- Home /

- Forex Brokers /

- NAGA

NAGA Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a NAGA Account

- Regulatory Oversight and Client Protection

- Trading Platforms and Tools

- Diverse Asset Selection

- Deposits and Withdrawals

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about NAGA

- Employee Overview of Working for NAGA

- Pros and Cons

- In Conclusion

Naga stands out as a leading social trading broker, offering Forex, stocks, commodities, indices, and cryptocurrencies on a user-friendly platform. The broker provides competitive spreads, strong regulatory oversight, and advanced copy trading features, ensuring that both beginners and professional traders can efficiently access the markets, follow top investors, and trade with confidence.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Overview

Naga positions itself as a versatile trading platform where users can invest, trade, and copy strategies all within one app. With over 2000 instruments, low fees, and strong community trust, Naga delivers both accessibility and advanced tools for traders at every level.

Frequently Asked Questions

Is Naga suitable for beginners?

Yes, Naga is highly suitable for beginners thanks to its user-friendly interface, free account setup, and educational tools through Naga Academy. New traders can learn via webinars, courses, and analysis while also exploring copy trading to follow experienced investors.

What markets can I trade with Naga?

Naga provides access to global markets, including over 2000 stocks, ETFs, commodities, indices, and cryptocurrencies. With coverage across more than 15 major stock exchanges worldwide, traders can diversify portfolios and seize opportunities across multiple asset classes with one powerful platform.

Our Insights

Naga succeeds in blending ease of use with professional-grade tools, making it a compelling choice for both beginners and advanced traders. With competitive spreads, wide market access, and educational resources, Naga creates an engaging environment where investors can confidently trade and learn.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Fees, Spreads, and Commissions

NAGA offers competitive trading conditions with variable spreads, starting from 1.1 pips for the Iron account. While the broker does not charge commissions on trades, it applies an inactivity fee of $50 per month and overnight funding fees. Deposits are free, but third-party fees may apply. Withdrawals may incur a flat fee, depending on the account type.

| Account Type | Minimum Deposit | EUR/USD Spread | Commission | Inactivity Fee |

| Iron | 250 USD | 1.1 pips | 6 USD | 50 USD/month |

| Bronze | 2,500 USD | 1.0 pips | 6 USD | 50 USD/month |

| Silver | 5,000 USD | 0.6 pips | 6 USD | 50 USD/month |

| Gold | 25,000 USD | 0.5 pips | 6 USD | 50 USD/month |

| Diamond | 50,000 USD | 0.3 pips | 6 USD | 50 USD/month |

| Crystal | 100,000 USD | 0.1 pips | 6 USD | 50 USD/month |

Frequently Asked Questions

What are NAGA’s typical spreads and commissions?

NAGA offers spreads from 1.1 pips on the EUR/USD pair for the Iron account. There are no direct commissions on trades, but an inactivity fee of $50 per month applies. Overnight positions may incur funding fees depending on the instrument.

Are there any hidden fees at NAGA?

Most fees are transparent, including spreads and inactivity charges. Deposit methods are usually free, but third-party providers may charge processing fees. Withdrawals can incur a flat fee depending on account type, so checking terms before trading is advised.

Our Insights

NAGA provides a clear and competitive fee structure, making it suitable for traders seeking transparency and a wide range of instruments. Traders should remain aware of inactivity and withdrawal fees when planning their strategy.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Minimum Deposit and Account Types

NAGA offers a range of account types to cater to different trading preferences and capital levels. The minimum deposit starts at $250 for the Iron account, providing access to various features and instruments. Higher-tier accounts offer reduced spreads and additional benefits.

| Account Type | Minimum Deposit | EUR/USD Spread | Features |

| Iron | 250 USD | 1.1 pips | Standard access |

| Bronze | 2,500 USD | 1.0 pips | Reduced withdrawal fees |

| Silver | 5,000 USD | 0.6 pips | Enhanced trading tools |

| Gold | 25,000 USD | 0.5 pips | Lower commission rates |

| Diamond | 50,000 USD | 0.3 pips | Priority support |

| Crystal | 100,000 USD | 0.1 pips | Premium features |

Frequently Asked Questions

What is the minimum deposit for a NAGA account?

The minimum deposit for the Iron account is $250. Higher-tier accounts, such as Bronze or Silver, require larger deposits but offer reduced spreads and access to advanced trading tools and support services.

Which account type is best for beginners?

The Iron account is ideal for beginners due to its low entry requirement and access to standard trading instruments. Beginners can gradually upgrade to higher-tier accounts as they gain experience and want additional features.

