Ethereum Slips Under the Key Support at $32K – Why the Bearish Trend Could Continue

The ETH/USD pair closed at $3159.96 after reaching a high of $3242.13 and a low of $3084.78. ETH/USD maintained its bearish momentum

- If Ethereum (ETH/USD) does not begin a new upward trend over $3,200, it may continue to fall

- It recently dropped all the way down to $3,129, and it is now correcting higher. There was a small increase above the $3,150 mark

- The blockchain security firm, PeckShield, has investigated, and claims that Crypto.com lost around $15 million

Ethereum Live Rate

Meanwhile, the blockchain security firm, PeckShield, has investigated, and claims that Crypto.com has lost around $15 million, with around half of it in Ethereum. The website Crypto.com was hacked in the early hours of Monday, and as a result, the total loss was calculated at $15 million. This news had a negative impact on ETH/USD prices on Tuesday. The rising strength of the US dollar, ahead of the US Federal Reserve meeting next week, also added to the negative pressure on Ethereum prices, as the two have a negative correlation. The US Dollar Index, which measures the greenback’s value against six major currencies, surged to 95.83 and strengthened the greenback, despite the release of unfavorable macroeconomic data on the day.

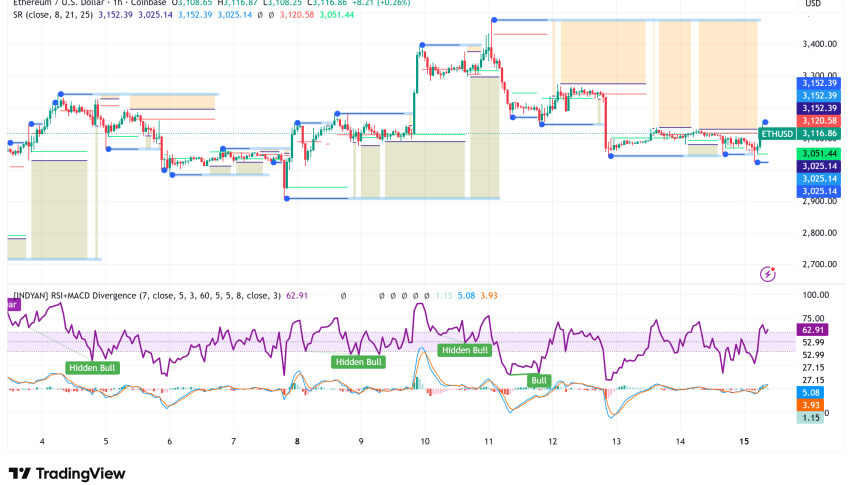

Ethereum (ETH/USD) – A Technical Outlook

Ethereum continued to fall, dropping below the $3,250 support level. ETH has even breached the $3,200 support level and is now trading underneath the 100 hourly simple moving average.

It recently dropped all the way down to $3,129, and it is now correcting higher. There was a small increase above the $3,150 mark. The price is currently encountering resistance around the $3,180 level. On the hourly time frame for ETH/USD, a key negative trend line is developing, with resistance near $3,180.

The trend line is close to the 23.6 percent Fib retracement level of the current slide from $3,392 down to $3,129. If the price breaks above the trend line, it could move towards the $3,250 resistance zone.

The 50 percent Fib retracement level of the current slide, from the high of $3,392, down to $3,129, is very close to the $3,250 level, and this could act as a barrier. A decisive rise above the $3,250 mark could boost the price in the short term. The next big obstacle is near the $3,400 mark, above which the price of Ether may begin to rise. In the aforementioned scenario, the price could grow to $3,550 in the near future.

Daily Technical Levels

3,082.45 3,239.80

3,004.94 3,319.64

2,925.10 3,397.15

Pivot Point: 3,162.29

More losses for ETH?

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account