CRWV Stock Near Breakdown As CoreWeave’s Meta Deal Fails to Lift Confidence Amid Losses

CoreWeave’s brief rebound following its $14 billion Meta deal is fading fast, with renewed doubts over profitability, Nvidia reliance, and..

Quick overview

- CoreWeave's stock has fallen nearly 30% after a brief rebound following its $14 billion deal with Meta, raising concerns about profitability.

- The company's reliance on Nvidia and costly expansion plans have led to increased scrutiny and doubts about its financial stability.

- Despite a significant increase in revenue, CoreWeave reported widening net losses, indicating a disconnect between sales growth and profitability.

- Analysts warn that ongoing trade tensions and high capital expenditures could lead to further declines in CoreWeave's stock.

CoreWeave’s brief rebound following its $14 billion Meta deal is fading fast, with renewed doubts over profitability, Nvidia reliance, and geopolitical turmoil weighing heavily on sentiment.

Momentum Unravels After Short-Lived Rebound

After a steep summer collapse, CoreWeave Inc. (NASDAQ: CRWV) briefly regained momentum in September, soaring back above $150 from its June lows. But that strength has quickly faded. Shares have now fallen nearly 30%, including a 5.5% drop today, as traders abandon the stock once again.

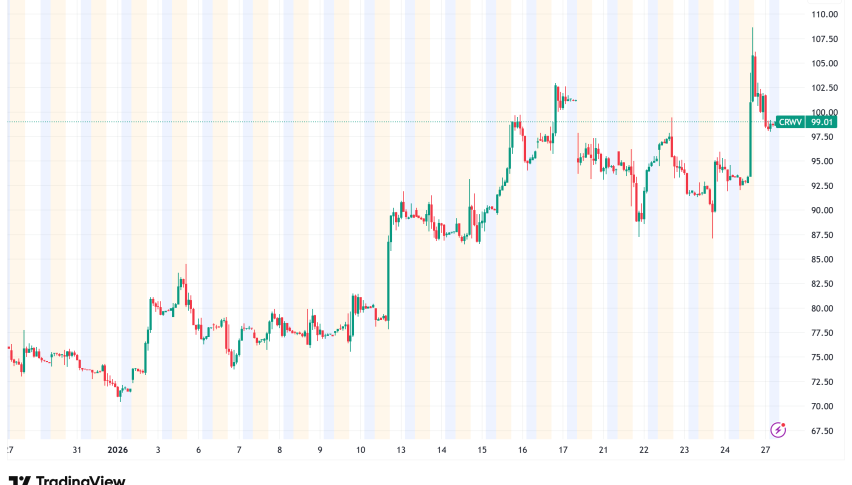

CRWV Chart Daily – The 50 SMA Will Likely Give Way to Sellers

The 20-week moving average has flipped from support to resistance — a bearish signal suggesting that sellers remain firmly in control. With the 50-day SMA now under pressure, technical analysts warn of another leg lower, possibly toward $114, or even $84, if momentum continues to deteriorate.

Meta Partnership Fails to Rebuild Trust

The market’s initial enthusiasm came after CoreWeave announced a $14.2 billion deal with Meta Platforms (META) to provide long-term AI computing power through 2031. Yet what was supposed to be a credibility boost has instead amplified doubts.

Analysts argue that such long-duration contracts expose the company to crippling capital cycles, requiring constant hardware upgrades and draining liquidity. The Meta deal lifted visibility — but not investor confidence — as questions mount about whether CoreWeave can ever deliver meaningful profit margins.

Costly Expansion and Nvidia Dependence

CoreWeave’s planned acquisition of Marimo Inc., developer of an open-source AI notebook platform, adds another layer of complexity — and cost — to its already heavy balance sheet. Critics view it as a poorly timed expansion given the firm’s ballooning infrastructure spending.

Its deep partnership with Nvidia (NVDA) further complicates matters. Nvidia’s agreement to buy up to $6.3 billion of CoreWeave’s unused capacity gives temporary revenue stability but reinforces dependence on its largest supplier. CoreWeave’s success is now tightly bound to Nvidia’s own production cycles and pricing, limiting strategic flexibility.

Profitability Far Away

CoreWeave’s Q2 results revealed the growing disconnect between revenue and reality. While sales surged 105% year-on-year to $1.21 billion, net losses widened to $290.5 million amid a record $3 billion in data-center spending. Analysts estimate annual capital expenditures will reach $20–23 billion, warning the company may be expanding faster than its finances allow.

With Weiss Ratings assigning a “Sell (D+)” and trade tensions adding pressure, CoreWeave’s rally looks less like recovery — and more like the calm before another correction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM