7 Best Forex Brokers in The UAE

We have listed the 7 Best Forex Brokers in the UAE, offering access to a wide range of currency pairs, indices, commodities, and cryptocurrencies. These brokers provide competitive spreads, strong regulatory oversight, and reliable trading platforms, ensuring that both beginners and professional traders can trade forex efficiently and with confidence.

7 Best Forex Brokers in The UAE (2026)

- MultiBank Group – Overall, The Best Forex Broker in the UAE

- IG – Regulated by the DFSA in the UAE

- eToro – Streamlined Onboarding with UAE PASS

- AvaTrade – User-friendly platforms and strong regulatory backing

- Saxo Bank – No Inactivity or Platform Fees

- Swissquote – Multi-asset trading platforms and ePrivate Banking solutions

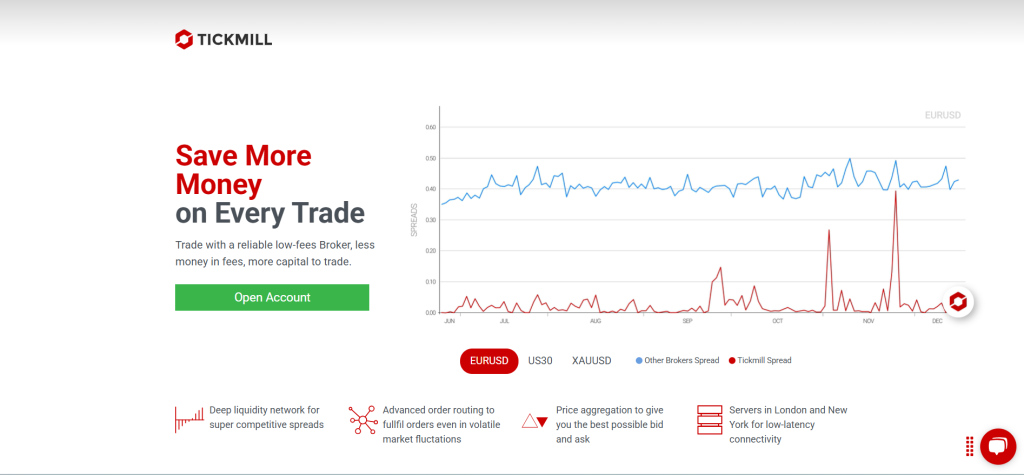

- Tickmill – VPS hosting for low-latency trading

Top 10 Forex Brokers (Globally)

1. MultiBank Group

Multibank Group is a multi-regulated global broker with a growing presence in the UAE, offering forex and CFD trading across 20,000+ instruments. The broker provides advanced platforms, competitive spreads, deep liquidity, and robust fund security through segregated accounts and strong international regulatory oversight.

However, clients should note that UAE traders are not covered by a local investor compensation scheme.

Frequently Asked Questions

How safe is trading with MultiBank Group?

MultiBank Group is among the most strictly regulated brokers worldwide, operating under rigorous financial frameworks across multiple regions. It safeguards client funds through segregated accounts and offers negative balance protection, providing enhanced security for both new and experienced traders.

What instruments can you trade with MultiBank?

Clients of MultiBank gain access to more than 20,000 instruments, including forex, metals, shares, indices, commodities, and cryptocurrencies. The broker delivers ultra-fast execution with nanosecond processing and offers zero-commission trading on its ECN account options.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multiple account types | Limited research tools |

| No deposit or withdrawal fees (usually) | Restricted in some countries due to regulations |

| Supports social trading | Some spreads are higher on select accounts |

| Offers eBooks, seminars, and training content | Not all instruments available on all platforms |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is a trusted, well-capitalized broker regulated across multiple jurisdictions, delivering deep liquidity, lightning-fast execution, and leverage up to 500:1. With advanced technology and a client-focused model, it ranks as a leading option for both retail and institutional traders worldwide.

