Ethereum Faces Yield Competition Challenge While Maintaining $2,500 Support Level

Ethereum (ETH) holds steady above key psychological level of $2,500 in the past day as staking yields decline amid rising DeFi competition

Quick overview

- Ethereum is currently trading above the $2,500 support level, showing stability despite market volatility.

- The cryptocurrency's price rose about 1% after the Federal Reserve maintained interest rates, indicating growing institutional confidence.

- Staking yields for Ethereum have dropped below 3%, facing competition from stablecoins and DeFi protocols offering higher returns.

- The near-term price outlook for ETH includes potential bullish and bearish scenarios, with critical resistance at $2,565 and support at $2,480.

Ethereum ETH/USD is currently trading above the important $2,500 support level. This shows that it has been rather stable over the previous 24 hours, even if the market as a whole has been very volatile. The second-largest cryptocurrency in the world, ETH, showed strength after the Federal Reserve decided to keep interest rates at 4.25%-4.50% for the fourth straight meeting. ETH rose about 1% right after the news.

The market’s lack of response shows that institutions are becoming more confident, but President Trump’s ongoing attacks on Fed Chair Jerome Powell add political instability to the macroeconomic picture.

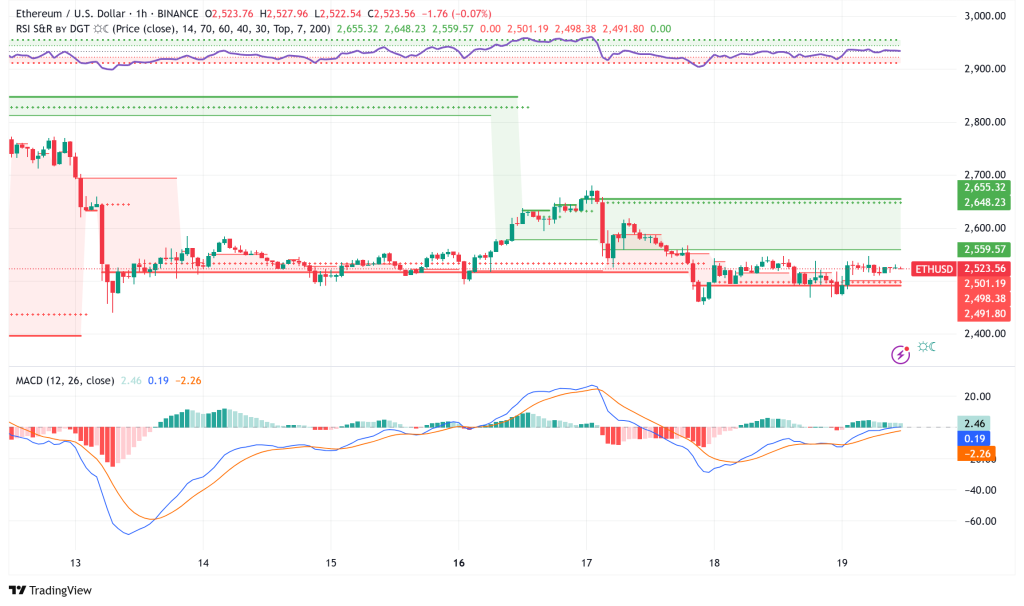

ETH/USD Technical Analysis: Critical Levels Define Near-Term Direction

The technical picture for Ethereum shows a mixed picture, with clear support and resistance areas. ETH dropped from recent highs of about $2,680 and found support in the $2,450-$2,480 range, which set up a rising channel pattern.

Key Technical Levels:

- Current Price: Approximately $2,522, holding above $2,500 psychological support

- Immediate Resistance: $2,540-$2,565 zone (50% Fibonacci retracement level)

- Major Resistance: $2,625, with potential extension to $2,680

- Critical Support: $2,480 rising channel support, followed by $2,450

Technical Indicators Signal Caution:

- MACD losing momentum in bearish territory

- RSI trading below neutral 50 level

- Price below 100-hourly Simple Moving Average at $2,540

ETH needs to clearly break through the $2,565 resistance zone for the bulls to take back control. A breakout might start a rally that takes prices up to $2,625 to $2,680. On the other hand, if the support level of $2,480 is not kept, the price could test $2,450, and there is a possibility of going down to $2,320.

The Yield Wars: Ethereum’s Staking Returns Under Pressure

Declining Staking Yields Challenge ETH’s Value Proposition

Ethereum is having a hard time since staking rewards have dropped below 3% per year, down from about 5.3% at their highest point after the Merge in September 2022. This drop is due to the way the protocol was set up: when more ETH is staked (now above 35 million ETH, or 28% of the supply), the rewards per validator go down according to an inverse square root curve.

Rising Competition from Alternative Yield Products

Ethereum is facing more and more competition from stablecoins that pay interest and DeFi protocols that offer better returns:

Yield-Bearing Stablecoins (4-6.5% annual returns):

- sUSDe (Ethena): about 6% APR using synthetic delta-neutral techniques

- SyrupUSDC (Maple Finance): 6.5% through tokenized Treasuries and MEV schemes

- sUSDS (Sky/MakerDAO): 4.5% supported by real-world things

DeFi Lending Protocols:

- Across sites like Aave and Compound, the average lending rate for USDC is about 5%.

- When demand is high, USDT lending might earn you up to 3.8% more.

The yield-bearing stablecoin market has grown by an incredible 235% in the last year, bringing its total value to $11.4 billion.

Strategic Outlook: Network Effects May Offset Yield Disadvantage

Despite facing yield competition, Ethereum benefits from a fundamental advantage: most competitive yield products are developed on its network. When more people use yield-bearing stablecoins, tokenized assets, and DeFi protocols, the network gets busier, transaction costs go up, and ETH demand goes up.

Ethereum’s Competitive Advantages:

- Net inflation rate of just 0.7% (vs. Solana’s 4.5%)

- Dominant position in institutional DeFi adoption

- Deepest liquidity pools across DeFi applications

- Serving as foundational infrastructure for competing yield products

Ethereum Price Prediction: Defined Risk-Reward Scenarios

Near-Term Outlook (1-3 Months)

Bullish Scenario (40% probability): ETH breakthrough above $2,565 resistance could target:

- Initial: $2,625-$2,680 range

- Extended: $2,800-$2,880 zone

Bearish Scenario (35% probability): Failure to hold $2,480 support may trigger correction toward:

- Initial: $2,320-$2,240 range

- Extended: $2,150 support zone

Sideways Consolidation (25% probability): ETH may trade within $2,450-$2,680 range as markets digest Fed policy implications and DeFi ecosystem evolution.

Long-Term Outlook

Ethereum is the best platform for smart contracts, which is good for the long term even when there are short-term yield problems. The network’s ability to take value from the larger DeFi ecosystem, along with minimal inflation and patterns of institutional adoption, suggests that the current yield problems may not last long. The main driver will be showing that network effects can make up for rivalry between individual yield products. This idea is becoming more and more backed by on-chain activity data.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account