10 Best Forex Brokers in Tanzania

The 10 Best Forex Brokers in Tanzania – Rated and Reviewed. We have listed the Best and approved Forex Brokers that accept traders in Tanzania.

Top 10 Forex Brokers in Tanzania – A Direct Comparison

10 Best Forex Brokers in Tanzania (2026)

- Exness – Overall, The Best Forex Broker in Tanzania

- XM – Strong educational resources for Tanzanian traders

- Pepperstone – Supports both MetaTrader 4 and MetaTrader 5 platforms

- HFM – local customer support in Tanzania

- Axi – Accepts deposits and withdrawals via Mobile Money

- JustMarkets – Swap-free Islamic accounts and a user-friendly mobile app

- FBS – Competitive spreads and leverage up to 1:3000

- AvaTrade – Live market updates and volatility alerts

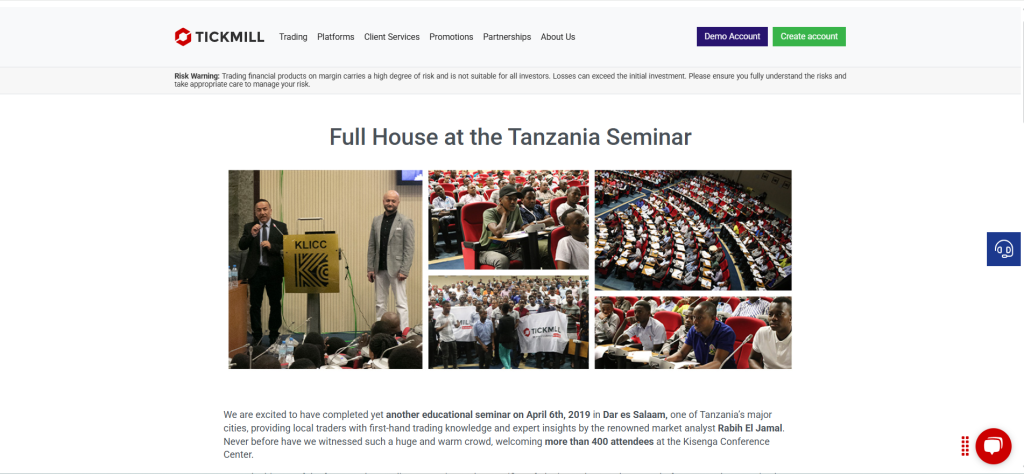

- Tickmill – Competitive trading conditions in Tanzania

- FXTM – Globally regulated and offers copy trading

Top 10 Forex Brokers (Globally)

1. Exness

Tanzanian traders are able to use Exness through its international branch, benefiting from local payment options and dedicated support. The broker offers flexible leverage, competitive spreads, swap-free Islamic accounts, and intuitive trading platforms such as MT4 and MT5.

Frequently Asked Questions

Does Exness accept clients from Tanzania?

Yes, Exness does accept clients from Tanzania. Tanzanian traders are typically onboarded under Exness (SC) Ltd, which is regulated by the Financial Services Authority (FSA) in Seychelles.

Is Exness a good broker for beginners?

Exness is considered a good broker for beginners. They offer features like a low minimum deposit, commission-free Standard and Standard Cent accounts, negative balance protection, and user-friendly platforms like their Exness Trade app and WebTerminal. They also provide demo accounts for practice.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | Limited Educational Resources |

| Low Minimum Deposit | No Proprietary Social Trading |

| Ultra-Low Spreads | No Bonus or Promotion Programs |

| Multilingual & Regional Support | Leverage Restrictions by Region |

| High Leverage | Limited CFD Range on Some Accounts |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legit and well-regulated forex broker offering low-cost trading, flexible leverage, and fast withdrawals. It’s beginner-friendly, supports Tanzanian traders, and provides a reliable platform, though educational resources are somewhat limited.

2. XM

Traders in Tanzania are welcome at XM and can take advantage of local deposit options, flexible leverage up to 1:1000, and swap-free Islamic accounts. XM provides access to both MT4 and MT5 platforms, requires a low minimum deposit of just $5, and offers negative balance protection along with multilingual customer support, making it a reputable and accessible broker for Tanzanian traders.

