex Brokers

The 5 Best MAS Regulated Forex Brokers – Rated and Reviewed. We have listed the Best Forex Brokers governed by the Monetary Authority of Singapore (MAS).

In this in-depth guide, you will learn:

- Top MAS-Regulated Forex Brokers – A Comprehensive List

- Understanding MAS Regulation – An Overview

- Top MAS-Regulated Forex Brokers Using MT4/MT5 Platforms

- Best Forex Brokers for Beginners in Singapore

and much, MUCH more!

| 🔎 Broker | 🚀Open an Account | ⭐ MAS Regulated | 💶 Min. Deposit |

| 🥇 Saxo Bank | 👉 Open Account | ✅Yes | None |

| 🥈 Swissquote | 👉 Open Account | ✅Yes | None |

| 🥉 Interactive Brokers | 👉 Open Account | ✅Yes | None |

| 🏅 MultiBank Group | 👉 Open Account | ✅Yes | 50 USD |

| 🎖️ City Index | 👉 Open Account | ✅Yes | 150 USD |

5 Best MAS Regulated Forex Brokers (2024)

- ☑️ Saxo Bank – Overall, the Best MAS Regulated Forex Broker

- ☑️ Swissquote – High Regulation, Security, and, Trust Score

- ☑️ Interactive Brokers – Advance Trading Platforms + Innovative Technology

- ☑️ MultiBank Group – High User Trust Score and Customer Support

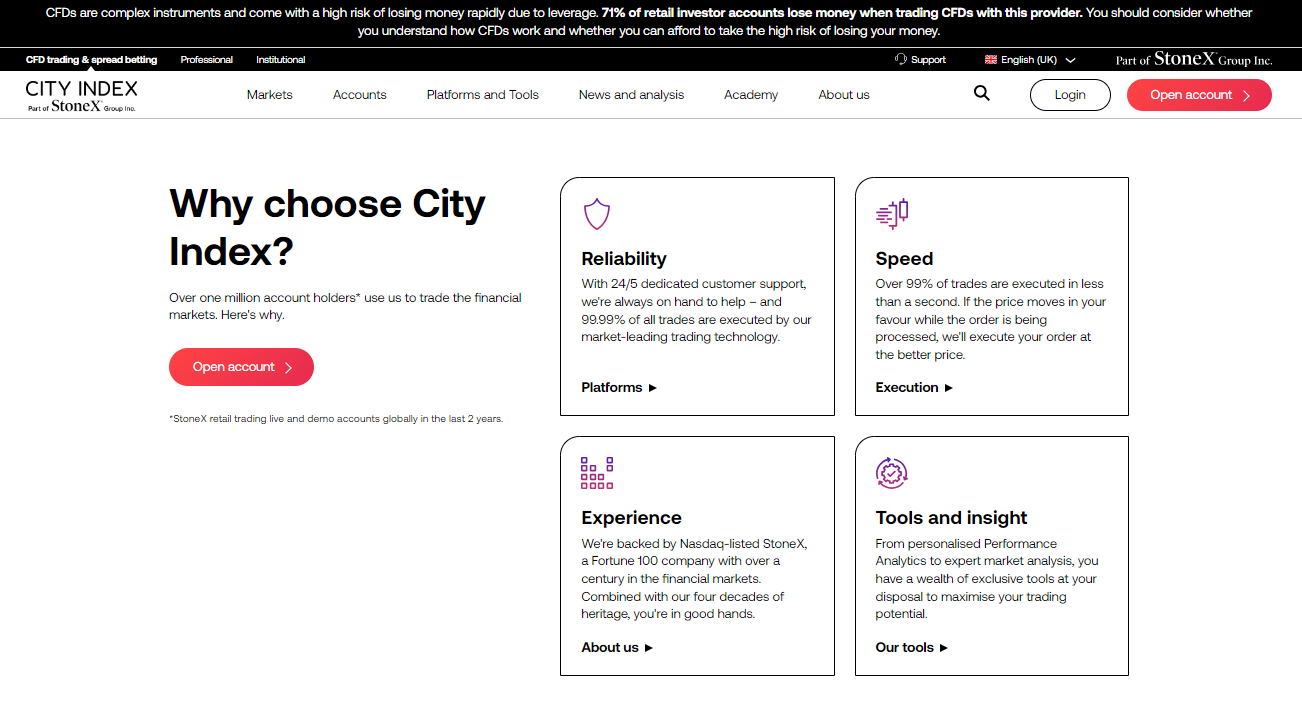

- ☑️ City Index – Wide Range of Account Types + Flexible Trading Conditions

🏆 10 Best Forex Brokers

Saxo Bank

Saxo Bank is a trusted and highly regulated Forex broker that holds a ‘capital markets services license’ under the Monetary Authority of Singapore (MAS). Moreover, Saxo Bank offers a comprehensive suite of trading services, including access to a wide range of financial instruments such as forex, stocks, commodities, and bonds.

| 🔎 Broker | 🥇 Saxo Bank |

| 📌 Year Founded | 1992 |

| 👤 Amount of Staff | Approximately 2,300 employees |

| 🧾 Publicly Traded | Yes (Listed on the Copenhagen Stock Exchange) |

| 🛡️ Regulation and Security | High |

| 📍 Regulation | FSA, FCA |

| 🌎 Country of Regulation | United Kingdom |

| ↪️ Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| ⭐ Investor Protection Schemes | Yes (FCA Compensation Scheme, Danish Investor Protection Scheme) |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 🥇 Suited to Beginners | ✅Yes |

| 🥈 Suited to Professionals | ✅Yes |

| 🥉 Suited to Active Traders | ✅Yes |

| 🏅 Suited to Scalpers | ✅Yes |

| 🎖️ Suited to Day Traders | ✅Yes |

| 💴 Minor Account Currencies | Multiple |

| 💶 Minimum Deposit | None |

| ⏰ Avg. Deposit Processing Time | Instant to 1 business day |

| ⏲️ Avg. Withdrawal Processing Time | 1 to 3 business days |

| 💵 Fund Withdrawal Fee | Generally none |

| 📈 Spreads From | From 0.4 pips |

| 💷 Commissions | Variable, depending on the account type and instrument |

| 💳 Number of Base Currencies Supported | 30+ |

| 📉 Swap Fees | Variable, depending on the instrument and market conditions |

| 📊 Leverage | Up to 1:200 |

| 💹 Margin Requirements | Varies by instrument and account type |

| ☪️ Islamic Account | ✅Yes |

| 🆓Demo Account | ✅Yes |

| ⏲️ Order Execution Time | Typically under 1 second |

| 🖱️ VPS Hosting | Available |

| 📊 CFDs Total | 6,000+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📈 CFD Shares | ✅Yes |

| 🪙 Deposits and Withdrawals | Trusted Options |

| 💴 Deposit Options | Bank transfer, credit/debit card, electronic wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit card, electronic wallets |

| 🖥️Trading Platforms and Tools | Desktop, Web, Mobile |

| 💻 Trading Platforms | SaxoTraderGO, SaxoTraderPRO |

| 📌 OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex Trading Tools | Advanced charting, technical indicators, trading signals |

| ❤️Customer Support | Responsive |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Support Email | Varies |

| 💙 Social Media Platforms | LinkedIn, Twitter, Facebook, |

| ⏩Languages Supported | Multiple |

| ▶️Educational Resources | Multiple |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Comprehensive resources |

| 📒 Partnerships and Programs | Multiple |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 IB Program | ✅Yes |

| 🫰🏻 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Open Account |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Highly regulated under MAS | High minimum deposit |

| Advanced trading platforms | High trading fees for some assets |

| Wide range of financial instruments | Limited educational resources |

| Strong security and regulatory compliance | Complex for beginners |

| Excellent customer support | Not ideal for small-scale traders |

Frequently Asked Questions

Is Saxo Bank suitable for beginners?

