EUR/JPY – Easter Holiday, Thin Volatility & Breakout Setup

Whilst investors are enjoying the Easter holidays, the Japanese cross EUR/JPY is cooking a nice trade setup. Let's check it out...

What’s up, fellas?

Whilst investors are enjoying the Easter holidays, the Japanese cross EUR/JPY is cooking a nice trade setup. Let’s check it out…

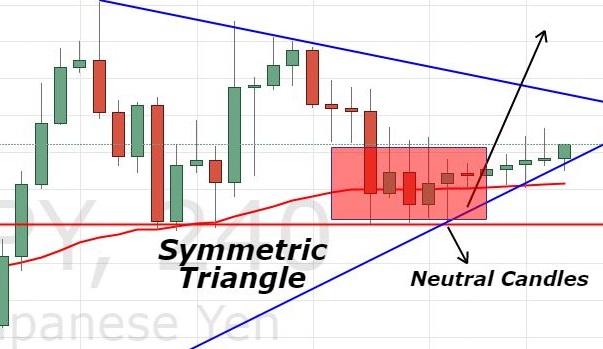

EUR/JPY – Symmetric Triangle Pattern Doing Well

Fellas, it’s an update on our previous trade idea. If you recall EUR/JPY Tests 130.650 – Symmetrical Triangle Breakout Looms, the market is still trading bullish above 130.650. However, the moment is very light and boring. It is because investors are on holiday.

EUR/JPY has soared only 50 pips above the buying level of 130.640. I would like to highlight the number of Doji and Spinning Top candles that have closed near 131. It is important to note that these candles are not representing a reversal pattern but rather a lack of trading volume.

Can we expect a continuation of a bullish trend? Let’s find out…

EUR/JPY – 4- Hour Chart

Looking at the 4-hour chart, the EUR/JPY is still trading in the oversold zone. Both of the leading indicators, RSI and Stochastics, have started coming out of the selling zone, signifying potential for a bullish reversal. The Japanese cross is expected to face an immediate resistance level near 131.400.

EUR/JPY – Trading Plan

Fellas, I’m sticking with the same plan of staying bullish above 130.650 to target 131.400. Investors are advised to move their stops to break-even to avoid reversals. Are you wondering why it’s necessary? Refer to FX Leaders Money Management Strategy. Good Luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account