Crypto Guide: 10 Best Bitcoin CFD Brokers

We have listed the 10 Best Bitcoin CFD Brokers for trading the world’s leading cryptocurrency with ease and flexibility. These brokers offer tight spreads, robust regulation, and advanced trading platforms, enabling both beginners and experienced traders to speculate on Bitcoin price movements confidently and securely.

10 Best Bitcoin CFD Brokers (2026)

- MultiBank Group – Overall, The Best Bitcoin CFD Broker

- Exness – Flexible and high leverage

- IG – Reliable and highly-regulated platform

- OANDA – Competitive commission-free trading

- Forex.com – Offers access to integrated global markets

- Plus500 – User-friendly proprietary trading platform

- Capital.com – Rapid withdrawals, and integrated educational resources

- FISG – Offering competitive leverage of up to 1:2000

- FxPro – Top trading platforms (MetaTrader, cTrader, and proprietary FxPro Edge

- AvaTrade – Unique risk management tool to protect against losses

Top 10 Forex Brokers (Globally)

1. MultiBank Group

MultiBank Group is a globally regulated broker offering Bitcoin CFDs with competitive spreads, fast execution, and advanced trading platforms like MetaTrader 4 and 5. Traders can speculate on Bitcoin price movements without owning the asset, benefiting from secure trading conditions, negative balance protection, and strong regulatory oversight.

Frequently Asked Questions

Is MultiBank Group authorized to offer Bitcoin CFD trading?

Yes, MultiBank Group is authorized to offer Bitcoin CFD trading. They are a heavily regulated derivatives broker, offering CFDs on a range of cryptocurrencies, including BTC/USD, under their various global licenses.

What platforms does MultiBank Group offer for Bitcoin CFD trading?

MultiBank Group offers Bitcoin CFD trading through the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary MultiBank-Plus platform.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated by several financial authorities | Limited crypto selection beyond Bitcoin |

| Tight spreads and competitive trading conditions | Inactivity fees may apply |

| Supports popular platforms like MT4 and MT5 | High leverage can increase trading risk |

| Advanced risk management and negative balance protection | No direct crypto ownership (CFDs only) |

| Global presence with strong customer support | Platform interface may be complex for beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and trusted Bitcoin CFD broker offering secure, regulated, and efficient trading conditions. With advanced platforms, strong oversight, and tight spreads, it provides a professional environment for both new and experienced traders.

2. Exness

Exness is an authorized and regulated global broker offering Bitcoin CFD trading with tight spreads, instant execution, and flexible leverage. Traders can speculate on Bitcoin price movements without owning the asset, benefiting from transparent pricing, advanced trading platforms like MetaTrader 4 and 5, and strong financial security under trusted regulatory supervision.

Frequently Asked Questions

Is Exness a legit Bitcoin CFD broker?

Yes, Exness is generally considered a legit and well-regulated multi-asset broker. It offers Bitcoin CFDs and is overseen by multiple financial authorities globally, providing a secure environment for CFD trading.

Does Exness offer leverage on Bitcoin CFDs?

Yes, Exness offers leverage on Bitcoin and other Cryptocurrency CFDs. Leverage is typically fixed for cryptocurrencies, and sources indicate a maximum fixed leverage of 1:400 is available on crypto CFDs.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated by top financial authorities | Limited range of crypto CFDs |

| Tight spreads and low trading costs | Leverage on crypto can be restricted by regulations |

| Fast execution on MT4 and MT5 platforms | No direct Bitcoin ownership (CFDs only) |

| Transparent pricing and reliable performance | Platform interface may be complex for beginners |

| 24/7 multilingual customer support | Some regional restrictions apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legit Bitcoin CFD broker offering transparent, fast, and secure trading conditions. With tight spreads, flexible leverage, and regulated oversight, it provides traders with a reliable environment to trade Bitcoin confidently and efficiently.

3. IG

IG is a legit and authorized global broker offering Bitcoin CFD trading with competitive spreads, advanced charting tools, and reliable execution. Traders can speculate on Bitcoin price movements without owning the asset, benefiting from IG’s strong regulation, transparent pricing, and powerful platforms like MetaTrader 4 and the IG proprietary web platform.

Frequently Asked Questions

What trading platforms does IG offer for Bitcoin CFDs?

IG offers multiple platforms for Bitcoin CFDs, including their proprietary web-based trading platform and award-winning mobile app. They also support third-party platforms like MetaTrader 4 (MT4), TradingView, and ProRealTime.

