10 Best Forex Brokers Accepting Bitcoin

The 10 Best Forex Brokers Accepting Bitcoin. This convergence provides traders with the freedom of digital currencies while also leveraging the established infrastructure of forex trading. This article will list the Top Forex Brokers Accepting Bitcoin.

10 Best Forex Brokers Accepting Bitcoin (2026)

- FP Markets – Overall, The Best Forex Broker Accepting Bitcoin

- BlackBull Markets – Competitive pricing with spreads from 0.0 pips

- Octa – Ultra-low spreads and zero commissions

- easyMarkets – Guaranteed stop-loss orders

- Tickmill – Fast execution speeds, and a wide range of trading instruments

- Eightcap – Multiple payment methods, including Bitcoin

- FXTM – Access to multiple trading platforms, including MT 4 and 5

- Axi – Robust Axi Select funded trader program

- IG – Wide range of tradable assets including Cryptocurrencies

- eToro – Innovative social trading platform

Top 10 Forex Brokers (Globally)

1. FP Markets

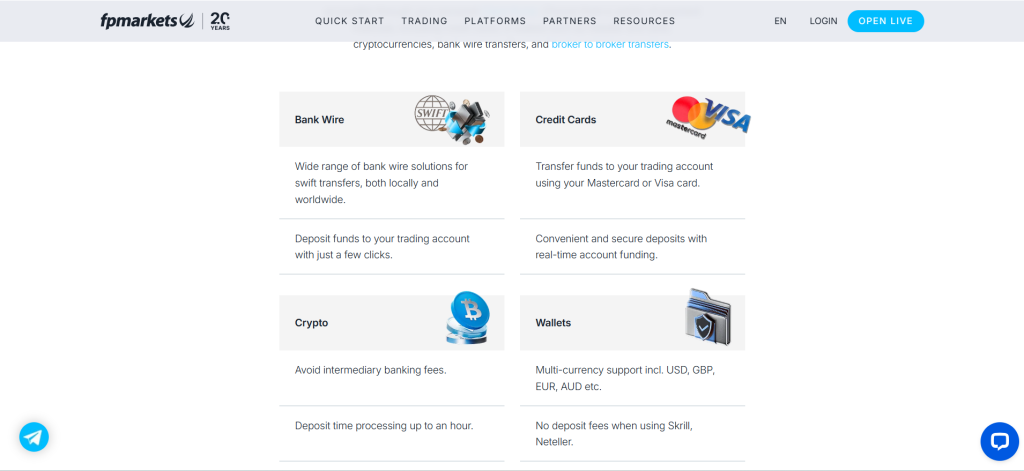

FP Markets is a regulated Forex and CFD broker that offers access to multiple asset classes, including Forex, commodities, indices, and crypto. It supports Bitcoin deposits, competitive spreads, and popular platforms like MetaTrader 4 and 5.

Frequently Asked Questions

Does FP Markets accept Bitcoin or crypto payments?

Yes, FP Markets does accept cryptocurrency payments for deposits and withdrawals, including Bitcoin. They list “Cryptocurrencies” as one of their available payment methods on their funding page, alongside credit cards, e-wallets, and bank transfers.

What trading platforms does FP Markets offer?

FP Markets offers a comprehensive suite of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop, web, and mobile. They also support cTrader and TradingView, providing diverse options for analysis, charting, and automated trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by ASIC, CySEC, FSCA, and FSA | Investor protection only under CySEC |

| Supports popular platforms | No proprietary trading platform |

| Low spreads | Higher minimum deposit |

| Accepts Bitcoin and other crypto payments | Limited educational resources |

| Fast execution | No fixed spread accounts |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is an authorized and well-regulated broker offering low spreads, advanced platforms, and crypto-friendly deposits. While it suits experienced traders, beginners should note the limited investor protection and educational resources.

