11 Best IIROC (CIRO) Regulated Forex Brokers

The 11 best IIROC (CIRO) Regulated Forex Brokers revealed. We have explored and tested several prominent brokers to identify the 5 best regulated brokers.

Top 11 IIROC (CIRO) Regulated Forex Brokers – a Head-to-Head Comparison

11 Best IIROC Forex Brokers (2026)

- Interactive Brokers – Overall, The Best IIROC (CIRO) Regulated Forex Broker

- CMC Markets – Advanced trading features and real-time data

- AvaTrade – Strong regulatory backing in Canada

- OANDA – Variety of account types for Canadian Traders

- FXCM – Market accessibility through web, desktop, and mobile interfaces

- City Index – Unique Performance Analytics tool

- FP Markets – Fast execution speeds and diverse platform options

- Eightcap – Various account types and educational resources

- XTB – Competitive interest on uninvested funds

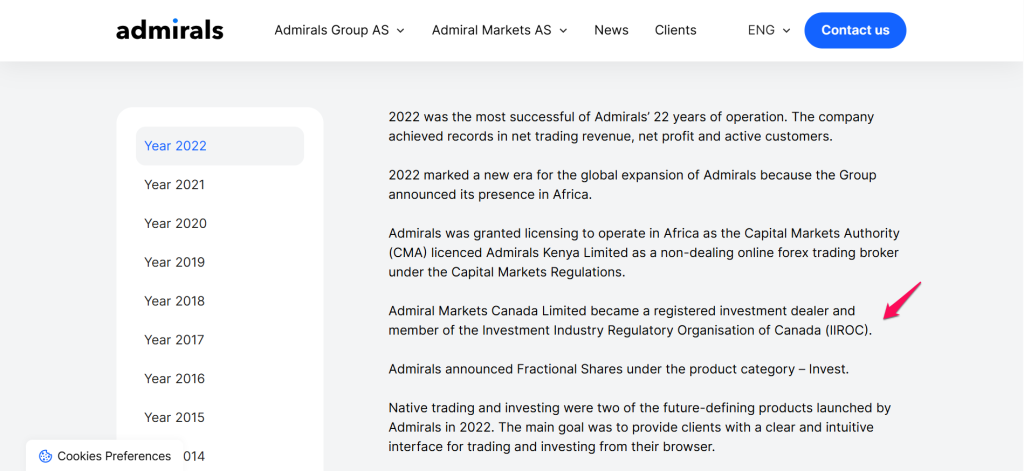

- Admirals – Excellent trading conditions and comprehensive trading tools

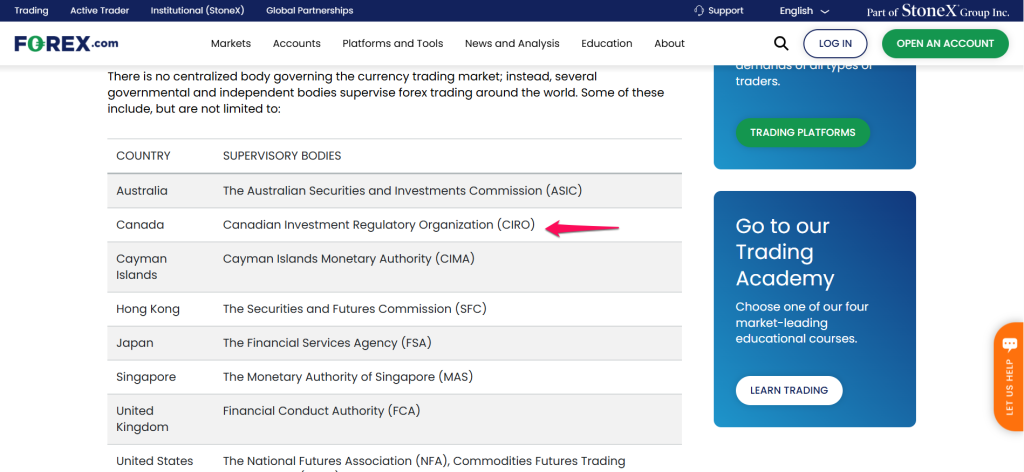

- Forex.com – Robust trading platforms and diverse market access

Note: In 2023, the Investment Industry Regulatory Organization of Canada (IIROC) merged with the Mutual Fund Dealers Association (MFDA) to form the Canadian Investment Regulatory Organization (CIRO), creating a single self-regulatory body for all investment and trading firms in Canada.