Frequently Asked Questions

Does XM offer Islamic (swap-free) accounts?

Yes, XM offers Islamic (swap-free) accounts. For traders whose religious beliefs prohibit earning or paying interest (swaps) on overnight positions, XM designs these accounts to ensure Sharia compliance.

Does XM accept traders from Tanzania?

Yes, XM does accept traders from Tanzania. Tanzanian clients are typically onboarded through XM Global Ltd, which is regulated by the Belize FSC. XM offers features like a low minimum deposit and negative balance protection for these clients.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | TZS Not Supported as Base Currency |

| Low Minimum Deposit | Limited Share CFD Coverage |

| Commission-Free Accounts | No Proprietary Trading Platform |

| User-Friendly Platforms | Inactivity Fee |

| Promotions & Bonuses | Spreads on Some Accounts |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is an approved and globally regulated broker offering low deposits, user-friendly platforms, and over 1,000 CFDs. It suits beginners and experienced traders, especially in Tanzania, with Islamic accounts and strong fund protection features.

3. Pepperstone

Established in Australia in 2010, Pepperstone is internationally regulated and recognized for providing low-cost, fast-execution forex and CFD trading across various platforms. Tanzanian traders can access Pepperstone via its Kenyan-regulated branch, enjoying flexible account types, robust regulatory oversight, and a wide range of deposit methods.

Frequently Asked Questions

What types of accounts does Pepperstone offer?

Pepperstone primarily offers two main live trading accounts: the Standard Account and the Razor Account. The Standard Account is commission-free with slightly wider spreads, while the Razor Account features raw spreads and a per-lot commission.

Does Pepperstone support MetaTrader?

Yes, Pepperstone strongly supports MetaTrader. They offer both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are highly popular platforms known for their charting tools, expert advisors (EAs), and custom indicators, catering to a wide range of traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight Spreads | No Proprietary Platform |

| Low Fees | Limited Investor Protection |

| Multiple Platforms | No TZS-denominated Accounts |

| Strong Regulation | CFD-Only Broker |

| Copy Trading Available | No Bonus Programs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Top-tier authorities like ASIC, FCA, and CMA authorize and regulate Pepperstone, making it a globally trusted broker. It offers low spreads, fast execution, and advanced platforms, making it ideal for both beginners and professionals.

Top 3 Forex Brokers in Tanzania – Exness vs XM vs Pepperstone

4. HFM

Founded in 2010, HFM is internationally regulated (including by the FCA and CMA Kenya) and accepts TZS deposits starting from just TZS 12,000. The broker provides rapid ECN/STP execution on MT4, MT5, and the HFM app, offers high leverage up to 1:2000, and features a wide range of CFDs—including cryptocurrencies.

With negative balance protection and segregated client funds, HFM stands out as a solid choice for traders in Tanzania.

Frequently Asked Questions

Can I open an HFM account from Tanzania?

Yes, you can open an HFM account from Tanzania. HFM has a strong presence there, offering local customer support and fast deposits/withdrawals from local banks. Tanzanian traders are typically registered under HFM’s Saint Vincent and the Grenadines-based entity.

Are Islamic (swap-free) accounts available?

Yes, HFM offers Islamic (swap-free) accounts for traders whose religious beliefs prohibit interest. These accounts are available across various HFM account types, including Cent, Premium, Zero, Pro, and Pro Plus, ensuring Sharia compliance by removing overnight swap charges.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | Offshore Entity Risk |

| Low Minimum Deposit | Crypto Trading Limited in Some Regions |

| TZS Funding Support | No Proprietary Desktop Platform |

| Multiple Account Types | Inactivity Fees |

| Swap-Free Islamic Accounts | No Direct Stock Ownership |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a legit, multi-regulated broker offering low deposits, high leverage, and a wide range of CFD instruments. It supports Tanzanian traders with local payment options, swap-free accounts, and negative balance protection.

5. Axi

Axi is a legit forex and CFD broker founded in 2007 and regulated by top authorities like the FCA (UK), ASIC (Australia), and DFSA. It accepts traders from Tanzania under its offshore FSA (SVG) entity, offering access to MT4 and the Axi Trading Platform.

