Weekly Preview: Central Banks to Lead Forex Markets

Welcome to another big trading week guys,Last week it was the ECB, that shook up forex markets, when the ECB and President Mario Draghi, de

Welcome to another big trading week guys,

Last week it was the ECB, that shook up forex markets, when the ECB and President Mario Draghi, decided to reduce their bond buying program. The Euro really began its sell-off and towards the end of the week, the USD rallied.

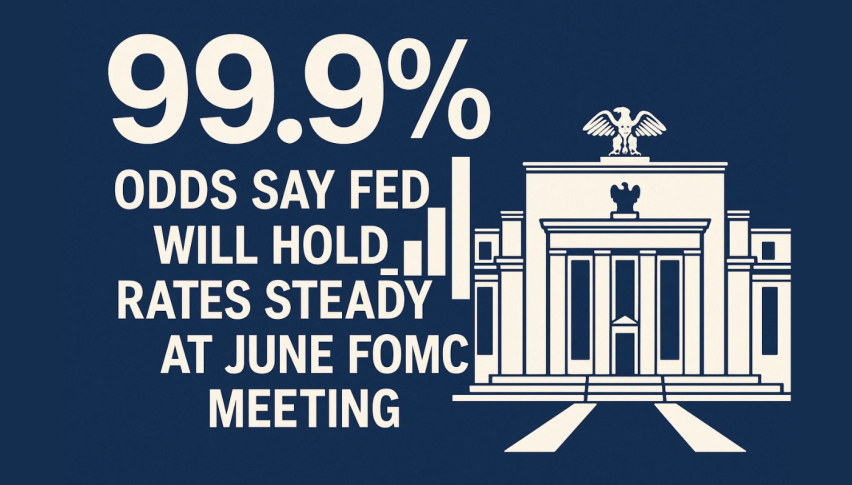

For the most part, all the attention now turns to the FOMC interest rate decision, where we will see if the US Federal Reserve will increase interest rates. We also have the Bank of England releasing their decision and the Bank of Japan Statement on Monetary Policy. And let’s not forget, we also have US non-farm payroll data to round out what is a massive week on forex markets.

Most of the talk around town, is suggesting that there won’t be any changes to official rates in the US at the Fed meeting this month. In December the chance of a hike jumps to around 80%, as US Federal Reserve Chairman Janet Yellen, has suggested that might be the course of action they take.

As a result, there will be a fair bit of focus, not so much on the outcome of this meeting, but rather what might happen in December. If there’s no talk about December, that might be dovish. If it’s mentioned, that’s certainly hawkish.

US Dollar Index (DXY) – 240 min Chart.

US Dollar Index (DXY) – 240 min Chart.

US Dollar on the Charge

Clearly this will have a huge impact on the USD, which for the last few weeks has really turned bullish. The US Dollar Index (DXY), smashed through 94.00 and rallied all the way to test 95.00 resistance. It has managed to hold to date, but I feel this will be a pivotal week.

I can see the USD breaking 95.00 and pushing to the next resistance level at 95.85, unless we get a very dovish statement from the Fed. Any hint that there might be a rate rise in December, will see the USD rally.

Top Trades

With that in mind I will be looking to continue to short the EUR/USD, AUD/USD and NZD/USD in particular, as they have all been weak against the Greenback. The Aussie was the weakest performer last week.

Top Economic Events To Start The Week

Monday is quiet in regards to top-tier economic data, however on Tuesday the big data week begins.

Tuesday

JPY – BOJ Policy Statement

EUR – Eurozone CPI

CAD – GDP

USD – Consumer Confidence

Wednesday

NZD – Employment

CHY – Manufacturing PMI

GBP – Manufacturing PMI

USD – FOMC Statement

Thursday

EUR – German Unemployment

GBP – BOE Interest Rate Decision

Friday

AUD – Retail Sales

USD – Employment

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

US Dollar Index (DXY) – 240 min Chart.

US Dollar Index (DXY) – 240 min Chart.