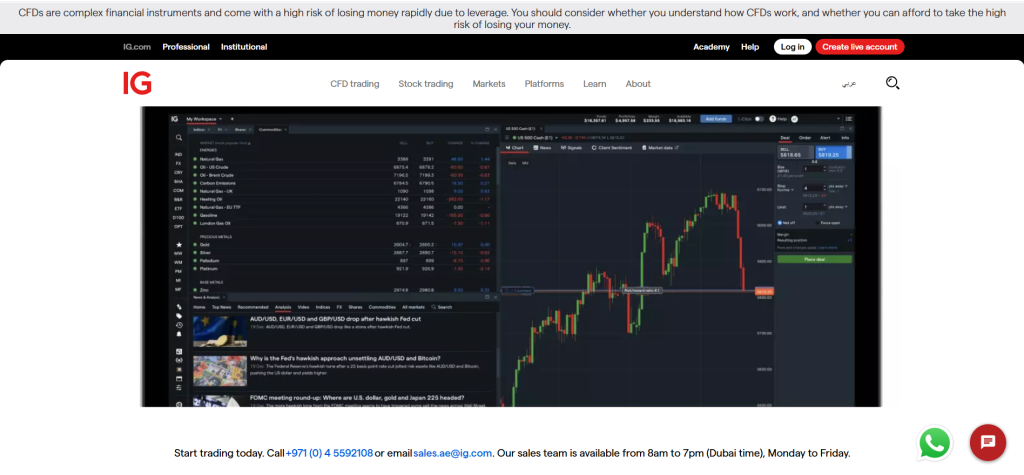

2. IG

Established in 1974, IG operates as a globally regulated broker, with the DFSA (DIFC) licensing it in the UAE. Clients in the UAE enjoy the advantages of local regulatory oversight, negative balance protection, segregated client funds, and access to advanced trading platforms such as IG Web, MetaTrader 4 (MT4), ProRealTime, and TradingView.

IG also provides strong educational support through IG Academy and UAE-specific resources.

Frequently Asked Questions

Can I open an IG account in the UAE?

Yes, you can open an IG account in the UAE. IG has a local entity, IG Limited, regulated by the Dubai Financial Services Authority (DFSA), allowing it to offer CFD trading services to clients in Dubai and the wider Middle East.

Does IG offer Islamic (Swap-Free) accounts?

IG does not directly offer dedicated “Islamic” or “swap-free” accounts in the conventional sense for all its regulated entities. While they acknowledge Sharia-compliant investing principles in their glossary, their standard CFD accounts involve overnight funding charges (swaps).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly Regulated | No DFSA Compensation Fund |

| Wide Market Access | Platform Complexity |

| Powerful Platforms | High Share CFD Commission |

| Local UAE Support | No Cent or Micro Accounts |

| Strong Educational Resources | Islamic Account Not Clearly Advertised |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG offers powerful platforms, wide market access, and strong regulation, including in the UAE, establishing itself as a globally trusted broker. It’s ideal for serious traders, though beginners may find its advanced tools and commissions challenging.

3. eToro

In the UAE, eToro operates under DFSA regulation via eToro (ME) Limited, licensed in DIFC Dubai. Clients in the UAE enjoy the advantages of local regulatory compliance, AED currency support, negative balance protection, and access to eToro’s CopyTrader™ platform, which allows them to automatically replicate the trades of professional investors.

Leverage is limited to 1:30 for retail traders, in line with DFSA rules.

Frequently Asked Questions

Is eToro regulated in the UAE?

Yes, eToro operates under regulation in the UAE. Its entity, eToro (ME) Limited, holds licenses from and is regulated by the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM). This allows them to offer various trading services to clients in the UAE.

What is the minimum deposit on eToro?

For UAE clients, eToro requires a minimum first-time deposit of USD 100 (approximately 367 AED). Subsequent deposits can be as low as USD 50. A minimum deposit of USD 500 is required if you deposit via bank transfer.