Our Insights

NAGA’s tiered account structure provides flexibility for traders of all levels, with higher deposits unlocking additional features. This setup suits a wide range of trading preferences and supports gradual growth from beginner to advanced accounts.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

How to Open a NAGA Account

Opening a NAGA account is fast and mostly online. You can sign up for a demo or upgrade to a live account, complete identity checks, and fund your wallet to start trading on NAGA’s web or mobile platform.

1. Step 1: Visit the NAGA registration page

Click Sign Up or Open Demo on the NAGA site to begin your application.

2. Step 2: Complete the online form

Enter your personal details, country of residence, phone number, email, and create a secure password; complete the short trading experience questionnaire.

3. Step 3: Confirm your email

Open the verification email from NAGA and click the activation link to access your client area.

4. Step 4: Submit KYC documents

Upgrade to a live account and upload a valid government ID and proof of residence to complete identity verification.

5. Step 5: Fund your account and choose a platform

Go to Money Management, pick a deposit method from many options, fund your account (typical minimums vary by region, commonly around 250 USD), then pick web or mobile to start trading.

This entire process can be finished in minutes for registration, although KYC review times may vary.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Regulatory Oversight and Client Protection

NAGA is a regulated broker offering services through entities authorized by the Cyprus Securities and Exchange Commission (🇨🇾 CySEC) under license No. 204/13. This regulation ensures adherence to strict anti-money laundering (AML) and know your customer (KYC) protocols, safeguarding client funds and data.

| Regulator | License Number | Investor Protection | Segregated Accounts |

| 🇨🇾 CySEC | 204/13 | Yes | Yes |

Frequently Asked Questions

Is NAGA regulated?

Yes, NAGA is regulated by 🇨🇾 CySEC, providing a level of regulatory assurance crucial for traders considering NAGA markets trading.

What protections does CySEC regulation offer?

CySEC mandates negative balance protection, preventing traders from losing more than their initial investments, and requires brokers to maintain segregated accounts for client funds.

Our Insights

NAGA’s 🇨🇾 CySEC regulation offers a secure trading environment with essential protections like negative balance coverage and segregated client funds, making it a reliable choice for traders within the EU.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Trading Platforms and Tools

NAGA provides traders with access to various platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary NAGA WebTrader. These platforms offer advanced charting tools, risk management features, and access to a wide range of markets.

| Platform | Available On | Key Features | Market Access |

| MT4 | Desktop Web | Advanced charting | Forex CFDs |

| MT5 | Desktop Web | Multi-asset trading | Forex Stocks ETFs |

| NAGA WebTrader | Web Mobile | Social trading, Autocopy | Stocks ETFs Crypto Forex |

Frequently Asked Questions

What platforms does NAGA offer?

NAGA offers MT4, MT5, and its proprietary NAGA WebTrader, catering to different trading preferences and strategies.

What markets can I trade on NAGA?

Traders can access over 2,100 instruments, including stocks, ETFs, forex, commodities, and cryptocurrencies, providing a diverse trading experience.

Our Insights

NAGA’s diverse platform offerings, including MT4, MT5, and its proprietary WebTrader, provide traders with robust tools and access to a wide range of markets, catering to various trading preferences and strategies.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Diverse Asset Selection

NAGA offers a comprehensive range of trading instruments, including stocks, forex, indices, commodities, ETFs, and cryptocurrencies. This diverse selection caters to both novice and experienced traders, providing opportunities across various markets.

| Asset Class | Examples | Account Types Available | Trading Platforms |

| Stocks | Tesla Apple Amazon | All | MT4 MT5 Web |

| Forex | EUR/USD GBP/JPY | All | MT4 MT5 Web |

| Indices | S&P 500 DAX 30 | All | MT4 MT5 Web |

| Cryptocurrencies | Bitcoin Ethereum Litecoin | All | MT4 MT5 Web |

Frequently Asked Questions

What assets can I trade on NAGA?

NAGA provides access to over 2,100 instruments, including stocks, forex, indices, commodities, ETFs, and cryptocurrencies, allowing traders to diversify their portfolios.

Does NAGA offer cryptocurrency trading?

Yes, NAGA supports cryptocurrency trading, enabling users to trade popular digital currencies alongside traditional assets.

