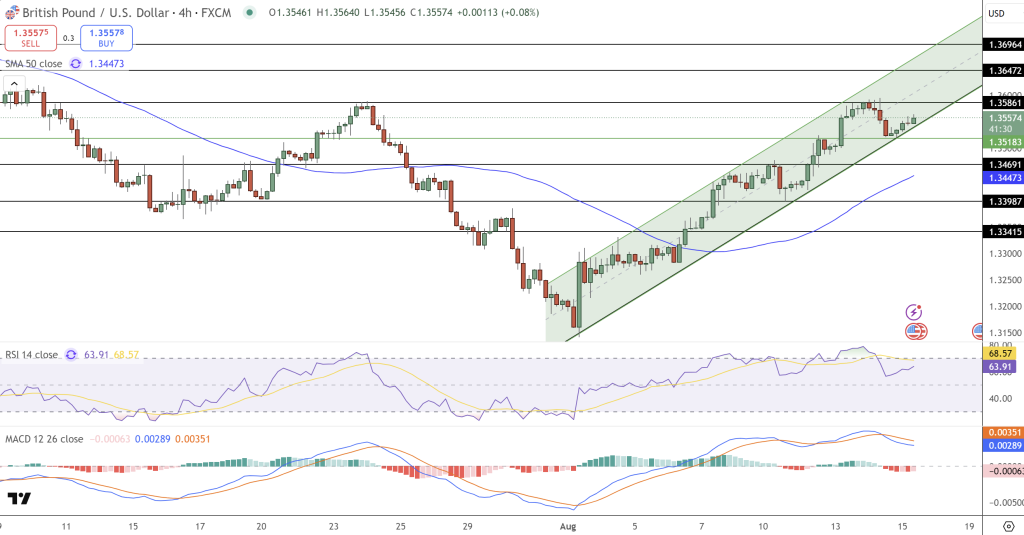

GBP/USD Poised for Move: Can It Break $1.3586 After Fed Cut Signals?

GBP/USD is trading at $1.3557 inside a clear ascending channel since late July. The pair is approaching resistance at $1.3586...

Quick overview

- GBP/USD is currently trading at $1.3557 within an ascending channel, nearing resistance at $1.3586.

- The 50-SMA indicates upward momentum, while recent candle patterns suggest strong buying interest.

- Momentum indicators like RSI and MACD show caution, with RSI at 63.9 and MACD flattening.

- A breakout above $1.3586 could lead to further gains, while a dip below $1.3518 may signal a correction.

GBP/USD is trading at $1.3557 inside a clear ascending channel since late July. The pair is approaching resistance at $1.3586 which is the channel’s upper trendline and a key horizontal level. Buyers have been defending higher lows with the 50-SMA (currently at $1.3447) sloping upwards. A small bodied candle with long lower wicks after a pullback shows buying interest and strong buying pressure.

Momentum Signals Flash Caution

RSI is at 63.9, strong but not overbought. Slight divergence from the recent high of 68.6 shows some caution in the rally. MACD is above zero (bullish) but flattening, needs more fuel (volume) to push through resistance.

GBP/USD Trade Setup: Breakout or Pullback

If GBP/USD can break and close above $1.3586, it could be a continuation to $1.3647 and $1.3696, confirming the channel pattern. More conservative traders might wait for a pullback to $1.3518-$1.3530 before entering. On the flip side, if it fails to hold above $1.3586 and dips below $1.3518 it could be a correction to the channel.

Overall, GBP/USD is in a good technical setup but confirmation from a strong breakout or a backtest to support would give more confidence. I’d watch how the candles form around $1.3586, a bullish engulfing or three white soldiers would be a strong long entry, a shooting star or bearish engulfing would be a warning for a deeper pullback.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account