Pros and Cons

| ✓ Pros | ✕ Cons |

| ADGM-Regulated in UAE | High Spreads on Some Assets |

| Local AED Support | USD-Only Accounts |

| User-Friendly Platform | Limited Technical Tools |

| CopyTrader™ Feature | No MetaTrader or cTrader |

| Islamic Account Option | Withdrawal Fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro offers a beginner-friendly, socially driven trading experience with strong UAE regulation and commission-free stocks. While its spreads and platform tools may not suit professionals, it’s ideal for casual traders and copy trading enthusiasts.

Top 3 Forex Brokers in the UAE – MultiBank Group vs IG vs eToro

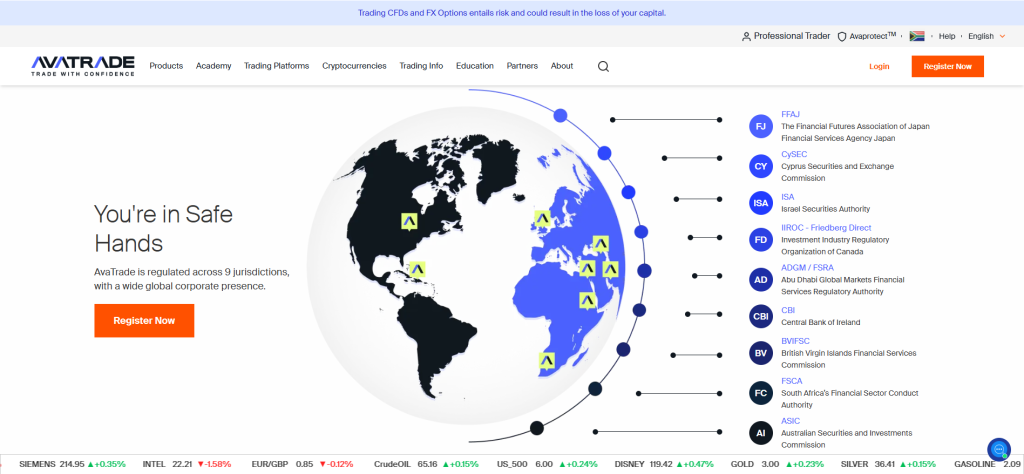

4. AvaTrade

AvaTrade is a highly regulated, award-winning broker in the UAE through ADGM, providing a secure trading environment, advanced platforms and risk management tools, a wide variety of instruments, and Sharia-compliant accounts, making it an excellent choice for both retail and professional traders.

Frequently Asked Questions

Can I deposit and withdraw in AED?

While AvaTrade is regulated in the UAE, its primary base account currencies are typically USD, EUR, GBP, and AUD. You can deposit funds from an AED bank account, but it will undergo currency conversion to your chosen account base currency.

Is AvaTrade suitable for beginners?

Yes, AvaTrade is suitable for beginners. They offer extensive educational resources through AvaAcademy, user-friendly platforms like AvaTradeGO, and popular MetaTrader platforms. With a generally low minimum deposit of $100 and a free demo account, new traders can learn and practice without significant risk.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in the UAE | No DFSA Regulation |

| Low Minimum Deposit | No Compensation Scheme |

| No Commissions | Limited Account Types |

| Wide Platform Support | No Proprietary Desktop Platform |

| Islamic Account Option | Inactivity Fee |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a well-regulated, beginner-friendly broker in the UAE, offering low-cost, commission-free trading and a wide range of platforms. It’s ideal for casual and Islamic traders, though inactive users may face extra fees.

5. Saxo Bank

Saxo Bank is a highly regulated, premium broker that provides an extensive selection of financial instruments and sophisticated trading platforms. Although it primarily serves high-net-worth individuals and professional traders, its offerings are also available to dedicated retail investors in the UAE.

The provision of Islamic accounts and Arabic-language support further strengthens its attractiveness to local clients.

Frequently Asked Questions

What trading platforms does Saxo Bank offer?

Saxo Bank offers a suite of advanced proprietary trading platforms: SaxoTraderGO (web and mobile), SaxoTraderPRO (desktop for advanced traders), and SaxoInvestor (simplified for long-term investing). These platforms provide access to a wide range of global markets and instruments.