While Saxo Bank offers advanced tools and features, it may be complex for beginners. However, it provides educational resources to assist new traders.

What educational resources are available at Saxo Bank?

Saxo Bank provides educational resources such as webinars, trading guides, and market analysis to help traders improve their skills and knowledge.

Does Saxo Bank provide customer support?

Saxo Bank offers comprehensive customer support through various channels, including phone, email, and live chat.

What are Saxo Bank’s trading fees?

Saxo Bank’s trading fees include spreads and commissions, which can vary depending on the asset class and trading volume.

Our Insights

Saxo Bank is renowned for its strong regulatory compliance, ensuring a secure and transparent trading environment for its clients. The broker provides advanced trading platforms with robust features, including SaxoTraderGO and SaxoTraderPRO, which are known for their sophisticated tools and user-friendly interfaces.

Swissquote

The Broker is licensed under the Capital Markets Services by the Monetary Authority of Singapore (MAS). Swissquote Bank Europe, based in Luxembourg, holds a banking license and is regulated by the CSSF, with supervision from the European Central Bank. This extensive regulatory framework ensures robust investor protection and a high standard of financial security for clients.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by MAS and CSSF | Minimum deposit is $1,000 |

| Offers a range of trading accounts | Higher spreads on some accounts |

| Provides a demo account | Limited leverage (up to 1:30) |

| Supports MT4 and MT5 platforms | Limited micro account options |

| Negative balance protection | Fees may apply for certain services |

Frequently Asked Questions

Does Swissquote provide negative balance protection?

Swissquote provides negative balance protection to ensure traders do not lose more than their deposited funds.

Are there any fees for depositing or withdrawing funds with Swissquote?

Swissquote generally does not charge fees for depositing or withdrawing funds, but it is advisable to check the specific terms as they vary.

What trading instruments are available with Swissquote?

Swissquote offers various trading instruments, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Does Swissquote provide educational resources?

Swissquote offers a range of educational resources, including forex courses, webinars, and various trading guides.

Our Insights

Swissquote is a highly regulated Forex broker with strong oversight from MAS and CSSF. It offers a variety of trading accounts and instruments, excellent security, and solid customer support. However, it requires a higher minimum deposit and has limited leverage.

Interactive Brokers

Interactive Brokers Singapore Pte. Ltd. is licensed and regulated by the Monetary Authority of Singapore. Moreover, the company adheres to strict regulatory standards and offers various financial instruments and trading platforms. With its global presence and comprehensive services, it provides robust trading solutions and investor protections.

| 🔎 Broker | 🥇 Interactive Brokers |

| 📌 Year Founded | 1978 |

| 👤 Amount of Staff | Approximately 2,700 |

| 👥 Amount of Active Traders | Over 2 million active traders |

| 📍 Publicly Traded | NASDAQ - IBKR |

| 🧾 Regulation | High |

| 🌎 Country of Regulation | USA (SEC, FINRA), UK (FCA), Australia (ASIC) |

| ↪️ Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🛡️ Investor Protection Schemes | SIPC |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 15+ |

| 💶 Minimum Deposit | None |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Typically free |

| 📈 Spreads From | Variable |

| 📉 Commissions | Variable |

| 📊 Base Currencies | 20+ |

| 💹 Swap Fees | ✅Yes |

| 💱 Leverage | Up to 1:40 (Retail Clients) |

| 📐 Margin Requirements | Varies |

| ☪️ Islamic Account | None |

| 🆓 Demo Account | ✅Yes |

| ⏰ Order Execution Time | Milliseconds |

| 🖱️ VPS Hosting | Free |

| 📈 CFDs Total | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank wire, ACH, credit/debit |

| 💶 Withdrawal Options | Bank wire, ACH, credit/debit |

| 🖥️ Trading Platforms | Trader Workstation (TWS), IBKR Mobile, WebTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting, market scanners, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Support Email Address | [email protected] |