Can traders use leverage for Bitcoin CFDs on IG?

Yes, traders can use leverage for Bitcoin CFDs on IG. Leverage is a key feature of CFD trading, allowing speculation on price movements without owning the asset. For retail clients, leverage limits are applied due to regulation.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated by top-tier authorities | Limited range of cryptocurrencies |

| Competitive spreads and transparent pricing | No direct Bitcoin ownership (CFDs only) |

| Advanced platforms with strong analytical tools | High leverage may increase potential losses |

| Excellent reputation and global presence | Minimum deposit may be high for some traders |

| Comprehensive educational and support resources | Inactivity fees may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legal and trusted Bitcoin CFD broker offering transparent pricing, strong regulation, and powerful trading platforms. Its advanced tools and global reputation make it a reliable choice for secure and efficient Bitcoin trading.

Top 3 Bitcoin CFD Brokers – MultiBank Group vs Exness vs IG

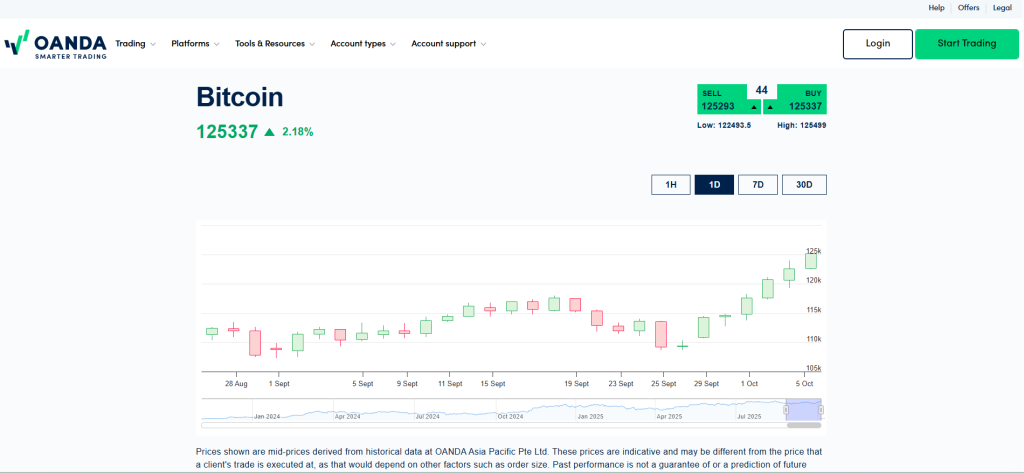

4. OANDA

OANDA is a legal and regulated global broker offering Bitcoin CFD trading with competitive spreads, transparent pricing, and advanced trading platforms. Traders can speculate on Bitcoin price movements without owning the asset, benefiting from OANDA’s strong regulatory oversight, reliable execution, and professional trading environment designed for both beginners and experienced investors.

Frequently Asked Questions

Is OANDA an approved Bitcoin CFD broker?

Yes, OANDA is a regulated global broker that offers Bitcoin CFDs in various jurisdictions through its regulated entities. Their regulatory status and CFD offerings depend on the specific OANDA entity and the trader’s region.

Can traders use leverage for Bitcoin CFDs on OANDA?

Yes, traders can use leverage for Bitcoin CFDs on OANDA. OANDA offers leveraged trading on their cryptocurrency CFDs, but the maximum leverage available for Bitcoin will depend on your specific OANDA entity and local regulatory limits.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated by major financial authorities | Limited range of cryptocurrencies |

| Transparent pricing with tight spreads | No direct Bitcoin ownership (CFDs only) |

| Reliable execution and platform stability | Leverage levels vary by jurisdiction |

| Strong global reputation and trust | Some regions may have account restrictions |

| Excellent educational and analytical resources | Platform may feel basic for advanced crypto traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is an approved and trusted Bitcoin CFD broker offering transparent pricing, tight spreads, and strong regulation. With advanced trading platforms and reliable execution, it provides a secure and professional environment for Bitcoin traders worldwide.