Top 10 Forex Brokers (Globally)

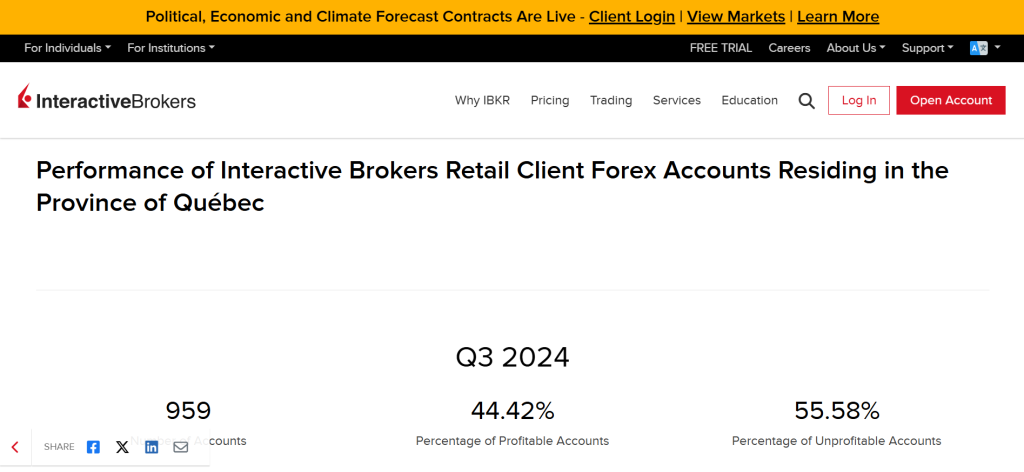

1. Interactive Brokers

Interactive Brokers is a globally recognized online brokerage firm regulated by the Canadian Investment Regulatory Organization (CIRO), formerly IIROC. It offers access to stocks, forex, options, and more with competitive fees, advanced platforms, and strong investor protection in Canada.

Frequently Asked Questions

Does Interactive Brokers offer demo accounts?

Yes, Interactive Brokers offers a free demo account. It provides a simulated trading environment with real market conditions, allowing you to practice strategies, explore their extensive platforms (TWS, IBKR Mobile, etc.), and use advanced tools without risking real money.

Is Interactive Brokers suitable for beginners?

Interactive Brokers can be complex for absolute beginners due to its extensive features and powerful Trader Workstation (TWS) platform. However, they offer simpler platforms like IBKR GlobalTrader and Client Portal, alongside a robust demo account and extensive educational resources.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Global Regulation | Complex Interface |

| Low Costs | Inactivity/Data Fees |

| Wide Asset Range | Limited Educational Content |

| Advanced Platforms | No Crypto Wallet Transfers |

| Robust Security | Slow Customer Service |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐☆☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Interactive Brokers is a highly reputable, globally regulated broker offering low-cost trading, advanced platforms, and access to diverse markets. While best suited for experienced traders, its competitive pricing and robust tools make it a strong choice for serious investors.