Frequently Asked Questions

Can Tanzanian traders open an account with Axi?

Yes, Axi accepts traders from Tanzania. They support opening live trading accounts for Tanzanian residents, as indicated on their website. This allows traders in Tanzania to access Axi’s platforms and services.

What types of accounts does Axi offer?

Axi offers various account types to suit different traders. Their main offerings include the Standard Account (commission-free, wider spreads) and the Pro Account (raw spreads, commission-based). They also provide Swap-Free (Islamic) accounts and a Premium account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly Regulated | No TZS Account Support |

| No Minimum Deposit | No Investor Protection |

| Tight Spreads on Pro Account | Limited Platform Choice |

| Wide CFD Range | Commissions on Pro Account |

| Negative Balance Protection | No Direct Stock Ownership |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a legit, globally regulated broker offering tight spreads, low entry costs, and strong trading tools. While it lacks TZS accounts or investor protection offshore, it’s a solid option for Tanzanian traders.

6. JustMarkets

JustMarkets is a globally regulated forex and CFD broker founded in 2012, providing access to MetaTrader 4 and 5, leverage up to 1:3000, and minimum deposits starting at just USD 10. Traders in Tanzania benefit from mobile money options such as Vodacom M-Pesa, Airtel Money, and Tigo Pesa, as well as the availability of Islamic accounts and a Welcome Account bonus.

Frequently Asked Questions

Can I deposit/withdraw using TZS or local methods?

Yes, JustMarkets supports deposits and withdrawals using local payment methods, including local bank transfers. While TZS isn’t explicitly listed, the availability of various local options suggests you can manage funds conveniently within supported regions.

What spreads & commissions apply?

JustMarkets offers varied spreads and commissions based on account type. Standard and Pro accounts feature spreads from 0.8 pips and 0.6 pips, with no commissions. The Raw Spread account boasts spreads from 0.0 pips but incurs a commission of $3 per lot per side.

Pros and Cons

| ✓ Pros | ✕ Cons |

| High Leverage | No Investor Compensation Scheme |

| Low Minimum Deposit | Limited Educational Content |

| Supports Mobile Money in Africa | No Proprietary Platform |

| Multiple Account Types | Not Regulated by Tier‑1 Bodies |

| Copy Trading | No TZS-denominated Accounts |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

JustMarkets is a flexible, low-cost broker offering high leverage, local payment options in Tanzania, and reliable platforms. It suits both beginners and advanced traders, though it lacks top-tier regulation and investor compensation outside the EU.

7. FBS

FBS is an internationally recognized forex and CFD broker, regulated by CySEC, FSC, and FSCA. It provides access to MetaTrader 4 and 5 platforms, offers leverage up to 1:3000, and supports local mobile money payment options in Tanzania.

Tanzanian traders using FBS benefit from negative balance protection, segregated accounts, and multilingual support. These features make FBS a strong option for both local and regional forex trading.

Frequently Asked Questions

Can Tanzanian traders use FBS?

Yes, Tanzanian traders are eligible to open an account with FBS. They can easily and quickly open a live account as long as they meet the minimum deposit requirements. FBS operates in over 150 countries, including Tanzania.

Does FBS offer swap-free (Islamic) accounts?

Yes, FBS offers swap-free (Islamic) accounts. This option allows traders to avoid overnight interest charges, adhering to Sharia law principles. You can activate the swap-free feature in your Personal Area account settings for all real accounts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Very low minimum deposit | No Investor Protection Schemes |

| High leverage | Limited number of tradable instruments |

| Swap-free Islamic account | High spreads |

| Accepts Tanzanian clients | Basic Education and research tools |

| Copy trading | Offshore regulation |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FBS is a beginner-friendly broker offering low entry barriers, high leverage, and local support in Tanzania. While offshore regulation limits investor protection, features like copy trading and swap-free accounts make it a solid choice.

8. AvaTrade

AvaTrade is a globally recognized forex and CFD broker, founded in 2006 and headquartered in Dublin, Ireland. It offers services to traders in over 150 countries, including Tanzania.

Frequently Asked Questions

Does AvaTrade offer Islamic accounts?