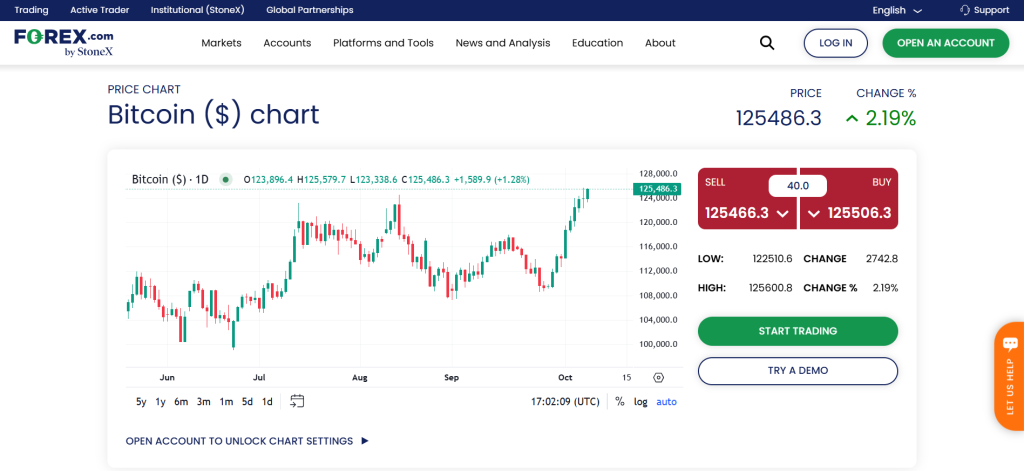

5. Forex.com

Forex.com is an approved and regulated global broker offering Bitcoin CFD trading with tight spreads, advanced trading platforms, and fast execution. Traders can speculate on Bitcoin price movements without owning the cryptocurrency, benefiting from secure trading conditions, transparent pricing, and robust oversight by top financial authorities.

Frequently Asked Questions

Is FOREX.com a registered Bitcoin CFD broker?

Yes, Forex.com is a regulated global CFD broker that offers Bitcoin CFDs. It is registered with multiple regulatory bodies worldwide and is part of the NASDAQ-listed StoneX Group.

What trading platforms does FOREX.com offer for Bitcoin CFDs?

Forex.com offers Bitcoin CFDs on its proprietary Web Trader and Mobile App, as well as on TradingView and the MetaTrader 5 (MT5) platform. Cryptocurrency CFD trading is not available on MetaTrader 4 (MT4).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated by multiple financial authorities | Limited cryptocurrency selection |

| Tight spreads and competitive pricing | No direct Bitcoin ownership (CFDs only) |

| Advanced trading platforms with strong tools | Higher minimum deposits in some regions |

| Fast and reliable trade execution | Inactivity fees may apply |

| Excellent educational and market research resources | Leverage restrictions based on jurisdiction |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Forex.com is a registered and reputable Bitcoin CFD broker offering secure, transparent, and efficient trading conditions. With tight spreads, strong regulation, and advanced platforms, it’s ideal for traders seeking reliable Bitcoin CFD trading.

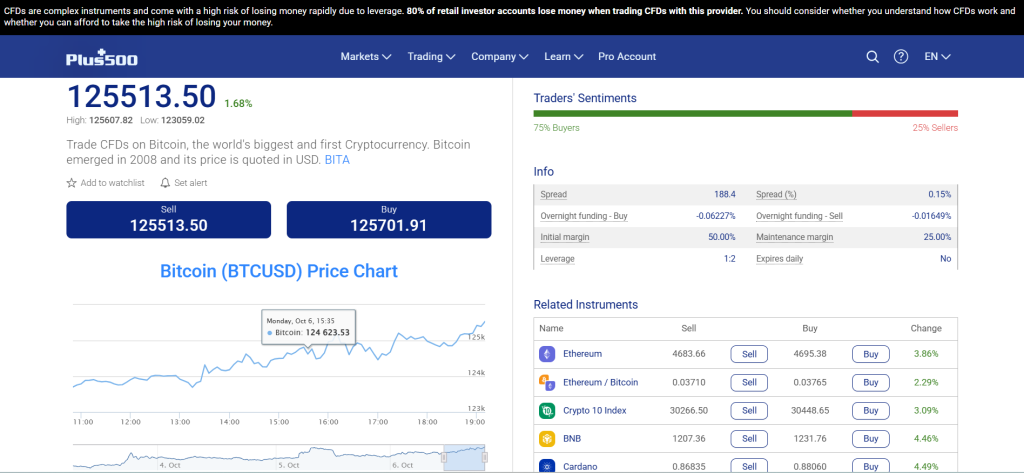

6. Plus500

Plus500 is a registered and regulated global broker offering Bitcoin CFD trading with zero commissions, tight spreads, and an intuitive trading platform. Traders can speculate on Bitcoin price movements without owning the asset, benefiting from strong regulatory protection, real-time quotes, and a secure, user-friendly trading experience.