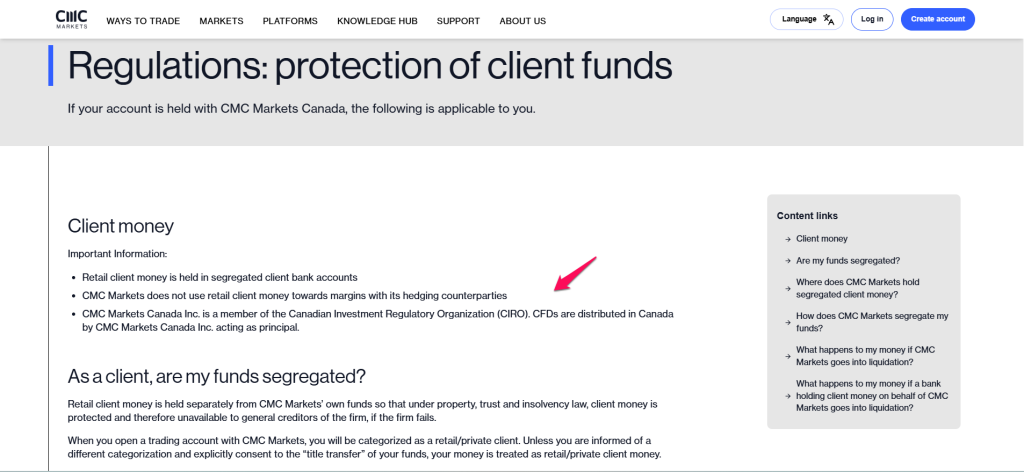

2. CMC Markets

CMC Markets is a trusted global broker regulated by the Canadian Investment Regulatory Organization (CIRO), formerly IIROC. It offers access to forex, indices, commodities, and shares with advanced platforms, competitive pricing, and strong investor protection for Canadian traders.

Frequently Asked Questions

Can I use MetaTrader 4 with CMC Markets?

Yes, CMC Markets supports MetaTrader 4. You can download the MT4 platform directly from their website for desktop or use the MT4 mobile app. CMC Markets offers competitive spreads on forex, indices, and commodities via MT4.

What leverage does CMC Markets offer in Canada?

In Canada, CMC Markets offers retail clients a maximum leverage of 50:1 for major currency pairs. For other instruments like minor forex pairs and CFDs, the leverage is typically capped at 30:1, adhering to Canadian regulatory standards.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | CFD-Only in Many Regions |

| Advanced Trading Platforms | Limited Account Types |

| No Minimum Deposit | Fees on Inactivity |

| Tight Spreads | Learning Curve for Platform |

| Free Demo Account | Crypto as CFD Only |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

CMC Markets is a well-regulated, globally trusted broker offering a wide range of CFDs, competitive spreads, and advanced trading tools. It’s ideal for active traders seeking low costs and robust platforms, though less suited for beginners or passive investors.

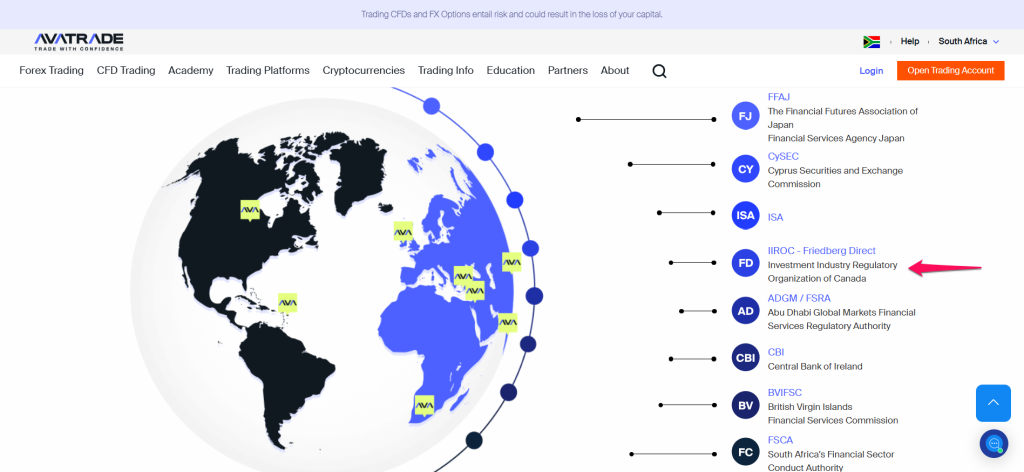

3. AvaTrade

AvaTrade, founded in 2006, is a globally regulated online broker offering forex, CFDs, options, cryptocurrencies, and more. In Canada, trading is conducted via Friedberg Direct, which is regulated by CIRO (formerly IIROC) and protected by CIPF, ensuring strong client safeguards.

Frequently Asked Questions

Does AvaTrade offer Islamic (swap-free) accounts?

Yes, AvaTrade offers Islamic accounts for Muslim clients, adhering to Sharia law. While AvaTrade eliminates regular overnight interest fees, traders incur swaps on trades held open for more than 5 days, and Islamic accounts may experience wider spreads.

Is AvaTrade suitable for beginners?