Yes, AvaTrade offers Islamic accounts, also known as swap-free accounts. These accounts are specifically designed to comply with Sharia law, ensuring that Muslim clients can trade without incurring or paying overnight interest (swaps).

Does AvaTrade allow copy trading?

Yes, AvaTrade fully supports copy trading through its proprietary AvaSocial app. This innovative platform allows clients to connect with, follow, and automatically replicate the trades of experienced traders. Additionally, AvaTrade integrates with third-party copy trading services like DupliTrade.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Well-Regulated | Limited Support for Local Currencies |

| Commission-Free Trading | Inactivity Fees |

| Multiple Platforms | No ECN/STP Execution |

| Islamic Account | No Variable Spreads |

| Beginner-Friendly | Slow Withdrawal Processing |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a well-regulated broker offering commission-free trading, multiple platforms, and a wide range of CFDs. It suits both beginners and experienced traders, though local currency support and inactivity fees may be drawbacks.

9. Tickmill

Tickmill, founded in 2014, offers Tanzanian traders low‑cost CFD and forex trading via MT4/MT5. With $100 minimum deposit, Islamic account, tight spreads, regulation by FCA, CySEC, FSCA, and no TZS‑denominated accounts, it suits both retail and pro traders.

Frequently Asked Questions

Does Tickmill support Tanzanian traders?

Yes, Tickmill does support Tanzanian traders. They are onboarded through Tickmill’s Seychelles-based entity (Tickmill Ltd), which is regulated by the Financial Services Authority (FSA). Tanzanian clients benefit from segregated funds and negative balance protection.

Does Tickmill offer copy trading?

Yes, Tickmill offers copy trading through its proprietary Tickmill Social Trading platform. This allows traders to either become “Strategy Providers” and share their trades for a fee or become “Followers” and automatically copy the strategies of successful traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly Regulated | No Local TZS Accounts |

| Low Spreads | Limited CFDs on Stocks |

| Commission-Free Classic Account | No Proprietary Platform |

| Islamic Account Option | Inactivity Fee |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a reliable, well-regulated broker offering low spreads, fast execution, and strong safety measures. It suits both beginners and professionals, though it lacks local TZS accounts and native copy trading features.

10. FXTM

FXTM offers Tanzanian traders access to MT4/MT5 and proprietary FXTM Trader, with minimum deposit $200, tight spreads from 0.0 pips, leverage up to 1:2000, Islamic accounts, negative balance protection, and local support options (e‑wallets, M‑Pesa).

Frequently Asked Questions

Does FXTM offer Islamic accounts?

Yes, FXTM offers swap-free Islamic accounts that adhere to Sharia law principles. These accounts eliminate overnight interest charges. While generally free of swaps, some instruments or positions held beyond a certain period might incur a fixed financing fee.

Can Tanzanian traders open accounts?

Yes, Tanzanian traders can open accounts with FXTM. They are onboarded through FXTM’s Mauritius-based entity. While this provides higher leverage, it’s important to note that the regulatory oversight may differ from other jurisdictions. FXTM also supports TZS for deposits and withdrawals via local solutions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated Globally | No TZS Account |

| Multiple Account Types | Higher Minimum Deposits |

| Competitive Spreads | Commission Fees |

| Local Payment Options | Withdrawal Fees |

| High Leverage | Limited Cryptocurrency CFDs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a well-regulated broker offering diverse account types, competitive spreads, high leverage, and Islamic accounts. It suits traders worldwide, including Tanzania, though it lacks TZS accounts and may charge commissions on ECN trades.

Is Forex Trading Legal and Popular in Tanzania?

Yes, forex trading is legal and approved in Tanzania. It is regulated by the Capital Markets and Securities Authority (CMSA), ensuring that licensed brokers operate within legal and legit financial guidelines.

While still growing, forex trading is becoming increasingly popular among Tanzanian retail traders, especially due to access to mobile trading, high leverage, and global brokers.