2. BlackBull Markets

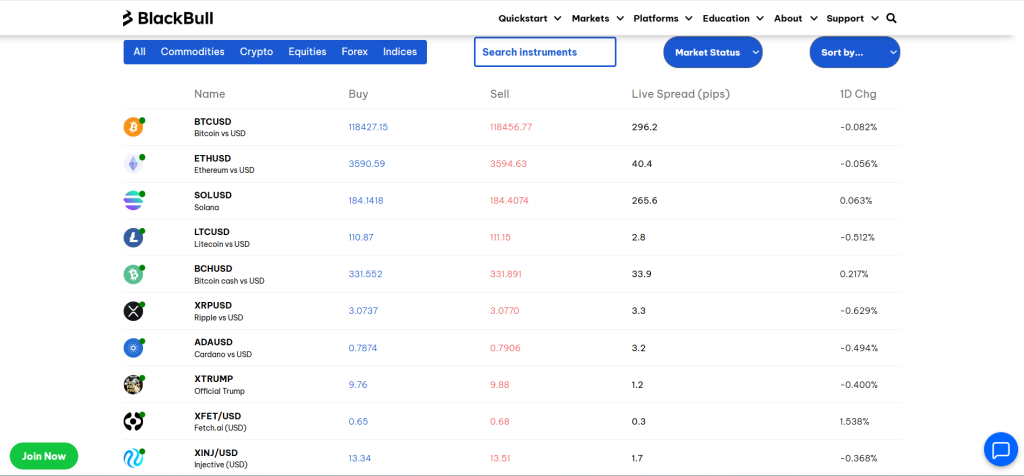

BlackBull Markets is a New Zealand-based, regulated Forex and CFD broker offering trading on Forex, indices, commodities, and shares. It accepts Bitcoin for deposits and provides access to MetaTrader 4, MetaTrader 5, and TradingView platforms.

Frequently Asked Questions

Does BlackBull Markets accept Bitcoin?

Yes, BlackBull Markets accepts Bitcoin and other cryptocurrencies for deposits and withdrawals. They support various popular cryptocurrencies like BTC, ETH, USDT, USDC, XRP, LTC, LINK, BCH, and XLM. Deposits are processed instantly upon approval, with a minimum of $25 depending on the network.

What trading platforms are available?

BlackBull Markets provides a robust selection of trading platforms. These include the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop, web, and mobile. They also offer cTrader for advanced users and TradingView, allowing direct trading from its charting interface.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Supports MT4, MT5, and TradingView | No formal investor compensation scheme |

| Accepts Bitcoin and crypto deposits | Limited educational content for beginners |

| Offers zero spreads on Prime accounts | No proprietary trading platform |

| Fast ECN execution and low latency | Swap-free accounts not available by default |

| Negative balance protection available | Limited bonus or promotion options |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BlackBull Markets is a legit Forex and CFD broker offering advanced platforms, crypto deposits, and a wide asset range. While it suits experienced traders, limited investor protection may concern some users in stricter regulatory regions.

3. Octa

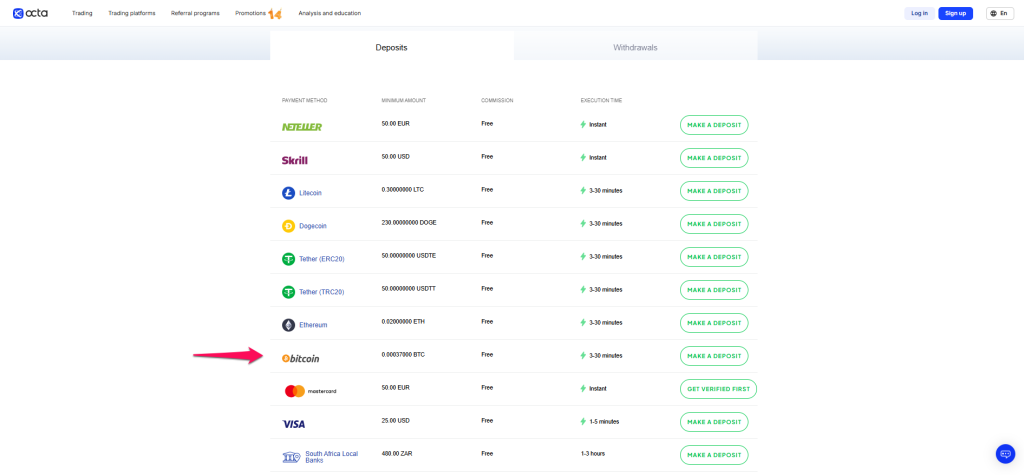

Octa supports deposits and withdrawals via Bitcoin, along with other cryptocurrencies like Ethereum, Litecoin, Tether, and Dogecoin. Crypto deposits are fast (typically 3–30 min) and commission‑free.