AvaTrade suits beginners well because it offers user-friendly platforms (AvaTradeGO, WebTrader), comprehensive educational resources (AvaAcademy with free courses, videos, eBooks), and a readily available demo account. Their low minimum deposit ($100) also makes it accessible for those new to trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | No ECN Access |

| Commission-Free Trading | Inactivity Fee |

| Wide Range of Platforms | Limited Leverage in Some Regions |

| Islamic Account Available | No US Clients |

| Copy Trading Options | Execution Transparency |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade offers user-friendly platforms, commission-free trading, and a broad asset range, making it a globally regulated forex and CFD broker. It suits both beginners and experienced traders, offering strong educational support, Islamic accounts, and reliable copy trading options.

Top 3 IIROC Regulated Brokers – Interactive Brokers vs CMC Markets vs AvaTrade

Note: The Top 3 IIROC Regulated Brokers are ranked based on a combination of User Trust Scores and verified Customer Reviews.

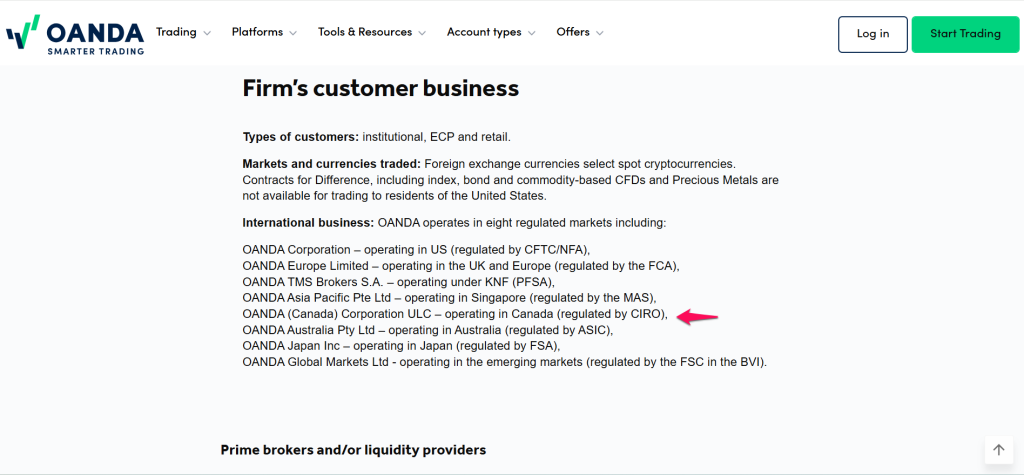

4. OANDA

OANDA is a well‑established, globally regulated forex broker that operates under IIROC in Canada via its subsidiary, ensuring strong client protection, zero minimum deposits with competitive spreads, and negative balance safeguards.

Frequently Asked Questions

What is the minimum deposit to open a trading account with OANDA?

OANDA prides itself on accessibility, offering no minimum deposit requirement to open or maintain a trading account. While you can open an account with any amount, you will need sufficient funds to open positions and engage in actual trading activities

What trading platforms can I use with OANDA?

OANDA offers its proprietary OANDA Trade platform, known for its intuitive design and advanced charting. They also support the popular MetaTrader 4 and MetaTrader 5. Additionally, OANDA integrates with TradingView, allowing clients to trade directly from its advanced charting platform.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Trusted Global Regulation | Limited Product Range |

| No Minimum Deposit | Inactivity Fees |

| Fast Execution Speed | Higher Spreads on Standard Accounts |

| Robust Trading Platforms | Few Bonuses or Promotions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is a globally trusted broker known for strong regulation, no minimum deposit, fast execution, and user-friendly platforms. It suits both beginners and professionals, though limited assets and inactivity fees may concern some traders.

5. FXCM

FXCM is a reputable forex and CFD broker, established in 1999, regulated globally and in Canada under IIROC via Friedberg Direct. It provides no-dealing-desk execution, high leverage in select regions, client fund segregation, and CIPF protection, making it a secure choice for Canadian and international traders.

Frequently Asked Questions

What is the minimum deposit to start trading with FXCM?

FXCM requires a minimum initial deposit of 50 currency units for individual trading accounts. For corporate, trust, or IRA accounts, the minimum is significantly higher at 50,000 currency units. Subsequent deposits by card also have a $50 minimum, while bank wires have no minimum.

What platforms can I use with FXCM?