Criteria for Choosing a Forex Broker in Tanzania

| Criteria | Description | Importance |

| Regulation & License | Broker should be regulated by reputable authorities (e.g., FCA, FSCA, CySEC) and approved by CMSA. | ⭐⭐⭐⭐⭐ |

| Local Payment Methods | Support for M-Pesa, mobile banking, or local bank transfers makes funding easier. | ⭐⭐⭐⭐☆ |

| TZS Account or Support | Ability to deposit in Tanzanian Shillings or get conversion friendly accounts. | ⭐⭐⭐☆ |

| Spreads & Commissions | Lower trading costs via tight spreads and low or no commissions. | ⭐⭐⭐⭐☆ |

| Minimum Deposit | Affordable minimum deposit suited to local economic conditions. | ⭐⭐⭐⭐☆ |

| Leverage Options | Flexible leverage (e.g., up to 1:1000) for both beginner and advanced strategies. | ⭐⭐⭐⭐☆ |

| Islamic Account Option | Swap-free (Sharia compliant) accounts for Muslim traders. | ⭐⭐⭐☆ |

| Trading Platforms | Access to user friendly, stable platforms like MT4, MT5, and mobile apps. | ⭐⭐⭐⭐⭐ |

| Customer Support | Responsive support with options for Swahili or local timezone assistance. | ⭐⭐⭐⭐☆ |

| Education & Tools | Broker should offer training, webinars, and analysis tools for beginners. | ⭐⭐⭐⭐☆ |

What Real Tanzanian Traders Want to Know

Q: Is forex trading regulated in Tanzania? – Asha M. (Dar es Salaam)

A: While Tanzania’s financial authorities mainly focus on local financial institutions, direct forex broker regulation for international brokers is limited. Tanzanian traders often use brokers regulated by reputable international bodies which offer client fund segregation and negative balance protection.

Q: Can I deposit and withdraw funds using local Tanzanian methods like M-Pesa or local bank transfers? – Juma K. (Arusha)

A: Many international brokers popular in Tanzania offer local payment solutions. Some brokers directly support TZS accounts or facilitate deposits/withdrawals via local bank transfers or mobile money services like M-Pesa, Tigo Pesa, or Airtel Money, making transactions convenient.

Q: What is the minimum deposit required to start forex trading with a reputable broker? – Neema S. (Dodoma)

A: Minimum deposits vary significantly. Many brokers cater to beginners with low minimums, sometimes as low as $5, $10, or $50 for standard or cent accounts. This allows traders to start with a smaller capital outlay.

Q: As a Muslim trader, can I get a swap-free or Islamic account that complies with Sharia law? – Baraka O. (Mwanza)

A: Yes, most reputable international forex brokers offer swap-free or Islamic accounts. These accounts eliminate overnight interest charges (swaps) on positions held open, adhering to Islamic finance principles. You typically need to request this account type after opening a standard account.

Q: Which trading platforms are best and widely supported by brokers available in Tanzania? – Sophia L. (Zanzibar)

A: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most popular and widely supported platforms. They are available on desktop, web, and mobile (Android/iOS), offering advanced charting, analytical tools, and support for automated trading (Expert Advisors).

In Conclusion

Forex brokers available in Tanzania offer access to global markets with regulated platforms, competitive spreads, and local payment options. While TZS accounts are rare, many brokers provide Swahili support, Islamic accounts, and beginner-friendly tools.

You Might also Like:

- Exness Review

- XM Review

- Pepperstone Review

- HFM Review

- Axi Review

- JustMarkets Review

- FBS Review

- AvaTrade Review

- Tickmill Review

- FXTM Review

Faq

While direct Swahili support might be limited, many international brokers offer multilingual customer support, often including English, 24/5. Some brokers with a strong presence in Africa might have local representatives or dedicated support channels for African traders.

Yes, most reputable brokers offer extensive educational resources. These typically include webinars, e-books, video tutorials, articles, and demo accounts. These resources are crucial for beginners to understand forex fundamentals, strategies, and risk management.

Many brokers provide copy trading or social trading features, either through their proprietary platforms (like AvaSocial, Tickmill Social) or integration with third-party services (e.g., ZuluTrade, Myfxbook AutoTrade). This allows traders to follow and automatically copy the trades of experienced investors.

Leverage varies by broker and the regulatory entity serving Tanzanian clients. It can range from 1:500 to even 1:3000. While high leverage can amplify profits, it also significantly increases the risk of substantial losses, making risk management essential.