The 50 Hourly SMA Keeps USD/JPY Bearihs

USD/JPY turned quite bearish in the last few days of last year, as traders turned into safe havens just in case a world war broke out. Well, that wasn’t too far fetched, as geopolitical tensions between US and Iran increased in the first week of this year and safe havens rallied higher, with USD/JPY losing around 200 pips in total.

But, the sentiment improved after the US didn’t attack back, following the Iranian attack on US bases in Iraq. As a result, safe havens turned bearish again and USD/JPY turned bullish, climbing above 110. But, the sentiment turned negative again this week, after the coronavirus outbreak in China.

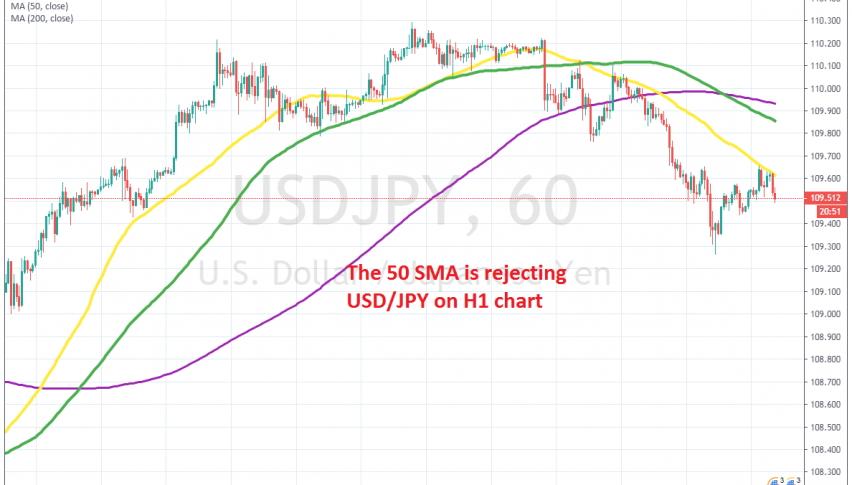

As a result, USD/JPY has turned bearish again, as safe havens attract bids. USD/JPY fell to 109.20s, but it was retracing higher yesterday. Although, buyers couldn’t push above the 50 SMA (yellow) on the H1 chart, which has been providing resistance since yesterday. They failed to push above it, and instead the 50 SMA pushed the price down. The virus is still strong in China, so I suppose the sentiment will remain negative and USD/JPY will remain bearish.