Our Insights

NAGA’s extensive range of trading instruments, combined with user-friendly platforms, offers traders ample opportunities to diversify their portfolios and access global markets.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

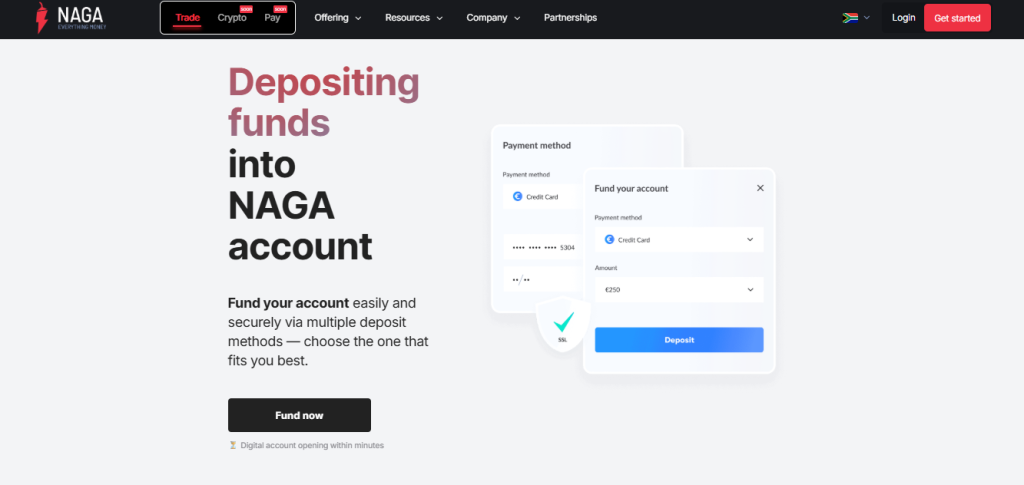

Deposits and Withdrawals

NAGA provides various deposit and withdrawal methods, including credit/debit cards, bank transfers, and e-wallets. This flexibility ensures that traders can fund their accounts and access their funds conveniently.

| Method | Deposit Time | Withdrawal Time | Fees |

| Credit/Debit Cards | Instant | 1-3 Business Days | None (third-party fees may apply) |

| Bank Transfer | 1-3 Business Days | 3-5 Business Days | None (third-party fees may apply) |

| E-wallets | Instant | 1-2 Business Days | None (third-party fees may apply) |

Frequently Asked Questions

What deposit methods are available on NAGA?

NAGA supports multiple deposit methods, including credit/debit cards, bank transfers, and e-wallets, catering to a wide range of preferences.

Are there any fees associated with withdrawals?

While NAGA does not charge withdrawal fees, third-party fees may apply depending on the chosen payment method.

Our Insights

NAGA’s diverse deposit and withdrawal options, coupled with a user-friendly interface, provide traders with convenient and flexible ways to manage their funds.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

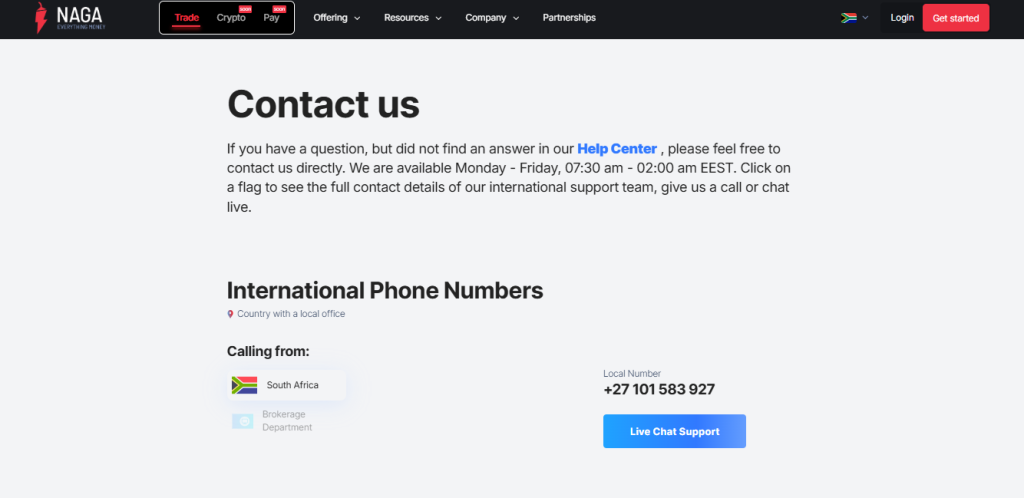

Customer Support

NAGA offers comprehensive customer support to assist traders with various inquiries and issues. Their support team is available Monday through Friday, from 07:30 AM to 02:00 AM EEST. Traders can reach out via email, phone, or live chat, depending on their location. Additionally, NAGA provides support in multiple languages, ensuring a global reach for its diverse clientele.

