EUR/USD Breaking Moving Averages – Sell the Breaks?

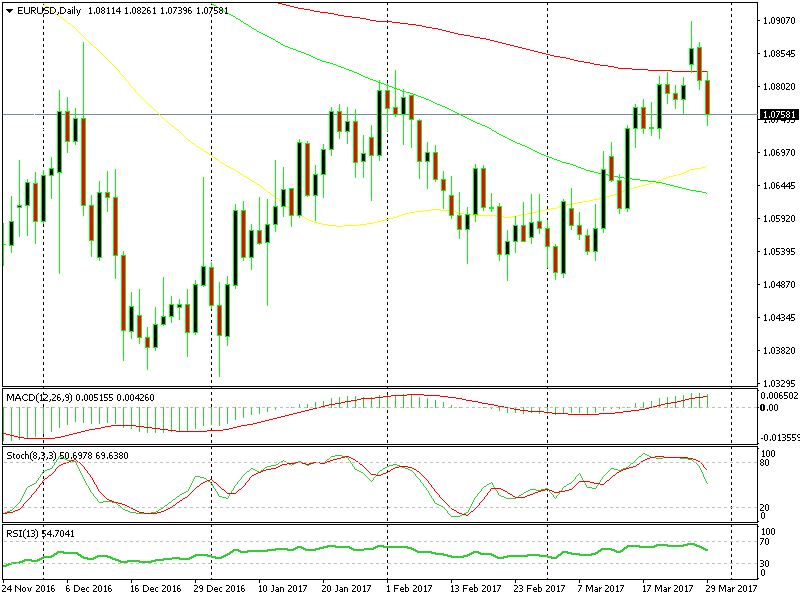

EUR/USD has been in a solid uptrend since the beginning of the year. After managing to create a fake-out when it broke at 1.0450 and 1.0350, after reaching 1.0340, we saw a swift turnaround.

It has gained more than 550 pips since then, but in the last two days we have seen a substantial retrace. This forex pair has lost nearly 200 pips in the last couple of days, so the weekend gap has been filled.

The moving averages can´t hold the price, but they´re good selling spots

The moving averages can´t hold the price, but they´re good selling spots

As seen on the hourly chart, the moving averages are nothing more than a blip on the radar during strong trends when it comes to holding the price. Nevertheless, they´re good at providing resistance after being broken. So, you can use these MAs during higher retraces for short term sell signals/trades.

The downtrend of the last 2 days has been quite strong. Yet, if we switch to the H4 chart or the daily chart we see that this is nothing more than a retrace of the bigger uptrend, which began in early January.

The decline of the last 2 days looks merely a pullback of the bigger uptrend

The decline of the last 2 days looks merely a pullback of the bigger uptrend

We can't know at the moment whether this is a proper reverse downwards or just a normal retrace before the next higher leg.

According to the Elliott Wave Theory, we are currently in the fourth wave, which is a pullback before the fifth wave takes us higher. I don´t know how much this theory will work this time, but it's something to keep in mind.

When the stochastic indicator reaches the oversold area on the daily forex chart, the time has come to look for a buying spot from which to target the fifth wave. I think that the two lower moving averages will provide the support we need. Right now, selling at the MAs on the H1 chart seems to be the best bet.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account