| ☎️ Support Contact Number | +1-877-442-2757 |

| 💙 Social Media Platforms | Facebook, Twitter, |

| 🔊 Languages Supported | English, Spanish, Chinese, Japanese |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous |

| 🫰🏻 IB Program | ✅Yes |

| 📌 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| 📍 Rebate Program | ✅Yes |

| 🥇 Suited to Beginners | ✅Yes |

| 🥈 Suited to Professionals | ✅Yes |

| 🥉 Suited to Active Traders | ✅Yes |

| 🏅 Suited to Scalpers | ✅Yes |

| 🎖️ Suited to Day Traders | ✅Yes |

| 🚀Open an Account | 👉 Open Account |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low trading fees | High minimum deposit for some accounts |

| Wide range of instruments | Complex platform for beginners |

| Advanced trading tools | Limited educational resources |

| Regulated by top authorities | No VPS hosting available |

| High leverage options | Limited customer support hours |

Frequently Asked Questions

What is Interactive Brokers?

Interactive Brokers is a global brokerage firm that provides trading services in stocks, options, futures, forex, and more. It is known for its advanced trading platforms and low-cost trading.

What are the trading fees with Interactive Brokers?

Interactive Brokers charge low trading fees, including tight spreads and low commissions. Fees vary by asset class and trading volume.

What are the typical withdrawal and deposit processing times?

Deposit and withdrawal processing times typically range from 1-2 business days, depending on the method used.

What customer support options are available at Interactive Brokers?

Interactive Brokers provides customer support via live chat, email, and phone. They also have a comprehensive online help center.

Our Insights

Interactive Brokers offers low trading fees and a wide range of instruments, making it ideal for experienced traders. However, its complex platform and high minimum deposit requirements may be challenging for beginners.

MultiBank Group

The broader MultiBank Group is regulated and closely supervised by over 15 financial regulators worldwide. MEX Global Markets represents the Group’s Singapore entity regulated by MAS. Moreover, MultiBank Group’s extensive regulatory network ensures a high level of oversight and investor protection, contributing to its reputation as a reliable and secure trading partner.

The Group offers a wide range of trading instruments and robust trading conditions, appealing to both novice and experienced traders globally.

| 🔎 Broker | 🥇 MultiBank Group |

| 📍 Year Founded | 2005 |

| 👥 Amount of staff | Over 300 |

| 📌 Publicly Traded | None |

| 🚩 Regulation and Security | High |

| 🛡️ Regulation | ASIC, FCA, BaFin |

| 🌎 Country of regulation | Australia, UK, Germany |

| 🔖 Account Segregation | ✅Yes |

| 🚨 Negative balance protection | ✅Yes |

| 🏷️ Investor Protection Schemes | ✅Yes |

| ⭐ Account Types and Features | Multiple |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 🪙 Minor account currencies | ✅Yes |

| 💰 Minimum Deposit | 50 USD |

| ⏰ Avg. deposit processing time | 1-3 business days |

| ⏱️ Avg. Withdrawal processing time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Varies by method |

| 📈 Spreads from | 0.0 pips |

| 💶 Commissions | From $3 per side |

| 🔢 Number of base currencies | 30+ |

| 💴 Swap Fees | Varies |

| 📉 Leverage | Up to 500:1 |

| 📊 Margin requirements | Varies by account and instrument |

| ☪️ Islamic account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ▶️ Order Execution Time | Instant |

