GBP/USD Analysis – The Most Split BOE Decision Since 2008

- The US Employment Sector adds a further 353,000 jobs in January 2024, the highest in 11 months. Salaries also rose at their fastest pace in over 12 months.

- Economists advise the US employment sector remains resilient and unbalanced which keeps inflations risks high. The US Unemployment Rate remains at 3.7% for a third consecutive month.

- The Bank of England has not been more split in their decision since the 2008 banking crisis. Two members voted for a 0.25% hike while one member voted for a 0.25% cut.

- The FOMC members all believe the Federal Fund Rate will be cut by 0.75% in 2024 according to the Fed Chairman.

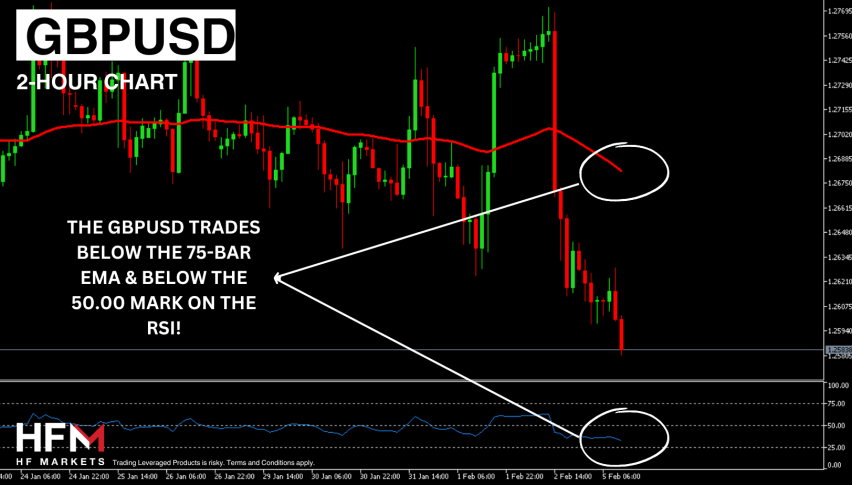

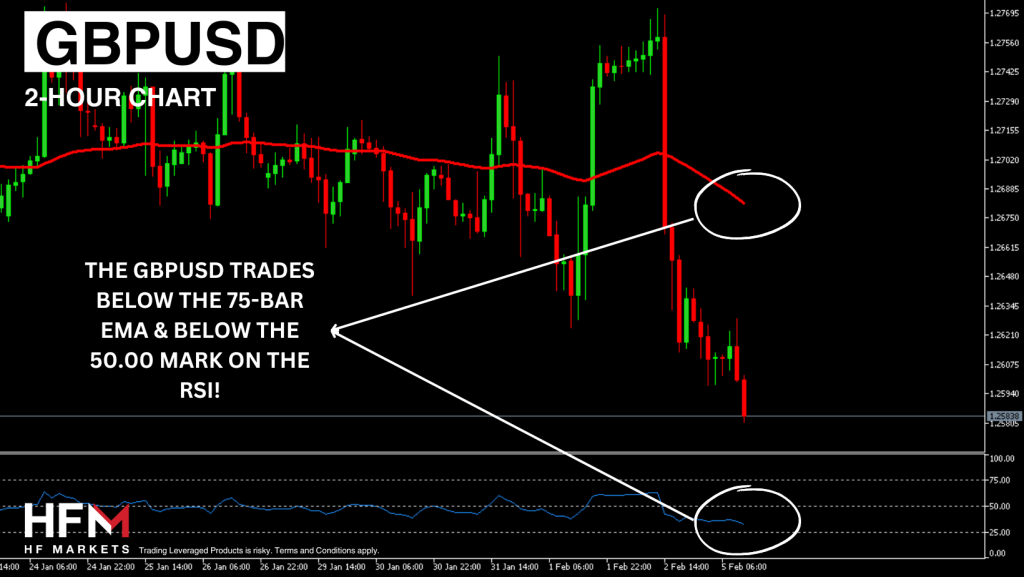

GBPUSD – Signals and Technical analysis

On Friday, the GBPUSD depreciated by more than 0.90%, the largest decline seen since the first half of October 2023. The exchange rate has been trading in a “side-ways” trend since the latter half of December 2023. The main support level is at 1.25999 and the resistance levels are also slightly tilted downwards. Therefore, the asset is close to forming a descending triangle pattern which would show the Dollar is outcompeting the Pound.

Technical analysts also note that the bearish price action is primarily quick large impulse waves. Whereas the Pound sees steady gains over a longer period. Therefore, the Dollar would need to maintain momentum and break through the current support level to form a bearish trend. Lastly, on the two-hour chart, the GBPUSD is trading below the 75-bar EMA and below the Neutral on the RSI meaning there is a higher possibility of sellers gaining control. However, after such a strong decline on Friday, short-term traders should be cautious traders do not push the Pound slightly higher closer to the trendline before declining again.

Federal Reserve Chairman Powell – Latest Interview, 04/02/2024

Last night, the Chairman of the Federal Reserve in an interview advised markets that the committee believe three 0.25% cuts are required in 2024. However, he did advise this is not likely in March and markets pricing six cuts is not possible unless the economy deteriorates. The question remains, as to when the Fed will make the first move. Currently most market participants believe the Fed will cut in May 2024. However, if inflation rises for a second consecutive month, a cut will be pushed back. As a result, the Dollar can appreciate against all currencies.

According to economists, higher inflation is possible considering the rise in salaries and significantly higher employment data. A stronger employment sector can increase consumer demand and increase risk appetite. As a result, it is not difficult to tackle and bring inflation down to its 2% target. Economists believe US inflation will fall to 2.6% which is still above its target but is a comfortable level. However, if inflation next Wednesday does not drop below 3.4%, analysts will start to doubt a cut in the first two quarters of the year. Again, this can potentially support the Dollar.

Bank of England – Dr Dhingra Votes for a 0.25% Cut!

The Pound this morning is increasing in value against all currencies, however, the Bank of England’s votes were not so reassuring. The UK Monetary Policy Committee, which is made up of nine members, had a member vote for a 0.25% cut for the first time since March 2020. In addition to this, only 2 members voted for a hike, whereas previously 3 members were deemed hawkish. If the central bank becomes more dovish the Pound can take a hit as inflation remains high and UK consumer demand low.

Dr Swati Dhingra was the member which voted for a cut. Dr Dhingra advised the decision was made as she believes the policy is restrictive enough and higher rates are punishing the low paid and even some working-class families. As a result, economic growth remains poor. For example, the US economy in the latest quarter grew 3.3% and 4.9% the quarter before. The UK economy recorded growth of -0.1% and 0.0%.

Even though the US is witnessing much higher economic growth and stability, the question remains, who will cut first and who will cut more frequently. This will largely determine which will be the “winning” currency.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account