Frequently Asked Questions

Does Plus500 charge commissions for Bitcoin CFDs?

No, Plus500 does not charge a dealing commission for trading Bitcoin CFDs or any other instrument. Their primary method for generating revenue is through the bid/ask spread, as well as overnight funding charges and currency conversion fees.

What platform does Plus500 use for Bitcoin CFD trading?

Plus500 exclusively uses its own innovative, proprietary trading platform for all CFDs, including Bitcoin. This platform is called WebTrader, and it is accessible via web browser, desktop, and dedicated mobile trading apps.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Commission-free Bitcoin CFD trading | No direct crypto ownership (CFDs only) |

| Intuitive, easy-to-use trading platform | Limited customer service hours |

| Real-time pricing and quick execution | Inactivity fees apply after 3 months |

| Negative balance protection for added safety | Educational content could be more detailed |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is a regulated and reliable Bitcoin CFD broker that provides a straightforward, commission-free trading experience. With competitive spreads, solid regulatory oversight, and an easy-to-use platform, it offers a secure and efficient environment for trading Bitcoin CFDs.

7. Capital.com

Capital.com is an authorized and regulated global broker offering Bitcoin CFD trading with zero commissions, tight spreads, and advanced AI-powered tools. Traders can speculate on Bitcoin price movements without owning the cryptocurrency, benefiting from transparent pricing, fast execution, and strong investor protection under top-tier regulatory oversight.

Frequently Asked Questions

Is Capital.com a legit Bitcoin CFD broker?

Yes, Capital.com is a legit and regulated broker for Bitcoin CFDs. It is regulated by top-tier authorities like the FCA, CySEC, and ASIC, and is known for its large selection of crypto CFDs.

Does Capital.com charge commissions on Bitcoin CFDs?

No, Capital.com does not charge a commission on Bitcoin CFDs or any other markets. Their primary trading cost is the spread (the difference between the buy and sell price), along with overnight funding fees for positions held open overnight.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Limited leverage for retail traders |

| Commission-free Bitcoin CFD trading | No direct Bitcoin ownership (CFDs only) |

| AI-powered tools for smarter trading insights | Overnight fees apply for held positions |

| Advanced platforms with fast execution | No MetaTrader 5 support |

| Negative balance protection for retail clients | Limited availability in some regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐⭐ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Capital.com is a legit and trusted Bitcoin CFD broker offering zero commissions, tight spreads, and advanced AI-driven tools. With strong regulation, user-friendly platforms, and solid protection measures, it provides secure and efficient Bitcoin trading.

8. FISG

FISG is a highly regulated CFD broker, authorized by CySEC (Europe) and the FSA (Seychelles), and operating under ASIC’s representative rules. It allows traders to access Bitcoin and other crypto CFDs via MetaTrader 4/5, offering up to 1:500 leverage, competitive low spreads, segregated accounts, and negative balance protection.

Frequently Asked Questions

Is FISG a legal Bitcoin CFD broker?

Yes, FISG is a legal and regulated broker authorized by CySEC and the FSA Seychelles, ensuring compliant and secure Bitcoin CFD trading.

Does FISG offer leverage for Bitcoin CFDs?

Yes, FISG offers high leverage for Bitcoin CFD trading, ranging up to 1:500 (depending on account type and client jurisdiction).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Limited bonus and promotional offers |

| High leverage options for advanced trading | Swap fees apply for overnight positions |

| Multiple trading platforms including MT4 and MT5 | High leverage can increase trading risk |

| Segregated accounts and negative balance protection | Some account types require higher minimum deposits |

| Wide range of CFDs including Bitcoin and other crypto assets | Crypto CFD selection is smaller than specialized crypto brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Market Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FISG is a legal and regulated Bitcoin CFD broker offering secure, high-leverage trading with multiple platforms. Strong protections, segregated accounts, and global oversight make it suitable for both experienced and cautious traders.

9. FxPro

FxPro is a regulated broker offering Bitcoin CFDs (BTC/USD), enabling speculation on price movements through MetaTrader 4, MetaTrader 5, and cTrader. It features flexible leverage, tight spreads, and strong risk management. Note that FxPro UK Ltd. does not offer crypto CFDs to retail clients.

Frequently Asked Questions

Is FxPro an approved Bitcoin CFD broker?