Frequently Asked Questions

Can I deposit with Bitcoin?

Yes, Octa accepts Bitcoin deposits. They list Bitcoin as a supported payment method for funding your trading account, with a minimum deposit amount of 0.00037 BTC. Deposits typically process within 3-30 minutes, though network speeds can cause occasional delays.

Does Octa offer demo accounts?

Yes, Octa offers free demo accounts. These accounts come with virtual funds, simulate real market conditions, and are ideal for practicing trading strategies and exploring the platform without financial risk. They are unlimited and fully customizable, allowing you to set virtual balances and leverage.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low Minimum Deposit | Limited Asset Range |

| Zero Commissions | No Tier-1 Regulation |

| Islamic (Swap-Free) Accounts | Not Available in Some Regions |

| Supports Crypto Payments | No Stock CFDs |

| User-Friendly OctaTrader Platform | Basic Research Tools |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is a legal and regulated broker offering commission-free trading, crypto deposits, and user-friendly platforms. While it lacks stock CFDs and tier-1 regulation, it remains a solid choice for cost-effective, accessible trading.

Top 3 Forex Brokers Accepting Bitcoin – FP Markets vs BlackBull Markets vs Octa

4. easyMarkets

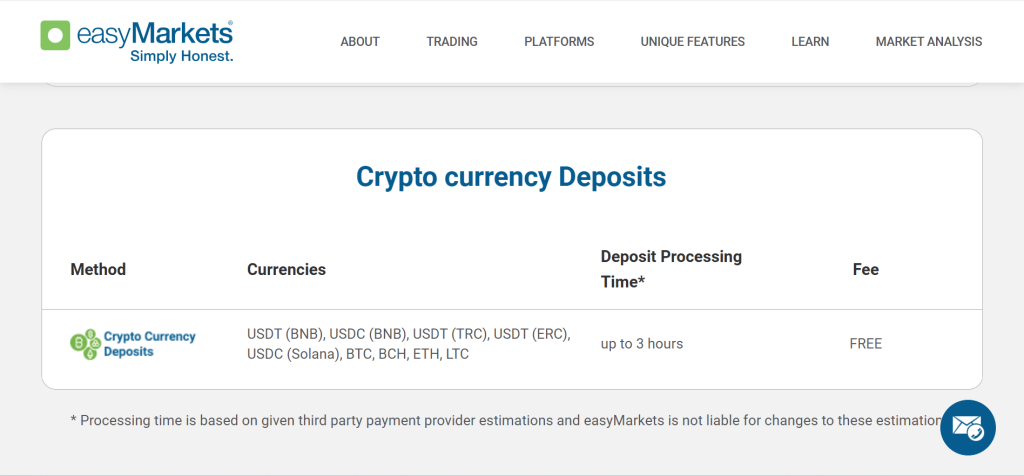

easyMarkets completely facilitates Bitcoin deposits, trading, and withdrawals—especially via its μBTC account, which allows trading directly in Bitcoin without needing to convert it to fiat currency.

Frequently Asked Questions

Does easyMarkets accept Bitcoin?

Yes, easyMarkets does accept Bitcoin for deposits and withdrawals, along with other cryptocurrencies like USDT, USDC, BCH, ETH, and LTC. They also allow trading Bitcoin as a CFD.

Does easyMarkets offer Islamic accounts?

Yes, easyMarkets does offer Islamic accounts, also known as swap-free accounts. These accounts are designed to comply with Sharia principles by eliminating swap fees (interest) on overnight positions. This allows Muslim traders to engage in forex trading while adhering to their religious beliefs.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fixed Spreads | Limited Variable Spread Accounts |

| Commission-Free Trading | Fewer CFDs than Competitors |

| Strong Regulation | Fixed Spreads Can Be Wider |

| Supports Crypto Deposits | Limited Stock CFD Coverage |

| Beginner-Friendly Tools | No Tier-1 Banking Partners Disclosed |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

easyMarkets is an approved and reliable broker offering fixed spreads, commission-free trading, and strong regulatory oversight. Its user-friendly tools and crypto support make it ideal for both beginners and experienced traders seeking a stable platform.

