6 Best PAMM Account Forex Brokers

10 Best PAMM Account Forex Brokers Revealed. PAMM accounts are an attractive choice for investors looking to use the knowledge of experienced traders without actively handling trades themselves. To help you navigate this advanced investing path, we painstakingly studied and evaluated many Forex brokers that provide PAMM accounts to find the 10 Best.

In this in-depth guide, you’ll learn:

- 6 Best PAMM Account Forex Brokers

- How do PAMM Accounts work?

- What is a PAMM Account?

and much, MUCH more!

| Forex Broker | Sign Up Here | Minimum Deposit | Leverage |

| 1. FP Markets | Click Here | $100 USD | 1:500 |

| 2. AvaTrade | Click Here | $100 USD | 1:400 |

| 3. Vantage Fx | Click Here | $50 USD | 1:1000 |

| 4. IC Markets | Click Here | $200 USD | 1:500 |

| 5. FxPro | Click Here | $100 USD | 1:30 |

| 6. Alpari | Click Here | $50 USD | 1:3000 |

6 Best PAMM Account Forex Brokers (2025)

- FP Markets – Overall, The Best PAMM Account Forex Broker

- AvaTrade – Best Forex Broker for Beginners

- Vantage Fx – Most Trusted Forex Broker

- IC Markets – Best CFD Forex Broker

- FxPro – Best ECN/STP Broker

- Alpari – Best IB Program

FP Markets

FP Markets is a globally regulated forex and CFD broker established in 2005, known for its competitive spreads, fast execution, and broad asset range, including forex, indices, commodities, stocks, and cryptocurrencies.

Investors can benefit from the expertise of experienced traders through FP Markets’ PAMM accounts, where their allocated funds are managed, and returns are distributed according to their investment share.

Frequently Asked Questions

What trading platforms does FP Markets offer?

FP Markets offers trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and IRESS platforms. These platforms support forex, CFD, and stock trading with advanced charting tools, algorithmic trading, and multi-device accessibility.

Does FP Markets offer PAMM accounts?

Yes, FP Markets offers PAMM accounts for clients who prefer passive investing. Investors can allocate funds to experienced money managers, and profits or losses are distributed proportionally based on their share in the managed trading account.

What is the minimum deposit?

The minimum deposit at FP Markets is $100 for Standard and Raw accounts. This low entry point makes it accessible for beginners while still offering competitive trading conditions, including tight spreads, fast execution, and access to multiple platforms.

Does FP Markets offer demo accounts?

Yes, FP Markets offers free demo accounts that simulate real trading conditions using virtual funds. These accounts are ideal for beginners to practice strategies and for experienced traders to test new approaches without risking real money.

Our Insights

Its PAMM account offering makes it especially attractive for those who prefer to invest in seasoned traders rather than trade themselves. Coupled with strong global regulation, swap-free options, and 24/5 multilingual support, FP Markets delivers a comprehensive and trustworthy trading environment.

AvaTrade

AvaTrade is a globally regulated broker founded in 2006, offering trading in forex, commodities, indices, stocks, ETFs, options, and cryptocurrencies.

The broker Supports automated trading with Expert Advisors (EAs) for PAMM accounts. Flexible allocation methods. No restrictions on sub-accounts.

Frequently Asked Questions

What is AvaTrade?

AvaTrade is a globally regulated forex and CFD broker established in 2006. It offers trading across forex, stocks, commodities, indices, cryptocurrencies, and options on user-friendly platforms with fixed or floating spreads and strong educational resources.

Is there a demo account?

Yes, AvaTrade offers a free demo account with virtual funds, allowing traders to practice strategies and explore the platform without financial risk. It’s ideal for beginners and advanced users to test market conditions in a safe environment.

Does AvaTrade offer Islamic accounts?

Yes, AvaTrade offers Islamic accounts that comply with Sharia law. These swap-free accounts eliminate overnight interest charges, making them suitable for Muslim traders who wish to trade forex and CFDs by their religious beliefs.

What is the minimum deposit?