Yes, FxPro is a regulated broker offering Bitcoin CFDs (BTC/USD) through its various entities. However, cryptocurrency CFDs are specifically unavailable to retail clients of FxPro UK Ltd. due to regulatory restrictions.

Does FxPro offer leverage for Bitcoin CFDs?

Yes, FxPro offers leverage for Bitcoin CFDs (BTC/USD). The maximum leverage for cryptocurrencies is generally 1:20, but higher leverage like 1:500 may be available depending on the client’s jurisdiction and account type (e.g., for professional clients).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Cryptocurrency CFDs unavailable to retail clients under FxPro UK Ltd |

| Multiple trading platforms including MT4, MT5, and cTrader | Limited crypto selection beyond Bitcoin |

| Competitive spreads and flexible leverage | Swap fees apply for overnight positions |

| Strong risk management tools and client protection | Leverage restrictions vary by region |

| Global reputation as a trusted and professional broker | Educational resources are moderate compared to top-tier brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is an approved and regulated Bitcoin CFD broker offering multiple platforms, competitive spreads, and strong risk management. Its secure environment and professional oversight make it suitable for both experienced and cautious Bitcoin traders.

10. AvaTrade

As a globally regulated broker, AvaTrade offers Bitcoin CFD trading with leverage up to 20:1, allowing speculation without asset ownership. Clients can trade via MetaTrader 4, MetaTrader 5, or the proprietary mobile app in a secure, compliant setting. Note: AvaTrade UK Ltd. prohibits crypto CFDs for retail traders.

Frequently Asked Questions

Which platforms are available for trading Bitcoin CFDs on AvaTrade?

You can trade Bitcoin CFDs on AvaTrade using MetaTrader 4 (MT4), MetaTrader 5 (MT5), the proprietary WebTrader platform, the AvaTrade App (mobile trading), and AvaSocial.

Does AvaTrade offer leverage for Bitcoin CFDs?

Yes, AvaTrade does offer leverage for Bitcoin CFDs. The maximum leverage for retail traders is generally 1:2 (50% margin requirement) on BTC/USD and BTC/EUR pairs, though it can vary based on your location and regulatory restrictions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Cryptocurrency CFDs unavailable to retail clients under AvaTrade UK Ltd |

| Multiple platforms | Limited crypto selection beyond Bitcoin |

| Leverage options for experienced traders | Overnight swap fees apply |

| Secure trading environment with risk management tools | Leverage restrictions vary by region |

| Global reputation as a reliable CFD broker | Educational content could be more comprehensive |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a registered and trusted Bitcoin CFD broker offering multiple platforms, flexible leverage, and strong regulatory oversight. Its secure environment and global reputation make it suitable for both new and experienced Bitcoin traders.

What is a Bitcoin CFD Broker?

A Bitcoin CFD broker is a financial service provider that allows traders to speculate on the price movements of Bitcoin without actually owning the cryptocurrency. It provides a regulated and convenient way to trade Bitcoin price movements without needing to buy, store, or manage actual Bitcoin.

Criteria for Choosing a Bitcoin CFD Broker

| Criteria | Description | Importance |

| Regulation & Authorization | Ensures the broker is legally licensed and follows strict financial rules, protecting your funds and ensuring fair trading practices. | ⭐⭐⭐⭐⭐ |

| Trading Platforms | Quality and usability of trading platforms (MT4, MT5, proprietary apps), which affect execution speed, charting, and analysis tools. | ⭐⭐⭐⭐☆ |

| Spreads & Commissions | Low spreads and transparent fees reduce trading costs and improve profitability. | ⭐⭐⭐⭐⭐ |

| Leverage & Margin | Determines how much capital you can control relative to your deposit; important for both profit potential and risk management. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Options | Availability, speed, and reliability of funding methods (bank transfer, e-wallets, crypto deposits). | ⭐⭐⭐⭐☆ |

| Customer Support | Quality of support via chat, email, or phone; important for resolving issues quickly. | ⭐⭐⭐⭐☆ |

| Range of Instruments | Access to Bitcoin and other cryptocurrencies, Forex, indices, stocks, and commodities for portfolio diversification. | ⭐⭐⭐⭐☆ |

| Risk Management Tools | Stop-loss, take-profit, negative balance protection, and account segregation to manage and limit losses. | ⭐⭐⭐⭐⭐ |

| Education & Research | Availability of educational content, tutorials, market news, and analysis tools to support informed trading. | ⭐⭐⭐☆☆ |

| Execution Speed & Reliability | Fast order execution and minimal downtime ensure accurate trade entry and exit points. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | Broker’s industry standing, client feedback, and transparency affect trustworthiness. | ⭐⭐⭐⭐⭐ |

Top 10 Best Bitcoin CFD Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From reliability to leverage, we provide straightforward answers to help you understand Bitcoin CFD Brokers and choose the right broker confidently.