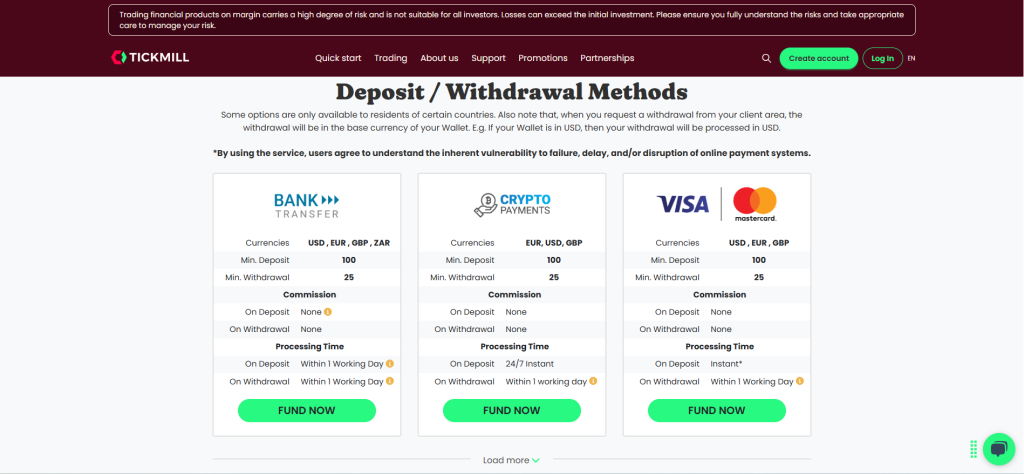

5. Tickmill

Tickmill accepts Bitcoin for deposits via select payment providers, making it accessible for crypto users. The broker is licensed by FCA (UK), CySEC (EU), FSCA (South Africa), and FSA (Seychelles), with a minimum deposit starting from $100.

Frequently Asked Questions

Does Tickmill accept Bitcoin for deposits?

Yes, Tickmill does accept Bitcoin for deposits, along with other cryptocurrencies like Ethereum and USDT. They facilitate these transactions through crypto payment providers, though availability might depend on your region. They also allow withdrawals to crypto wallets.

What is the minimum deposit?

Tickmill’s minimum deposit is USD 100 for all account types, including Classic and Raw accounts. While they do offer a $30 Welcome Account, this is for promotional purposes; to fully trade with a live account, a $100 deposit is required.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulatory Oversight | Higher Minimum Deposit |

| Low Spreads & Competitive Costs | Limited Educational Resources |

| Multiple Account Types | No US Clients Accepted |

| High Leverage Options | Restricted Bonuses |

| Fast Execution Speeds | Crypto Trading Limited to CFDs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered and well-regulated broker known for low spreads, fast execution, and diverse account types. Its strong regulatory oversight and Bitcoin acceptance make it a reliable choice for both beginner and professional traders.

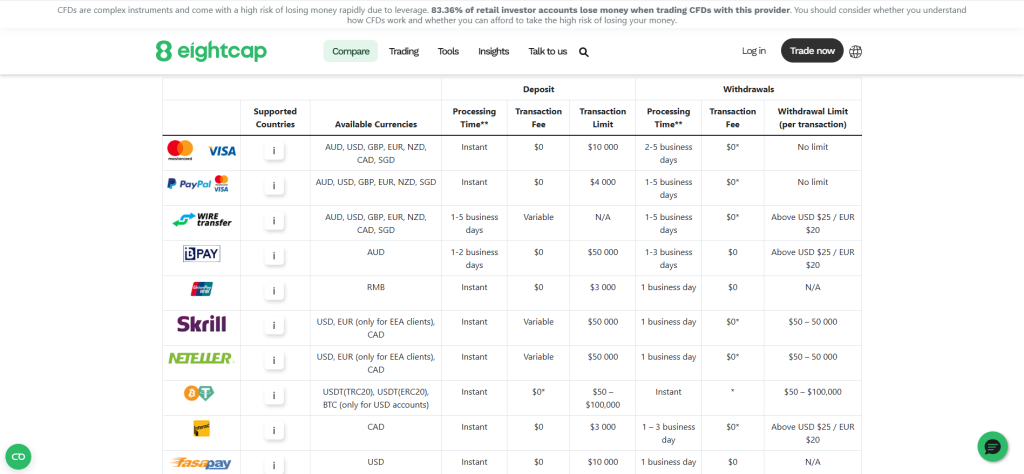

6. Eightcap

Eightcap also accepts Bitcoin and other cryptocurrencies for deposits and withdrawals via select payment providers, making it accessible to crypto-funded traders. It supports trading platforms such as MetaTrader 4, MetaTrader 5, and TradingView. The minimum deposit is $100, with spreads starting from 0.0 pips on Raw accounts and no commissions on Standard accounts.