The minimum deposit to open an AvaTrade account is $100. This affordable entry point gives traders access to a wide range of financial instruments, user-friendly platforms, and support features, making it suitable for both beginners and experienced traders.

Our Insights

With fixed and variable spreads, swap-free account options, and strong regulatory oversight, AvaTrade provides a secure and accessible environment for traders of all levels. Whether you’re looking to trade independently or follow others, AvaTrade offers flexible tools to match your trading style.

Vantage Fx

Vantage Fx is a globally regulated forex and CFD broker founded in 2009, offering access to a wide range of financial instruments including forex, commodities, indices, shares, and cryptocurrencies.

Its support for PAMM accounts is a significant advantage, allowing experienced money managers to trade on behalf of investors who allocate their capital, with profits and losses shared proportionally.

Frequently Asked Questions

Does Vantage offer PAMM accounts?

Yes, Vantage offers PAMM account services, allowing investors to allocate funds to skilled money managers who trade on their behalf. Profits and losses are shared proportionally, making it a convenient option for passive investors seeking forex market exposure.

Does Vantage offer copy trading?

Yes, Vantage offers copy trading through platforms like Vantage Copy Trading, ZuluTrade, and MyFXBook AutoTrade. This allows users to automatically replicate trades from experienced traders, making it ideal for beginners or those preferring a hands-off approach.

Is there a demo account available?

Yes, Vantage offers a free demo account with virtual funds, allowing traders to practice strategies and explore the platform in real market conditions. It’s an excellent tool for beginners to gain confidence without risking real money.

What is the minimum deposit?

The minimum deposit to open a Vantage FX account is $50, making it accessible for new traders. This low entry requirement provides access to a wide range of trading instruments, platforms, and features suitable for various experience levels.

Our Insights

Its PAMM account offering makes it attractive for passive investors who prefer to allocate their capital to professional traders. Vantage caters to both beginners and advanced traders seeking flexibility, speed, and transparency in the global markets.

IC Markets

IC Markets is a globally recognized forex and CFD broker established in 2007, known for its ultra-low spreads, fast order execution, and institutional-grade liquidity.

Known for raw spreads and institutional-grade liquidity, which can benefit PAMM account performance. Supports MT4 and MT5 for PAMM.

Frequently Asked Questions

Does IC Markets offer demo accounts?

Yes, IC Markets offers free demo accounts with virtual funds, enabling traders to practice strategies and test the platform in real-time market conditions. It’s ideal for both beginners and experienced traders looking to refine their trading skills risk-free.

Does IC Markets charge inactivity or withdrawal fees?

IC Markets does not charge inactivity fees, allowing traders to keep their accounts open without penalty during periods of no activity. However, withdrawal fees may apply depending on the method used, particularly for international bank transfers.

Is there mobile trading available?

Yes, mobile trading is readily available with Vantage FX. 1 They offer their proprietary “Vantage App” for both iOS and Android devices, allowing you to trade on the go. 2 Additionally, they support the popular MetaTrader 4 and MetaTrader 5 mobile applications.

Can I open multiple trading accounts?

Yes, you can open multiple trading accounts with Vantage FX. They offer various account types (Standard STP, Raw ECN, Pro ECN) and allow clients to hold more than one live trading account. 2 This enables you to test different strategies or manage funds separately.

Our Insights

Whether you’re a beginner looking for educational resources and a user-friendly experience or an advanced trader needing high-speed ECN access, IC Markets delivers a reliable, transparent, and cost-effective trading environment.

FxPro

FxPro is a well-established, multi-asset online broker founded in 2006. It offers trading in forex, commodities, indices, shares, and futures to both retail and professional clients across the globe.

The broker is well-regulated with a strong reputation. Offers PAMM on MT4 and MT5. Customizable commissions and performance fees. Rebates on spread charges for managers.

Frequently Asked Questions

Is there a demo account available?

Yes, a demo account is readily available at FxPro. They offer free demo accounts with up to $100,000 in virtual funds, allowing you to practice trading on all their platforms (MT4, MT5, cTrader, and FxPro Trading Platform) in a risk-free environment. Demo accounts are valid for 180 days and can be topped up via FxPro Direct.

