EUR/USD Rebounds Amid US Dollar Retreat and Anticipation of ECB Rate Hike Decision

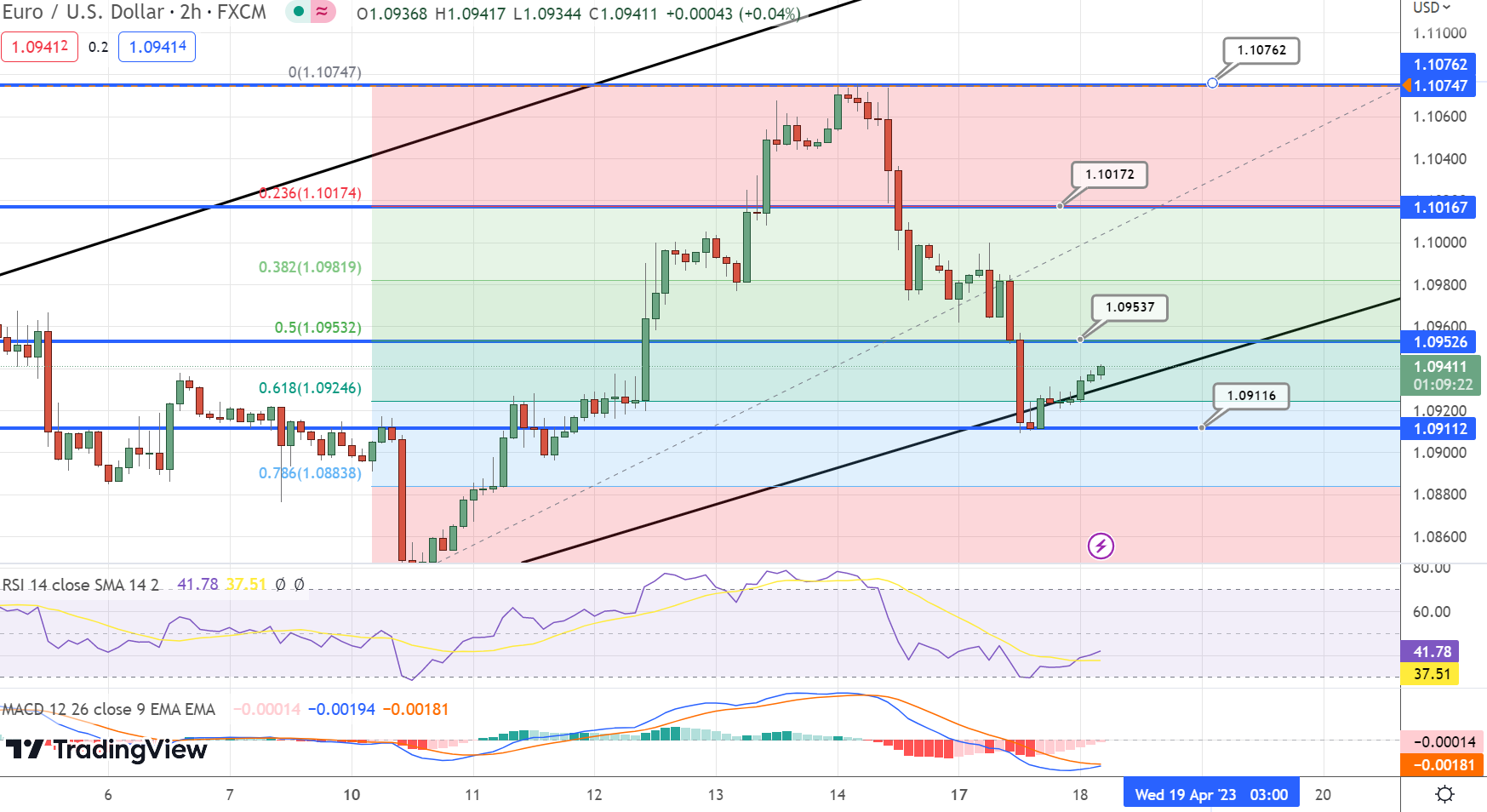

The EUR/USD currency pair has shown a recovery, hitting an intraday high of 1.0940 during Tuesday morning trading in Europe.

The currency pair’s gains may also be influenced by the upcoming release of key Eurozone and German ZEW sentiment data for April, which could impact the EUR/USD ‘s bullish momentum. Meanwhile, the US Dollar Index (DXY) has fallen back to 102.00, with both 10-year and two-year Treasury bond yields experiencing modest declines at 3.60% and 4.18%, respectively.

The potential for a 0.25% interest rate increase by the European Central Bank (ECB) in May has also attracted EUR/USD buyers, despite disagreement among policymakers on whether to opt for a 25 or 50 basis point hike. ECB policymaker Martins Kazaks noted that both options remain on the table for the central bank’s May decision.

Uncertainty surrounding the US debt ceiling plan, set for release on Wednesday, has further weighed on the US Dollar. However, ECB policymakers’ indecisiveness contrasts with the market’s expectation of a 0.25% Fed rate hike in May, which has bolstered the US Dollar.

As a result, S&P 500 Futures remain uncertain, despite Wall Street posting modest gains. Investors will be paying close attention to the upcoming Eurozone and Germany ZEW Survey data, as well as the US Housing Starts and Building Permits data for March, which will influence intraday EUR/USD moves. However, risk catalysts and central bank discussions will remain the primary focus for determining the currency pair’s direction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account