Frequently Asked Questions

Can I deposit or withdraw using Bitcoin?

Yes, Eightcap supports both Bitcoin (BTC) deposits and withdrawals, often alongside other cryptocurrencies like USDT. Deposits are usually instant, with a minimum of $50 and maximums up to $100,000. Withdrawals are processed instantly, with the same limits.

What trading platforms does Eightcap support?

Eightcap offers a strong selection of trading platforms, primarily featuring MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both widely popular for their robust charting and automated trading capabilities. They also provide seamless integration with TradingView, an advanced charting platform.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-licensed Regulation | No Proprietary Platform |

| Low-Cost Raw Account | No Share Dealing or ETFs |

| Supports Bitcoin Deposits | No Copy Trading Feature In-House |

| Advanced Platforms | Crypto CFDs Only (Not Real Coins) |

| Fast Execution | Not Available in Some Regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Eightcap is an authorized and well-regulated broker offering competitive spreads, advanced platforms like MT5 and TradingView, and a wide range of crypto CFDs. Its support for Bitcoin deposits adds flexibility for modern traders.

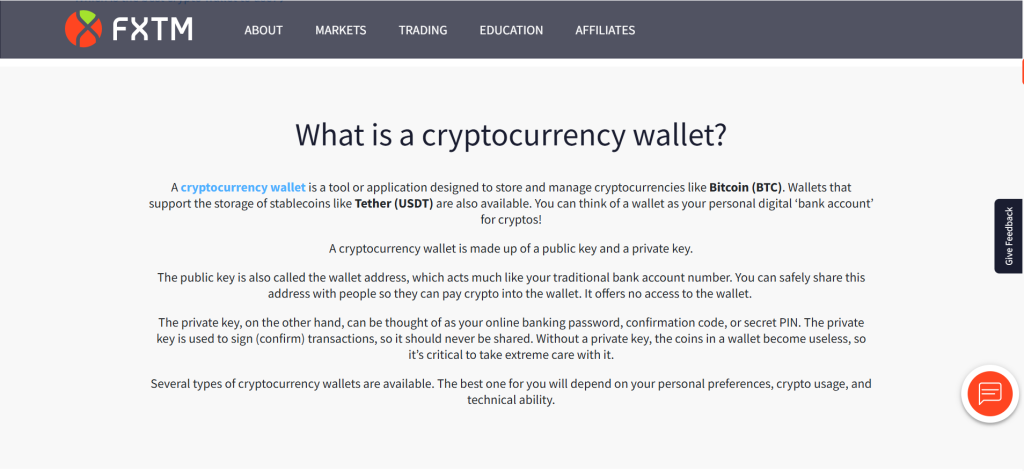

7. FXTM

FXTM accepts Bitcoin and other cryptocurrencies for deposits and withdrawals through approved third-party processors, making it convenient for crypto-focused traders.

Frequently Asked Questions

Are Bitcoin and crypto payments accepted?

Yes, FXTM does accept Bitcoin and other cryptocurrency payments for both deposits and withdrawals. They offer this as a convenient funding method alongside traditional options like credit/debit cards and bank transfers.

Is FXTM good for beginners?

Yes, FXTM is generally considered good for beginners. They offer a free demo account for practice, extensive educational resources (videos, webinars, guides), and account types like the Advantage account designed for newer traders with competitive spreads and low commissions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multiple Regulatory Licenses | High Minimum Deposit |

| Wide Range of Account Types | Spread Variability |

| Supports Bitcoin Deposits | No U.S. Clients |

| High Leverage Options | Withdrawal Fees |

| Multiple Trading Platforms | Limited Cryptocurrency Offering |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a legit, well-regulated broker offering low minimum deposits, diverse account types, and Bitcoin payment options. Its strong education resources and high leverage make it suitable for both beginners and experienced traders worldwide.

8. Axi

Axi accepts Bitcoin deposits and withdrawals through select third-party payment providers, catering to crypto users. It offers competitive spreads from 0.0 pips on Raw accounts and supports MetaTrader 4 and MetaTrader 5 platforms.

