Geopolitical Shock Triggers $291M in Ethereum Liquidations While Analysts Target $8,000 Bull Case

Ethereum (ETH) is navigating turbulent waters as geopolitical tensions and market volatility create a complex backdrop for the world's

Quick overview

- Ethereum is currently trading above $2,500 but has experienced an 8% decline in the past 24 hours due to geopolitical tensions and market volatility.

- A significant liquidation event resulted in $291 million in ETH liquidations, highlighting the cryptocurrency's sensitivity to global risk perception.

- Despite recent challenges, institutional interest in Ethereum is growing, with US spot Ethereum ETFs seeing $240.29 million in net inflows.

- Key price levels to watch for Ethereum include the $2,750-$2,850 resistance zone and the potential support around $2,500.

Ethereum ETH/USD is navigating turbulent waters as geopolitical tensions and market volatility create a complex backdrop for the world’s second-largest cryptocurrency. Trading above $2,500 but down over 8% in the past 24 hours, ETH finds itself at a critical technical juncture that could determine its near-term trajectory.

Massive ETH Liquidation Event Rocks Markets

After Israeli airstrikes on Iran, the bitcoin market became quite unstable. In just 24 hours, a huge liquidation event wiped away $1.1 billion in leveraged holdings. Ethereum took a lot of the damage, with perpetual contracts causing $291 million in liquidations—$245 million from long holdings and $45 million from short positions.

This liquidation incident shows how geopolitical concerns can make bitcoin markets even more volatile. The National Bureau of Economic Research’s historical data demonstrates that war zones usually cause crypto prices to rise 15–20% in volatility. This shows how sensitive the asset class is to global risk perception.

The steep drop brought ETH below the important $2,750-$2,850 resistance zone, which has always been a powerful barrier to upward movement. Market analysts are now keeping a close eye on whether Ethereum can go back into this area to avoid confirming a possible rounded top formation.

‘Digital Oil’ Thesis Projects Massive Upside Potential

Even though things have been rough lately, the institutional research company Etherealize has come out with a strong valuation framework that shows ETH is greatly undervalued. The company wrote a study called “The Bull Case for ETH,” which says that standard ways of valuing tech stocks don’t show Ethereum’s full value as “digital oil” for the growing tokenized economy.

The paper points out a big mistake in how ETH is priced, saying that network fees are only a small part of its genuine value. Instead, Etherealize talks about how ETH is different from other cryptocurrencies by comparing it to oil, which is used to fuel the existing economy.

The company’s price objectives are very high: $8,000 for the short term, $80,000 for the medium term, and an unbelievable $706,000 for the long term. This is predicated on a market cap of $89 trillion, which would be more than the world’s oil reserves.

ETH/USD Technical Analysis Reveals Mixed Signals

From a technical point of view, Ethereum shows an interesting contrast between short-term negative pressure and long-term bullish patterns. The Moving Average Convergence Divergence (MACD) indicator says that the market is oversold, but there is no hint of a quick turnaround.

Crypto analyst Titan of Crypto has found a huge weekly expanding wedge pattern that might push ETH up to $4,200 if it breaks through. This technical pattern, which has diverging trendlines and rising volatility, often comes before big breakouts.

The Relative Strength Index (RSI) and Stochastic Oscillator are both going down and getting closer to their neutral values. If these levels are broken decisively, it might accelerate bearish momentum and send ETH toward the $2,260-$2,110 support region.

Bulls, on the other hand, say that ETH doesn’t encounter much resistance until it reaches $3,417. The recent golden cross formation on daily charts also implies that the market is strong even though it is weak right now.

Institutional Interest Continues Growing

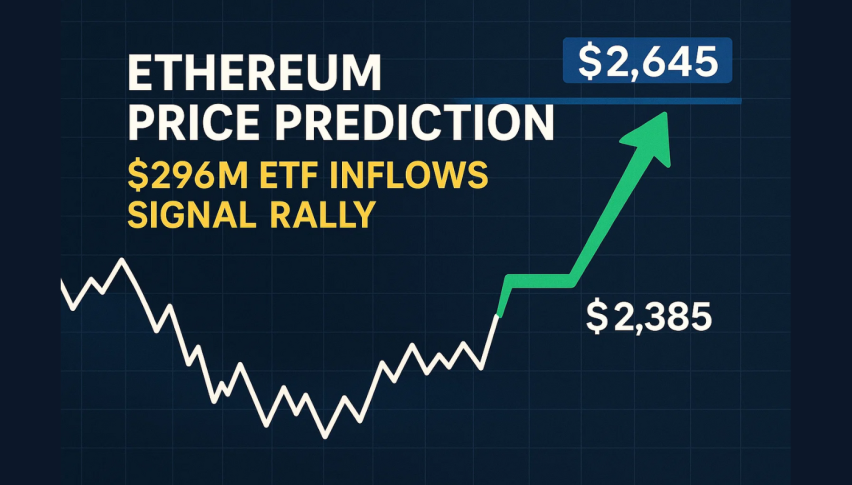

Even though the market is unstable, more and more institutions are starting to use Ethereum. On Wednesday, US spot Ethereum ETFs received $240.29 million in net inflows, making it the 18th day in a row that flows were positive. This was better than Bitcoin ETFs, which saw $164.6 million in inflows.

This shift of money from Bitcoin to Ethereum shows that more institutions are starting to see the unique worth of ETH. The ETF does better when the rules are clearer. The SEC is demonstrating more support for decentralized finance and tokenized assets.

On-chain data also shows that ETH futures open interest has hit an all-time high of 15.21 million ETH. This is because a lot of ETH is flowing into accumulation addresses, which means that smart investors are getting ready for the price to go up.

Ethereum Price Prediction: Key Levels to Watch

Ethereum’s price will probably depend on if it can get back into the $2,750-$2,850 level. If the price goes up above this level, it could cause a short squeeze because there are more than $2.2 billion in short bets near $3,000.

Caroline Mauron of Orbit Markets thinks that technical support will be around $2,500, but she also says that geopolitical events will probably have the biggest impact on prices in the medium term. If the price drops below $2,110, the bullish thesis would be wrong and the price might go down below $1,800.

On the other hand, a clear break over $2,850 might lead to $3,078 (61.8% Fibonacci retracement) and finally the $3,400 critical resistance mark, which is the top of the expanding wedge pattern.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account