FXCM offers its proprietary Trading Station platform (desktop, web, mobile), known for its advanced charting and tools. They also support MetaTrader 4 (MT4) for automated trading. Additionally, FXCM integrates with TradingView for advanced charting and analysis.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Well-Regulated Broker | Spreads Not the Lowest |

| No Dealing Desk Execution | Limited Product Offering |

| Wide Platform Support | Inactivity Fee |

| Low Minimum Deposit | MT5 Not Supported |

| Active Trader Program | Leverage Restrictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXCM is a well-regulated forex and CFD broker offering no-dealing-desk execution, strong platform variety, and educational tools. While spreads aren’t the lowest and MT5 is missing, it remains a solid choice for beginners and active traders alike.

6. City Index

City Index is a well-established online broker founded in 1983, offering trading in over 13,500 markets, including forex, indices, shares, commodities, and futures through platforms like Web Trader, MetaTrader 4, and TradingView.

Frequently Asked Questions

What trading platforms does City Index offer?

City Index offers its proprietary Web Trader platform and dedicated mobile apps for iOS and Android, both known for their intuitive design and advanced charting. They also support the popular MetaTrader 4, and integrate with TradingView for enhanced charting and social trading features.

Does City Index offer a demo account?

Yes, City Index offers a free demo account with virtual funds. This allows users to practice trading CFDs and forex on their Web Trader, mobile apps, or MT4 platforms in a risk-free environment. Demo accounts typically provide access for 12 weeks.

Pros and Cons

| ✓ Pros | ✕ Cons |

| IIROC Regulated | No Islamic Accounts |

| Low Spreads | Limited Leverage in Canada |

| Multiple Platforms | Platform Learning Curve |

| Fast Execution | No Bonuses or Promotions |

| Demo Account | Inactivity Fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

City Index is a well-regulated broker under IIROC, offering competitive spreads, fast execution, and a variety of trading platforms. It’s ideal for serious traders in Canada, though it lacks Islamic accounts and has limited leverage due to regulation.

7. FP Markets

FP Markets is a globally regulated forex and CFD broker. Traders can access a wide range of markets via MT4, MT5, cTrader, Iress, and TradingView, with a minimum deposit starting from just $100.

Frequently Asked Questions

Does FP Markets offer Islamic (swap-free) accounts?

Yes, FP Markets offers Islamic (swap-free) accounts for Muslim clients, designed to comply with Sharia law by eliminating overnight interest charges. These are available on both their Standard and Raw account types on the MT4 and MT5 platforms.

Is FP Markets suitable for beginners?

Yes, FP Markets is generally considered suitable for beginners. They offer a Standard account with no commissions, a free demo account for risk-free practice, and comprehensive educational resources including courses, guides, webinars, and platform tutorials.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Globally Regulated | Not IIROC Regulated in Canada |

| Tight Spreads | Iress Platform is Expensive |

| Multiple Platforms | Limited Crypto Offering |

| High Leverage | No Local Presence in Some Regions |

| Fast ECN Execution | Inactivity Fees May Apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FP Markets is a globally regulated broker known for tight spreads, fast ECN execution, and versatile trading platforms. It suits both beginners and advanced traders, though some features, like Iress accounts and regional limitations, may not suit everyone.

8. Eightcap

Eightcap provides competitive trading conditions with low spreads, leverage up to 500:1 (depending on jurisdiction), and supports popular platforms like MetaTrader 4, MetaTrader 5, and TradingView, making it suitable for both beginners and professional traders.

Frequently Asked Questions

Which platforms are available?

Eightcap primarily supports the widely used MetaTrader 4 and MetaTrader 5 platforms, available on desktop, web, and mobile. Additionally, they offer seamless integration with TradingView, allowing clients to trade directly from their advanced charting and social features, providing a comprehensive trading ecosystem.

Is customer support available?

Yes, Eightcap offers comprehensive customer support 24/5. You can reach their client services team via live chat, phone, and email. This multi-channel support ensures traders can get assistance with their queries efficiently, regardless of their location.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Globally Regulated | No Proprietary Platform |

| Multiple Platforms | Inactivity Fees May Apply |

| Tight Spreads & Low Costs | Limited Research Tools |

| Leverage up to 1:500 | Crypto Trading Restrictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Eightcap is a reliable, well-regulated broker offering competitive spreads, a wide range of instruments, and popular trading platforms. Its strong regulatory oversight and user-friendly features make it a solid choice for both beginner and experienced traders worldwide.