Frequently Asked Questions

Does Axi accept Bitcoin?

Yes, Axi does accept Bitcoin for both deposits and withdrawals, along with other cryptocurrencies like Ethereum, Litecoin, and Ripple. They also allow trading Bitcoin as a CFD, which means you speculate on its price movements without actually owning the underlying asset.

What platforms does Axi offer?

Axi primarily offers the widely popular MetaTrader 4 (MT4) platform, available on desktop, web, and mobile. They also provide their proprietary Axi Trading Platform (ATP) mobile app and integrate with advanced charting via TradingView. Additionally, Axi offers Axi Copy Trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by Top Authorities | No US Client Acceptance |

| Low Spreads on Pro Accounts | Limited Cryptocurrency CFDs |

| Accepts Bitcoin Deposits | No Proprietary Mobile App |

| Multiple Trading Platforms | High Minimum Deposit for Elite |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a legal and well-regulated broker offering competitive spreads, Bitcoin deposits, and reliable trading platforms like MT4 and MT5. It suits both beginners and professionals, though advanced account tiers require higher deposits.

9. IG

IG allows eligible international clients (excluding UK retail clients) to deposit and withdraw Bitcoin through partner services. Additionally, IG provides both cryptocurrency CFDs and, through a partnership with Uphold, the option to own real cryptocurrencies.

Frequently Asked Questions

What trading platforms does IG offer?

IG offers a range of trading platforms to suit different needs. These include their award-winning proprietary web platform and intuitive mobile trading apps. For advanced charting, they integrate with ProRealTime and also support the popular MetaTrader 4 (MT4) platform, and L2 Dealer for direct market access.

Does IG charge swap fees?

Yes, IG charges swap fees for CFD positions held open past a certain time (typically 10 PM UK time). These charges can be positive or negative depending on the direction of your trade and the interest rate differentials of the currencies involved.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Heavily Regulated | High Stock CFD Fees |

| Wide Range of Markets | Limited Crypto Offering in Some Regions |

| Advanced Trading Platforms | Complex Platform for Beginners |

| Bitcoin Accepted | Inactivity Fees |

| No Minimum Deposit | Islamic Accounts Not Standard |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is an approved and globally trusted broker offering access to over 17,000 markets with strong regulatory oversight, advanced platforms, and secure trading conditions, making it a solid choice for both beginner and professional traders.

10. eToro

eToro allows Bitcoin deposits and withdrawals via partnered crypto payment services. Please note that network fees apply, and minimum withdrawal limits are in place.

Frequently Asked Questions

Does eToro offer Copy Trading?

Yes, eToro is well-known for its CopyTrader™ feature, allowing users to automatically replicate the trades of successful investors in real-time. You can browse and select Popular Investors based on performance, risk score, and strategy, with a minimum investment of $200 to start copying.

What is the minimum deposit on eToro?

The minimum deposit on eToro varies greatly by region. For example, in the UK and USA, it can be as low as $10-$50 USD for initial deposits. Many European countries also benefit from a $50 USD minimum.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and Trusted | High Spreads |

| Copy Trading | Limited Advanced Tools |

| Crypto-Friendly | Withdrawal Fees |

| User-Friendly Platform | Inactivity Fee |

| Wide Range of Assets | Limited Customization |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is a registered and well-regulated broker known for its user-friendly platform, social trading features, and wide asset selection. It suits beginners and long-term investors, though fees and limited tools may deter advanced traders.

What is Bitcoin?

Bitcoin is a decentralized digital currency, also known as a cryptocurrency, that allows people to send and receive money over the internet without relying on banks or governments.

Bitcoin is like digital cash that you can use online. It’s not controlled by any single company or country, and you can send it to anyone, anywhere in the world, in minutes.