| ↪️ VPS Hosting | ✅Yes |

| 📊 CFDs Total | 1,000+ |

| 📈 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📉 CFD Shares | ✅Yes |

| 💴 Deposits and Withdrawals | Trusted Options |

| 💶 Deposit Options | Bank transfer, Credit card, E-wallets |

| 💵 Withdrawal Options | Bank transfer, E-wallets |

| 🖥️ Trading Platforms and Tools | Desktop, Web, Mobile |

| 💻 Trading Platforms | MultiBankTrader, MT4, MT5 |

| 🖱️ OS Compatibility | Windows, Mac, Mobile |

| ⚙️ Forex trading tools | Advanced charting, economic calendar |

| ❤️ Customer Support | Very Responsive |

| 🥰 Live chat availability | ✅Yes |

| ☎️ Customer Support Contact | Varies by Region |

| 💙 Social media Platforms | Facebook, Twitter, |

| 📌 Languages supported | English, German, Spanish, Arabic |

| 📒 Educational Resources | Multiple |

| 📚 Forex course | ✅Yes |

| 📔 Webinars | ✅Yes |

| ✏️ Educational Resources | Blog, Guides, Tutorials |

| 💛 Partnerships and Programs | ✅Yes |

| 🫶 Affiliate program | ✅Yes |

| 🤝 IB Program | ✅Yes |

| 💡 Sponsor notable events or teams | ✅Yes |

| ⭐ Rebate program | ✅Yes |

| 🅰️ Cent Accounts | None |

| 🅱️ Micro Accounts | None |

| 🥇 Suited to Beginners | ✅Yes |

| 🥈 Suited to Professionals | ✅Yes |

| 🥉 Suited to Active Traders | ✅Yes |

| 🏅 Suited to Scalpers | ✅Yes |

| 🎖️ Suited to Day Traders | ✅Yes |

| 🚀Open an Account | 👉 Open Account |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Highly regulated by over 15 authorities | Limited educational resources compared to some competitors |

| Low minimum deposit requirements | Withdrawal fees may apply |

| Competitive spreads from 0.1 pips | Leverage levels vary by account type |

| Offers demo accounts | Customer support response time can vary |

| Provides access to a wide range of instruments | Platform options may be limited for some traders |

| Available in multiple languages | Not as well-known as some major brokers |

Frequently Asked Questions

What is MultiBank Exchange Group?

MultiBank Exchange Group is a global financial services provider regulated by over 15 financial authorities worldwide, including the Monetary Authority of Singapore (MAS) through its Singapore entity, MEX Global Markets.

Does MultiBank Exchange Group offer leverage?

Yes, MultiBank provides leverage, with maximum levels depending on the account type and regulatory jurisdiction.

What are the typical spreads offered by MultiBank Exchange Group?

Spreads start from 0.1 pips, depending on the trading instrument and account type.

Is MultiBank Exchange Group suitable for beginners?

Yes, MultiBank offers a range of account types and educational resources suitable for both beginners and experienced traders.

Our Insights

MultiBank Exchange Group stands out for its extensive regulation and competitive trading conditions, making it a solid choice for traders seeking reliability and a broad range of instruments.

City Index

City Index is a global provider of spread betting, forex (FX), and CFD trading services. It is part of the StoneX Group, which is listed on Nasdaq, and operates under the regulatory oversight of the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Monetary Authority of Singapore (MAS) in Singapore.

| 🔎 Broker | 🥇 City Index |

| 📌 Year Founded | 1983 |

| 📍 Amount of Staff | 300+ |

| ⚙️ Publicly Traded | ✅Yes |

| ⭐ Regulation and Security | High |

| 🛡️ Regulation | FCA (UK), ASIC (Australia), MAS (Singapore) |

| 🌎 Country of Regulation | United Kingdom, Australia, Singapore |

| ↪️ Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🖇️ Investor Protection Schemes | FSCS (UK), SIPC (US) |