9. XTB

XTB is a globally regulated forex and CFD broker established in 2002. Traders can choose from Standard, Professional, or Islamic accounts, using the proprietary xStation 5 platform or MetaTrader in select regions.

Frequently Asked Questions

Is xStation beginner-friendly?

Yes, XTB’s xStation platform is widely considered beginner-friendly. It boasts an intuitive design, a clean dashboard, and easy navigation. XTB also offers a comprehensive demo account and extensive educational resources like their Trading Academy, making it very accessible for those new to trading.

Are there inactivity fees?

Yes, XTB charges an inactivity fee. A €10 monthly fee (or equivalent) is applied if there’s no trading activity for 12 consecutive months AND no cash deposit within the previous 90 days. The fee stops once trading resumes.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Top-Tier Global Regulation | No MT5 in Most Regions |

| No Minimum Deposit | Inactivity Fee |

| Proprietary xStation Platform | Crypto CFD Restrictions |

| Commission-Free Trading | No Cent or Micro Accounts |

| Fast, Reliable Execution | Limited Automated Trading |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XTB is a well-regulated broker offering a powerful proprietary platform, low trading costs, and a wide range of markets. It’s ideal for beginners and experienced traders, though automation and platform variety are limited in some regions.

10. Admirals

Admiral Markets Canada Ltd. is a registered investment dealer and member of the Canadian Investment Regulatory Organization (CIRO), formerly known as IIROC. It offers various account types, including Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Islamic, and Demo accounts.

Frequently Asked Questions

Does Admirals offer educational resources?

Yes, Admirals offers extensive educational resources. They provide a “Free Academy” with online courses (like Forex 101), webinars, articles, tutorials, e-books, and videos, covering topics from beginner basics to advanced strategies and trading psychology. They emphasize continuous learning and support.

Are there any inactivity fees?

Yes, Admirals does charge an inactivity fee. A €10 monthly fee (or equivalent) is applied if there’s no trading activity for 24 consecutive months and the account has a positive balance.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-Jurisdiction Regulation | Inactivity Fees |

| Low Minimum Deposit | No Cent/Micro Account |

| Diverse Account Options | Limited Promotions/Bonuses |

| Competitive Spreads | Leverage Restrictions |

| Advanced Trading Platforms | Limited Crypto Access in Some Regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Admirals is a globally regulated broker offering low-cost trading, advanced platforms, and strong educational resources. It’s suitable for both beginners and experienced traders, though some regional limitations and inactivity fees may affect certain users.

11. Forex.com

FOREX.com, a subsidiary of StoneX Group Inc. (NASDAQ-listed), is a globally regulated forex and CFD broker registered with IIROC (now CIRO) in Canada and a member of the Canadian Investor Protection Fund (CIPF).

Frequently Asked Questions

Is FOREX.com a safe broker?

Yes, FOREX.com is considered a very safe and trusted broker. It’s regulated by multiple top-tier authorities globally, including the CFTC and NFA (US), FCA (UK), ASIC (Australia), MAS (Singapore), and CIRO (Canada).

Are there commission-free accounts?

Yes, FOREX.com offers commission-free accounts. Their Standard Account and MetaTrader 4/5 accounts are structured with no commissions on forex pairs, where your primary trading cost is the spread. They also offer a RAW Spread Account with tighter spreads.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Globally Regulated | Limited Leverage in Some Regions |

| Strong Financial Backing | No Social Copy Trading |

| Diverse Trading Platforms | Inactivity Fee |

| Tight Spreads on Raw Account | Crypto Restrictions by Region |

| Low Minimum Deposit | Commission on Raw Account |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FOREX.com is a globally trusted broker offering tight spreads, fast execution, and robust platform options. Regulated by top-tier authorities, including CIRO in Canada, it suits both beginners and professionals, though regional leverage and crypto access may be limited.

What is an IIROC-regulated (CIRO) Forex Broker?

An IIROC-regulated forex broker is a forex and CFD trading firm that is authorized and supervised by the Investment Industry Regulatory Organization of Canada (IIROC)—now part of the Canadian Investment Regulatory Organization (CIRO) as of 2023.