Criteria for Choosing a Forex Broker Accepting Bitcoin

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is regulated by trusted authorities (e.g., FCA, ASIC, CySEC). | ⭐⭐⭐⭐⭐ |

| Bitcoin Deposit & Withdrawal | Confirm the broker supports direct Bitcoin funding and withdrawals. | ⭐⭐⭐⭐⭐ |

| Security Measures | Look for SSL encryption, 2FA, and cold wallet storage for crypto funds. | ⭐⭐⭐⭐☆ |

| Trading Costs (Spreads/Fees) | Check spreads, commissions, and conversion fees when trading or funding with Bitcoin. | ⭐⭐⭐⭐☆ |

| Leverage Options | Review available leverage for forex trading (typically 1:30 to 1:500 depending on the broker). | ⭐⭐⭐⭐☆ |

| Execution Speed & Order Types | Fast execution and variety of order types (market, limit, stop) are essential for efficient trading. | ⭐⭐⭐⭐☆ |

| Crypto Trading Availability | Some brokers let you trade crypto pairs in addition to using Bitcoin as payment. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Look for support of MetaTrader 4/5, cTrader, or a reliable proprietary platform. | ⭐⭐⭐⭐☆ |

| Customer Support | Access to fast, knowledgeable support for crypto related queries. | ⭐⭐⭐⭐☆ |

| Account Segregation & Protection | Client funds should be held in segregated accounts and protected under investor schemes if possible. | ⭐⭐⭐⭐☆ |

Top 10 Best Forex Brokers Accepting Bitcoin – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From the main risks to trading conditions, we provide straightforward answers to help you understand Bitcoin and choose the right broker confidently.

Q: Do all forex brokers accept Bitcoin for deposits or withdrawals? – Alex M.

A: No, not all forex brokers accept Bitcoin or other cryptocurrencies for deposits or withdrawals. While it’s becoming more common, especially with newer or more technologically advanced brokers, many still primarily rely on traditional methods like bank transfers, credit/debit cards, and popular e-wallets.

Q: What are the main risks of using Bitcoin with a forex broker? – Priya S.

A: The main risks of using Bitcoin with a forex broker include extreme price volatility, which can impact your deposit’s value even before trading. There’s also regulatory uncertainty in some regions, potential security vulnerabilities if the broker’s systems are compromised, and the irreversibility of Bitcoin transactions, meaning lost funds are harder to recover.

Q: How fast are Bitcoin deposits and withdrawals compared to bank wires? – James R.

A: Bitcoin deposits are generally much faster than bank wires, often instant or within minutes (depending on network congestion). Bank wires, especially international ones, can take 1 to 5 business days, as they rely on traditional banking hours and interbank processing.

Q: Is it safe to use an unregulated forex broker that accepts Bitcoin? – Maria G.

A: No, it is highly risky and generally unsafe to use an unregulated forex broker, especially one that accepts Bitcoin. Unregulated brokers lack oversight, offering no consumer protection in cases of fraud, fund manipulation, or bankruptcy.

Q: Are the trading conditions different if I fund my account with Bitcoin? – Luis F.

A: No, the fundamental trading conditions like spreads, leverage, and execution speed are generally not affected by the funding method. These factors are determined by the broker’s liquidity providers and overall business model. However, using Bitcoin introduces its own unique risks.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Faster Deposits & Withdrawals | Volatility Risk |

| Global Accessibility | Fewer Regulated Brokers |

| Lower Transaction Fees | Conversion Costs |

| Anonymity & Privacy | Limited Withdrawal Methods |

| Bypasses Banking Restrictions | Scam Risks |

You Might also Like:

- FP Markets Review

- BlackBull Markets Review

- Octa Review

- easyMarkets Review

- Tickmill Review

- Eightcap Review

- FXTM Review

- Axi Review

- IG Review

- eToro Review

In Conclusion

Forex brokers accepting Bitcoin offer speed, global access, and lower fees, making them attractive for modern traders. However, due to BTC’s volatility and fewer regulations, it’s vital to choose a secure and reputable broker.

Faq

Yes, many forex and CFD brokers that accept Bitcoin for deposits also offer trading on Bitcoin pairs like BTC/USD as CFDs. This allows you to speculate on Bitcoin’s price movements against fiat currencies without actually owning the cryptocurrency

If Bitcoin’s price crashes after you deposit, the fiat (e.g., USD) value of your account will decrease proportionally. Most brokers convert Bitcoin deposits to a fiat currency immediately, so your trading capital is then held in that stable currency.

No, Bitcoin funds are generally not protected by government deposit guarantee schemes like those for traditional bank accounts. While regulations are evolving globally, these typically focus on licensing crypto service providers and combating illicit activities, not on direct investor compensation if a crypto platform fails.

Yes, many forex brokers that accept Bitcoin for deposits also allow you to withdraw your trading profits in Bitcoin. However, be aware of a common policy: you typically have to withdraw the initial deposit amount back via the same method it came in.