Q: Is trading Bitcoin through CFD reliable? – Alex T.

A: Trading Bitcoin CFDs is highly risky due to Bitcoin’s extreme volatility and the use of leverage, which magnifies both profits and losses, potentially exceeding your initial deposit. Reliability depends heavily on a regulated broker and strict risk management.

Q: How is profit or loss calculated in Bitcoin CFD trading? – Sara P.

A: Profit or loss is calculated as the difference between the CFD’s opening and closing price, multiplied by your total position size (number of Bitcoin contracts). Leverage magnifies this result.

Q: Can I use leverage for Bitcoin CFDs? – Michael D.

A: Yes, you can use leverage when trading Bitcoin CFDs. This allows you to control a larger position with a smaller initial deposit, but it significantly magnifies both potential profits and losses.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Advanced Tools and Platforms | No Ownership of Bitcoin |

| Leverage Trading | Leverage Risk |

| Profit in Both Directions | Overnight Fees |

| Regulated Environment | Regional Restrictions |

| Access to Multiple Markets | Market Volatility |

In Conclusion

Bitcoin CFD brokers allow traders to speculate on Bitcoin’s price without owning it. They offer leverage, advanced tools, and regulated environments, but traders should manage risks carefully due to volatility and potential leveraged losses.

You Might also Like:

- MultiBank Group Review

- Exness Review

- IG Review

- OANDA Review

- Forex.com Review

- Plus500 Review

- Capital.com Review

- FxPro Review

- AvaTrade Review

Frequently Asked Questions

What is a Bitcoin CFD broker?

A Bitcoin CFD broker offers “Contracts for Difference” that let you speculate on Bitcoin’s price movement without owning the actual cryptocurrency. The broker acts as the counterparty to your trade.

How do Bitcoin CFDs work?

Bitcoin CFDs (Contracts for Difference) are agreements to speculate on Bitcoin’s price movement without owning the actual crypto. Your profit or loss is the difference between the opening and closing price of the contract. They often use leverage.

Do I own real Bitcoin when trading CFDs?

No, when trading Contracts for Difference (CFDs) on Bitcoin, you do not own the actual cryptocurrency. A CFD is a derivative that lets you speculate on Bitcoin’s price movements.

Are Bitcoin CFD brokers regulated?

Yes, many reputable Bitcoin CFD brokers are regulated by major financial authorities like the FCA, CySEC, and ASIC. Regulation varies by jurisdiction, so always check your chosen broker’s specific licenses and oversight.

Is trading Bitcoin CFDs legal?

The legality of trading Bitcoin CFDs varies significantly by location. They are banned for retail investors in the United States and the United Kingdom, but are legal and regulated in many other jurisdictions globally.

Do Bitcoin CFD brokers charge commissions?

Whether Bitcoin CFD brokers charge commissions varies. Many popular brokers offer commission-free crypto CFD trading, profiting instead from the spread (the difference between the buy and sell price). However, some brokers do charge a commission.

Can I go short on Bitcoin with CFDs?

Yes, you can short Bitcoin with Contracts for Difference (CFDs). CFDs let you speculate on Bitcoin’s price falling by opening a sell position, aiming to profit from the difference when you close the position at a lower price. This method uses leverage and doesn’t require owning the actual Bitcoin.

Do I pay overnight fees on Bitcoin CFDs?

Yes, you typically pay overnight funding fees (or swap fees) on Bitcoin CFDs that are held open past a broker’s cutoff time. This fee is an interest charge to cover the cost of the leverage used to maintain the position overnight.

Can beginners trade Bitcoin CFDs?

Yes, beginners can trade Bitcoin CFDs, as platforms are accessible. However, they are extremely high-risk due to Bitcoin’s volatility and the leverage used in CFDs, which can lead to rapid, significant losses.

What’s the main advantage of Bitcoin CFD trading?

The main advantage of Bitcoin CFD trading is the leverage it offers. This allows you to control a much larger position with a small initial capital, potentially magnifying your profits from Bitcoin’s price movements.