Criteria for Choosing an IIROC Regulated Broker

| Criteria | Description | Importance |

| Regulation & Safety | Must be fully licensed by IIROC/CIRO, ensuring client fund protection, transparency, and audits. | ⭐⭐⭐⭐⭐ |

| Trading Platforms | Availability of user friendly, reliable platforms like MT4, MT5, or proprietary software. | ⭐⭐⭐⭐☆ |

| Spreads & Fees | Competitive spreads and transparent fee structure to reduce trading costs. | ⭐⭐⭐⭐⭐ |

| Leverage Offered | Reasonable leverage limits compliant with IIROC rules, balancing opportunity and risk. | ⭐⭐⭐⭐☆ |

| Account Types | Variety of account options (standard, raw spread, demo, Islamic) to suit different trader needs. | ⭐⭐⭐⭐☆ |

| Customer Support | Responsive and professional customer service, preferably 24/5, with multilingual support. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal | Convenient and secure payment methods with fast processing times. | ⭐⭐⭐⭐☆ |

| Educational Resources | Access to webinars, tutorials, and market analysis to support trader development. | ⭐⭐⭐☆☆ |

| Execution Speed | Fast order execution to minimize slippage and improve trade outcomes. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | Positive user feedback and industry reputation indicate reliability and trustworthiness. | ⭐⭐⭐⭐☆ |

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From regulation, leverage, and minimum deposits, we provide straightforward answers to help you understand IIROC-regulated brokers and choose the right broker confidently.

Q: What does IIROC regulation mean for me as a forex trader? – Liam Fraser, Canada

A: IIROC regulation means your broker adheres to strict Canadian standards for financial conduct and client protection. This includes segregated client funds, participation in the CIPF (up to CAD 1 million coverage), and limited leverage, providing a secure trading environment.

Q: What’s the maximum leverage I can get with an IIROC-regulated broker? – Chloe Dupont, Canada

A: With IIROC-regulated brokers in Canada, the maximum leverage for retail clients is typically capped at 50:1 for major currency pairs. For other instruments like minor forex pairs, commodities, and indices, leverage limits are lower, often around 20:1 or 10:1.

Q: Is there a minimum deposit to open an account with an IIROC broker? – Noah Schmidt, Canada

A: The minimum deposit varies by IIROC-regulated broker and account type. Some, like OANDA, have no minimum. Others may require a minimum deposit, which could range from $50 to $100 or more, depending on the specific broker’s policies.

Q: Do IIROC brokers typically offer good customer support? – Lucas P. Canada

A: Yes, IIROC-regulated brokers generally offer robust customer support, usually via live chat, phone, and email, during business hours. Their adherence to regulatory standards often extends to providing efficient and responsive client assistance.

Q: What happens if I have a complaint against an IIROC-regulated broker? – Emma Davies, Canada

A: If you have a complaint against an IIROC-regulated broker, you should first try to resolve it directly with the broker. If unsatisfied, you can escalate your complaint to IIROC’s dedicated Complaints and Inquiries team for investigation and resolution.

In Conclusion

You Might also Like:

- Interactive Brokers Review

- CMC Markets Review

- AvaTrade Review

- OANDA Review

- FXCM Review

- City Index Review

- FP Markets Review

- Eightcap Review

- XTB Review

- Admirals Review

- Forex.com Review

Faq

Yes, IIROC-regulated brokers in Canada generally do offer negative balance protection for retail clients. This means your losses cannot exceed the funds in your trading account, preventing you from owing the broker money, even during extreme market volatility.

IIROC-regulated brokers commonly support popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Many also offer their own proprietary web and mobile trading platforms, often integrating with advanced charting services like TradingView.

IIROC-regulated brokers are members of the Canadian Investor Protection Fund (CIPF). In the event of broker insolvency, the CIPF can provide coverage for eligible client accounts, typically up to CAD 1 million, safeguarding your assets.

Yes, IIROC regulations require high transparency. Brokers must clearly disclose all fees, including spreads, commissions, and any other charges. They aim to prevent unfair pricing and ensure clients understand their trading costs.

Trading cryptocurrencies directly with IIROC-regulated forex brokers is limited. While some may offer crypto CFDs, the maximum leverage is very low (e.g., 2:1), and offerings are less extensive compared to unregulated platforms, due to strict regulatory oversight.