Does Saxo Bank provide demo accounts?

Yes, Saxo Bank offers free demo accounts. You can access a 20-day demonstration to practice trading on both their SaxoTraderGO and SaxoTraderPRO platforms. This allows you to familiarize yourself with their tools and test strategies without any financial risk.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple top-tier authorities | High Trading Fees |

| Wide range of tradable assets | Limited leverage |

| Advanced trading platforms | Inactivity fees |

| Local support available in Dubai | Commissions apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Saxo Bank is a well-regulated broker offering a broad range of assets and advanced platforms, ideal for experienced traders. However, its high fees may not suit beginners or low-budget investors.

6. Swissquote

Swissquote is a Switzerland-based online bank and brokerage firm providing multi-asset trading and banking services worldwide, including in the UAE. In the region, Swissquote MEA Ltd. operates within the Dubai International Financial Centre and is regulated by the 🇦🇪 Dubai Financial Services Authority.

Frequently Asked Questions

Is Swissquote good for beginners?

While Swissquote offers extensive educational resources and robust platforms, its USD 1,000 minimum deposit for a standard Forex account might be a barrier for absolute beginners with limited capital. It is better suited for traders with some initial capital.

Can I open an account from the UAE?

Yes, you can open an account with Swissquote from the UAE. Swissquote has a subsidiary, Swissquote MEA Ltd., based in Dubai and regulated by the Dubai Financial Services Authority (DFSA), specifically to serve clients in the Middle East, including the UAE.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulation | High Minimum Deposit |

| Segregated Accounts | No Islamic Account |

| Wide Range of Instruments | Complex Pricing Tiers |

| Multiple Platforms | Limited Educational Content |

| Local UAE Presence | Not Ideal for Small Traders |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Swissquote is a highly regulated broker offering robust platforms, wide asset selection, and strong client protection. Best suited for experienced traders, it may be less ideal for beginners due to high minimum deposits and complexity.

7. Tickmill

Tickmill is a globally regulated broker authorized by regulators such as the FCA, CySEC, FSCA, and the DFSA in the UAE. It features low spreads starting from 0.0 pips, rapid trade execution, and compatibility with MetaTrader 4 and 5. Clients in the UAE enjoy the advantages of a DFSA-regulated office in Dubai, AED deposit options, and the availability of Islamic accounts.

Frequently Asked Questions

Does Tickmill offer Islamic accounts?

Yes, Tickmill offers Islamic (swap-free) accounts, designed to comply with Sharia law. All Muslim clients can convert their Classic or Raw account to an Islamic type, eliminating swap or rollover interest on overnight positions.

Is there local support in the UAE?

Yes, Tickmill does have a local presence and offers support in the UAE. Tickmill UK Ltd has a Representative Office regulated by the Dubai Financial Services Authority (DFSA) located in the Emirates Financial Towers in Dubai.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulation | Limited Educational Tools |

| Low Minimum Deposit | No Proprietary Platform |

| UAE Local Support | Commissions on Raw Accounts |

| Advanced Platforms | Product Range Lacks Physical Stocks |

| Islamic Accounts | No Bonus for EU/UK Clients |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a well-regulated broker offering low spreads, fast execution, and strong UAE support. With a low minimum deposit and Islamic accounts, it’s ideal for cost-conscious traders, though less suited for long-term investors.

Top 7 Forex Brokers in The UAE – A Direct Comparison

Is Forex Trading Legal and Popular in The UAE?

Yes, forex trading is legal and widely conducted in the UAE, overseen by regulators such as the Securities and Commodities Authority (SCA), DFSA, and ADGM. Its popularity continues to grow thanks to a robust financial infrastructure, tax-free profits, and specialized features like Islamic (swap-free) accounts and local AED support.

Both novice and experienced traders actively engage in the expanding forex market within the UAE.