What is the minimum deposit at FxPro?

The minimum deposit at FxPro is generally USD 100 or the equivalent in other base currencies (EUR, GBP, CHF, JPY, PLN, AUD, ZAR). However, this can vary depending on the account type. For example, the Raw+ account has a higher minimum deposit of USD 500.

What leverage does FxPro offer?

FxPro offers varying leverage depending on the jurisdiction and the financial instrument. 1 For retail clients under CySEC and FCA regulations, the maximum leverage is typically 1:30 for major forex pairs. For professional clients, leverage can be higher.

Does FxPro charge inactivity fees?

Yes, FxPro does charge inactivity fees. If your account remains inactive for six months, they will levy a one-off maintenance and administration fee of $10 (or equivalent). Following this, a monthly inactivity fee of $10 will be applied

Our Insights

With user-friendly platforms like MT4, MT5, cTrader, and FxPro Edge, along with tight spreads and strong educational support, FxPro is a solid choice for both new and experienced traders looking for a reliable trading partner.

Alpari

Alpari is a well-established forex and CFD broker founded in 1998, known for its global reach and strong presence in emerging markets.

A standout feature of Alpari is its PAMM account service, a perfect solution for passive investors who want forex market exposure by allocating funds to skilled PAMM managers.

Frequently Asked Questions

Does Alpari offer PAMM accounts?

Yes, Alpari offers PAMM (Percentage Allocation Management Module) accounts. This service allows investors who prefer a passive approach to allocate funds to experienced traders (PAMM managers) who then trade on their behalf in the forex market.

Is there a demo account available?

Yes, Alpari provides demo accounts to practice in a risk-free environment. These accounts are available for their MetaTrader 4 and MetaTrader 5 platforms, allowing you to simulate trading various instruments with virtual funds and familiarize yourself with the platform’s features.

What is the minimum deposit?

The minimum deposit at Alpari varies depending on the account type you choose. It can range from USD 5 for the Nano account to USD 100 for the Standard account and higher amounts for ECN and Pro accounts.

What leverage does Alpari offer?

Leverage can be up to 1:1000.

Our Insights

While its regulation is offshore, its global experience, competitive trading conditions, and structured PAMM system make it a viable choice for those seeking both self-directed and managed forex trading solutions.