| 📊 Institutional Accounts | Available |

| 💴 Minor Account Currencies | Various |

| 💵 Minimum Deposit | $100 |

| ⏰ Avg. Deposit Processing Time | Typically same day |

| ⏱️ Avg. Withdrawal Processing Time | 1-3 business days |

| 💶 Fund Withdrawal Fee | No withdrawal fee |

| 📈 Spreads From | 0.5 pips (variable) |

| 📉 Commissions | Depends on account |

| 🔢 Base Currencies | 60+ |

| 🅰️ Swap Fees | Applicable |

| 🅱️ Leverage | Up to 1:30 |

| 🔖 Margin Requirements | Varies |

| ☪️ Islamic Account | Available |

| 🆓 Demo Account | Available |

| ⏱️ Order Execution Time | <1 second (varies) |

| 🏷️ VPS Hosting | Available |

| 📊 CFDs Total | 4,000+ |

| 📈 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📉 CFD Shares | ✅Yes |

| 💰 Deposits and Withdrawals | Trusted Options |

| 💴 Deposit Options | Bank transfer, Credit/Debit card, E-wallets |

| 💶 Withdrawal Options | Bank transfer, Credit/Debit card, E-wallets |

| 💻 Trading Platforms | City Index Platform, MetaTrader 4, Web Trading Platform |

| ⭐ Forex Trading Tools | Technical analysis, charting tools, economic calendar |

| 🩷Customer Support | Responsive |

| 😊 Live Chat | ✅Yes |

| 💌 Support Email | [email protected] |

| ⏩ Social Media Platforms | Twitter, Facebook, |

| ▶️ Languages Supported | Depending on region |

| 📔 Forex Course | Available |

| 📚 Webinars | Available |

| 🫶 Affiliate Program | ✅Yes |

| 🫰🏻 IB Program | ✅Yes |

| 💙 Rebate Program | Available |

| ↪️ Cent Accounts | None |

| ↘️ Micro Accounts | None |

| 🚀Open an Account | 👉 Open Account |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Regulated by top authorities. | Limited to specific regions. |

| Competitive spreads. | Fees may apply for withdrawals. |

| User-friendly trading platforms. | Customer support response times can vary. |

| Offers demo accounts. | Limited range of educational resources. |

| Supports mobile and desktop trading. | Leverage options may vary. |

| Provides VPS hosting. | Minimum deposit requirements. |

Frequently Asked Questions

Does City Index offer mobile trading?

Yes, City Index has mobile trading apps for both Android and iOS devices.

Are there any fees for withdrawals?

Withdrawal fees may apply depending on the payment method and account type.

Does City Index provide customer support?

City Index offers customer support through various channels including live chat and email.

What educational resources are available?

City Index provides educational materials such as webinars, articles, and trading guides.

Our Insights

City Index supports various trading styles and provides both mobile and desktop access, along with VPS hosting. Overall, it is a solid choice for traders seeking reliable and regulated trading services.

The Monetary Authority of Singapore (MAS) – Explained

The Monetary Authority of Singapore (MAS) is Singapore’s central bank and financial regulatory authority. MAS plays a crucial role in overseeing and regulating the financial industry in Singapore to ensure its stability and integrity. Key functions include:

- MAS regulates banks, insurance companies, securities firms, and other financial institutions.

- It formulates and implements monetary policy to ensure price stability and support economic growth.

- MAS works to safeguard the stability of Singapore’s financial system.

In addition, MAS promotes the development of Singapore’s financial markets, including facilitating innovation, improving market infrastructure, and supporting the growth of new financial products and services.

In Conclusion

MAS ensures that financial institutions adhere to fair practices and provides resources and guidance to help consumers make informed financial decisions. MAS is known for its stringent regulatory standards and robust enforcement, contributing to Singapore’s reputation as a global financial hub.

You might also like:

Faq

MAS is Singapore’s central bank and financial regulatory authority, responsible for overseeing and regulating the financial industry.

MAS regulates financial institutions, formulates monetary policy, ensures financial stability, issues currency, and promotes financial market development.

MAS sets regulatory standards and supervises banks, insurance companies, securities firms, and other financial entities to ensure they adhere to sound practices.

MAS implements monetary policy primarily through exchange rate policy to maintain price stability and support economic growth.

MAS monitors systemic risks, enforces regulatory standards, and implements measures to mitigate potential financial threats.