Criteria for Choosing a Forex Broker in The UAE

| Criteria | Description | Importance |

| Regulation | Ensure the broker is licensed by SCA, DFSA, ADGM, or other top tier regulators. | ⭐⭐⭐⭐⭐ |

| Islamic Account Option | Offers swap-free (Sharia-compliant) trading accounts for Muslim traders. | ⭐⭐⭐⭐☆ |

| AED Support | Supports AED as a base currency and allows AED deposits/withdrawals. | ⭐⭐⭐⭐☆ |

| Trading Costs | Low spreads, transparent commissions, and no hidden fees. | ⭐⭐⭐⭐⭐ |

| Trading Platforms | Availability of reliable platforms like MT4, MT5, cTrader, or proprietary tools. | ⭐⭐⭐⭐☆ |

| Leverage Options | Offers flexible leverage within regulatory limits, especially for professionals. | ⭐⭐⭐⭐☆ |

| Customer Support | Accessible, multilingual (preferably Arabic) support including UAE business hours. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | Positive feedback and credibility in the region and globally. | ⭐⭐⭐⭐☆ |

| Withdrawal/Deposit Methods | Supports local bank transfers, cards, and e wallets with fast processing. | ⭐⭐⭐⭐☆ |

| Educational Resources | Provides tutorials, webinars, and demo accounts for beginner traders. | ⭐⭐⭐☆☆ |

What Real UAE Traders Want to Know

Q: What are the most important regulations I should look for when choosing a Forex broker in the UAE? – Aisha (New to Forex, UAE Resident)

A: The most crucial aspect is that the broker is regulated by a reputable UAE authority. The two main regulators are the Dubai Financial Services Authority (DFSA), which governs brokers in the Dubai International Financial Centre (DIFC), and the Securities and Commodities Authority (SCA), which regulates brokers outside the free zones.

Q: I want to start with a low amount of capital. What’s the typical minimum deposit for UAE-friendly brokers? – Omar (Budget-Conscious Beginner)

A: The minimum deposit varies. Some top-tier brokers like IG may effectively have no minimum deposit to open a Standard account, though initial funding amounts might be suggested for practical trading

Q: Which trading platforms are most commonly used and recommended by brokers regulated in the UAE? – Fatima (Platform Preference)

A: The universally popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely supported by most UAE-friendly brokers like IG and AvaTrade. Many brokers also offer their own proprietary web and mobile platforms, which are often very user-friendly.

Q: Do UAE Forex brokers offer Islamic or swap-free accounts that comply with Sharia law? – Khalid (Sharia-Compliant Investor)

A: Yes, many reputable brokers catering to the UAE market offer Islamic (swap-free) accounts. They eliminate swap charges on overnight positions to adhere to Islamic finance principles.

You Might also Like:

- MultiGroup Review

- IG Review

- eToro Review

- AvaTrade Review

- Saxo Bank Review

- Swissquote Review

- Tickmill Review

In Conclusion

Forex brokers in the UAE are well-regulated and offer services tailored to local needs, including AED support and Islamic accounts. Traders benefit from strong legal frameworks, tax-free gains, and growing market access.

Faq

Yes, many top brokers with a strong presence in the UAE offer local customer support. Brokers like IG, Saxo Bank, and Swissquote have offices or dedicated support teams in Dubai, offering phone, email, and live chat assistance often during UAE business hours and sometimes 24/5.

For retail clients under DFSA regulation, leverage is typically capped at 1:30 for major currency pairs due to ESMA-like restrictions. While some international entities of brokers might offer higher leverage.

Negative balance protection is generally a standard feature for retail clients with DFSA-regulated brokers, ensuring you cannot lose more than your deposited capital.

Leading brokers for beginners in the UAE offer extensive educational resources. These often include comprehensive trading academies (e.g., AvaAcademy, IG Academy), webinars, video tutorials, e-books, articles, and market analysis.

Yes, eToro is a prominent broker regulated in the UAE (by ADGM / FSRA) that is widely known for its CopyTrader™ and social trading features. AvaTrade also offers copy trading via their AvaSocial app and integration with DupliTrade.