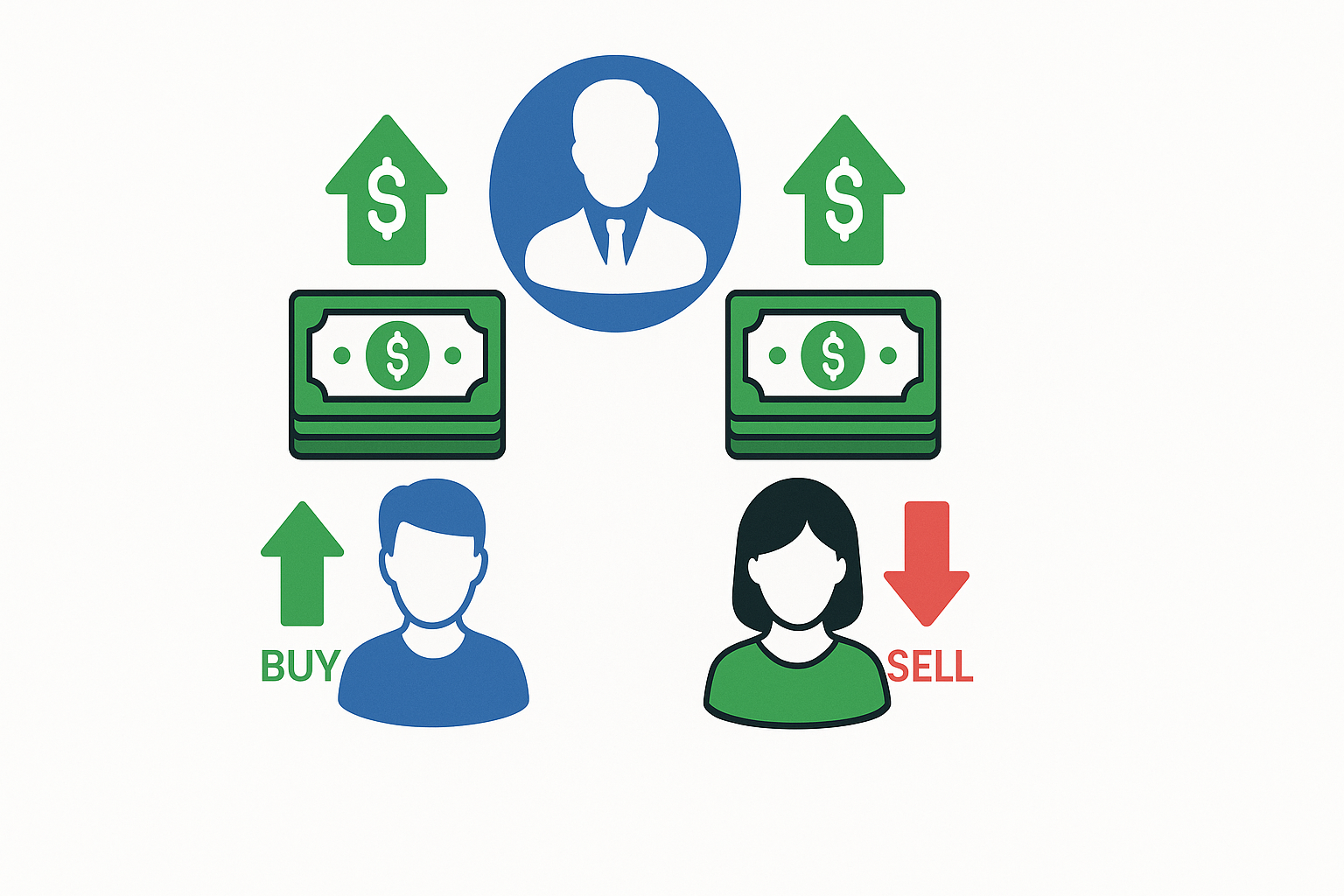

What is a PAMM Account?

A PAMM account (Percentage Allocation Management Module) is a type of investment account in which investors allocate their funds to be managed by a professional trader or money manager. The trader uses pooled funds from multiple investors to trade, and any profits or losses are distributed proportionally based on each investor’s contribution.

Key Features of PAMM Accounts

- Investor Role: Invests funds without making trading decisions.

- Manager Role: Trades using combined capital from all investors.

- Profit Sharing: Earnings (or losses) are split based on percentage contributions.

- Transparency: Most brokers provide performance stats and risk metrics.

- Control: Investors can add or withdraw funds or stop investing anytime.

If you invest $1,000 into a PAMM account where the total capital is $10,000, you own 10% of that account. If the manager makes a $1,000 profit, you earn $100 (10% of the total profit), minus any performance fees.

In Conclusion

These brokers provide the tools and infrastructure needed to manage risk, monitor performance, and ensure that profit sharing is fair and proportionate. Whether you’re a passive investor seeking returns or a skilled trader looking to manage capital, PAMM accounts create a win-win environment in the forex ecosystem.

You Might also Like:

Faq

PAMM accounts can be a convenient way to participate in forex, but they are not risk-free. The safety depends heavily on the broker’s regulation, the PAMM manager’s skill and trading strategy, and the transparency provided. Thorough due diligence is crucial.

Yes, PAMM managers typically charge fees for their services. The most common fee structure involves a performance fee, which is a percentage of the profits generated for the investors. Some managers may also charge a management fee.

While PAMM accounts are offered by numerous forex brokers globally, their availability can be restricted by regulations in certain countries. Factors like local financial laws and broker licensing determine accessibility. It’s best to check directly with specific brokers.

Yes, you can typically monitor your PAMM investment. Most brokers provide investors with access to a dashboard or reporting system where you can track the overall performance of the PAMM account, including profits, losses, and sometimes the trading history.