US Dollar Trades Close to Lowest Level Since March 2018

The US dollar continues to trade bearish, falling to a near three-year low on the back of a Democrat victory in the Georgia Senate elections

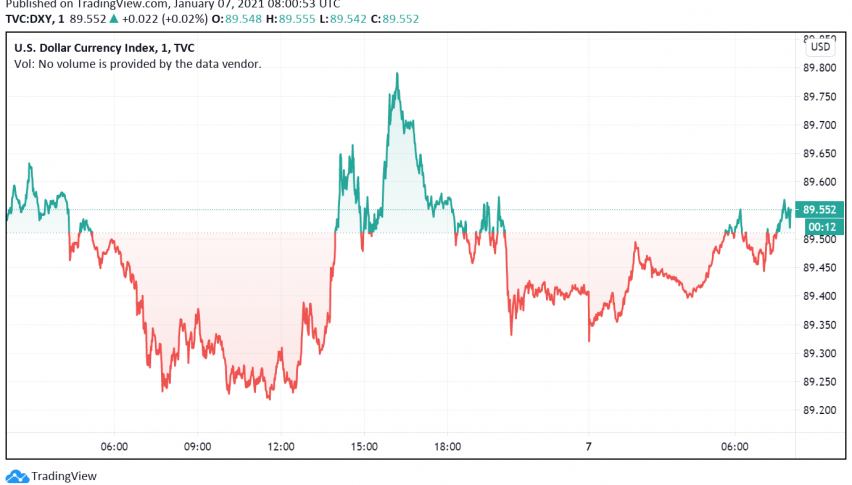

Early on Thursday, the US dollar continues to trade bearish, falling to a near three-year low on the back of a Democrat victory in the Georgia Senate elections. At the time of writing, the US dollar index DXY is trading around 89.55.

The Democrat victory in the two seats from Georgia gives the party a majority in the US Senate, which will allow President elect Joe Biden to pass key legislation with ease. While the victory has boosted market sentiment, it has driven the US dollar weaker over expectations that the Democrats could hike taxes and roll out more stimulus measures.

The protests at the Capitol, however, failed to make an impact on the US dollar with forex traders focusing completely on the election results instead. While the Democrat victory does increase the prospects of economic growth in the US, more stimulus could weaken US bond yields and the greenback as it could increase the country’s budget and trade deficits further.

During the previous session, the dollar fell to 89.206 against its major rivals – the lowest level seen since March 2018. Meanwhile, the 10-year Treasury yields surged to 1.054% – the highest level seen since mid-March when the coronavirus pandemic began to impact the US and most parts of the world.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account