Frequently Asked Questions

What are NAGA’s customer support hours?

NAGA’s customer support is available Monday to Friday, from 07:30 AM to 02:00 AM EEST. This schedule accommodates traders across various time zones.

How can I contact NAGA’s support team?

Traders can contact NAGA’s support team via email at [email protected], by phone at +49 40 74305833, or through live chat available on their website. Support is offered in multiple languages.

Our Insights

NAGA’s customer support is robust, offering multiple contact methods and multilingual assistance during extended hours. While not available 24/7, the support provided is comprehensive and accessible to traders worldwide.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Customer Reviews and Trust Scores

Customer sentiment around NAGA is generally positive, reflected in a strong TrustPilot rating and favourable feedback on trading tools and support. Nevertheless, alternative review platforms and forums surface some concerns.

| Source | Trust Score/Feedback Highlights |

| TrustPilot | TrustScore ~4.5/5 (72 % five-star, 8 % one-star) |

| Forex Peace Army | Rating ~1.69 / 5 critiques include withdrawal delays and misleading stats |

| Wikibit Fraud | No obvious scam indicators; some reports of slippage and withdrawal delays |

| ForexFraud | TrustPilot score 4.7/5; positive emphasis on sleek UI, copy trading, regulation |

Trust seems solid on mainstream platforms, though occasional critiques on niche sites suggest areas to watch.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Discussions and Forums about NAGA

Online trading communities offer mixed views: praise for social and mobile experience but impatience over spreads and withdrawal issues.

| Platform | Key Community Insights |

| Reddit (trading) | Some users say spreads in Forex are too high, e.g. EURUSD 1.2/1.4 |

| Sitejabber | Comments praise the social feed and support communication |

| Reddit (strategy) | Some traders prefer established brokers for withdrawal trust |

Online discussions reflect both enthusiasm for NAGA’s community features and realistic skepticism over fees and reliability.

Employee Overview of Working for NAGA

Though direct employee testimonials are scarce, NAGA’s global footprint, regulation, and public listing indicate a solid corporate structure and international presence.

| Aspect | Details |

| Regulation | Officially regulated by CySEC and publicly listed in Germany |

| Office Locations | Maintains offices in Cyprus, Germany, South Africa, Seychelles |

| Support Infrastructure | Multilingual support via phone, chat, email, and personal managers |

NAGA appears to operate with a robust corporate and regulatory backbone, which likely supports a structured working environment.

★★★★ | Minimum Deposit: $250 Regulated by: CySEC, BaFin Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| High TrustPilot rating | Mixed feedback on niche platforms |

| Social copy trading features | Complaints about wide spreads |

| User-friendly mobile app | Occasional withdrawal delays |

| Licensed and publicly listed | Forum discussions on reliability |

| Multilingual support | Limited awareness in some regions |

References:

In Conclusion

NAGA operates several local offices that provide direct customer support in various countries. These physical presences enable clients to reach out via local phone numbers and benefit from regionally tailored assistance. According to multiple sources, NAGA maintains local offices in the following countries:

- 🇨🇾 Cyprus

- 🇿🇦 South Africa

- 🇲🇽 Mexico

- 🇵🇪 Peru

- 🇮🇳 India

- 🇮🇩 Indonesia

- 🇲🇾 Malaysia

- 🇹🇭 Thailand

- 🇳🇿 New Zealand

- 🇻🇳 Vietnam

- 🇩🇪 Germany

- 🇻🇨 Saint Vincent and the Grenadines

Overall, NAGA’s strategy of maintaining local offices across these regions shows its commitment to offering accessible and localized customer support.

Faq

The broker charges a varied price structure. Some trades, such as equities and ETFs, may be commission-free, while others may incur spreads or extra fees.

Yes, due to using leverage in some forms of trading, losses can exceed your initial investment. Before engaging in leveraged trading, you must first grasp the dangers involved.

Withdrawals are normally processed instantly or within five business days, depending on the method and account type.

The minimum deposit to start an account is $250, which grants access to a wide range of trading products and platforms.

NAGA’s Autocopy tool automatically allows you to repeat the platform’s top-performing traders’ trades. This can be an effective technique for learning from expert traders or making passive revenue.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a NAGA Account

- Regulatory Oversight and Client Protection

- Trading Platforms and Tools

- Diverse Asset Selection

- Deposits and Withdrawals

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about NAGA

- Employee Overview of Working for NAGA

- Pros and Cons

- In Conclusion