HFM Minimum Deposit Review

HFM Minimum Deposit amount required to register a live trading account will range between 0 USD and 250 USD, depending on the live trading account type chosen. HFM offers 5 different live trading account types.

★★★★★ | Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes |

Account Categories and Starting Deposits

Whether you’re a first-time trader or a seasoned pro, HFM offers a range of trading accounts with varied starting deposits, spreads, leverage options, and execution features. From cent-based beginners to raw-spread professionals, there’s an account for everyone.

Cent Account

Trading with HFM’s Cent Account gives you a real-market experience at a fraction of the cost. Designed for beginners and strategy testers, it offers ultra-low capital requirements, swap-free flexibility, and access to Forex and Gold – all with no commission.

What instruments can I trade with the HFM Cent Account?

Cent Account holders can trade Forex pairs and Gold, giving them access to two of the most liquid and popular markets without needing to invest large amounts of capital.

Is the HFM Cent Account suitable for new traders?

Yes. With a $0 minimum deposit and micro trade sizes, the Cent Account allows new traders to gain real-market exposure with minimal risk — an ideal bridge from demo to live trading.

Zero Account

HFM’s Zero Spread Account offers direct market access with no hidden spreads, zero minimum deposit, and swap-free flexibility. With leverage up to 1:2000 and low commissions, this account is built for precision, speed, and transparency.

What instruments can I trade on the HFM Zero Account?

Traders can access all available instruments on the Zero Account, including Forex and Gold. Raw spreads are available on specific symbols, giving access to deep liquidity with minimal cost.

What makes the Zero Account ideal for serious traders?

Its key edge is the raw, super-tight spreads with no markup, combined with ultra-low commissions from $3 per lot and high leverage. It’s perfect for traders who prioritize accuracy and low-cost execution.

Pro Account

The HFM Pro Account delivers low spreads from just 0.5 pips, no commission fees, and leverage up to 1:2000. Built for experienced traders, it offers the power to scale up without compromising on cost-efficiency or flexibility.

What instruments can I trade on the Pro Account?

All available instruments on HFM – including Forex, commodities, indices, and more – are accessible through the Pro Account, giving traders full exposure to diverse global markets within one cost-effective and powerful account type.

What are the key benefits of the HFM Pro Account?

The Pro Account offers ultra-low spreads starting from 0.5 pips, swap-free options, no commissions, and high leverage. It’s an ideal choice for seasoned traders seeking enhanced control with reduced trading costs.

Pro Plus Account

HFM’s Pro Plus Account is crafted for professionals who demand peak performance. With spreads from 0.2 pips, leverage up to 1:2000, and swap-free options, this account is built for scale, speed, and serious strategy execution.

What are the advantages of the Pro Plus Account?

Traders benefit from ultra-tight spreads starting from 0.2 pips, market execution, no swap fees (on eligible instruments), and high leverage – all packaged into an account optimized for serious and high-volume trading.

What is the minimum deposit for the Pro Plus Account?

To open a Pro Plus Account, traders need to deposit a minimum of $250 or R4,700. This starting point balances accessibility with enhanced trading conditions for those ready to elevate their market presence.

Premium Account

HFM’s Premium Account is ideal for everyday traders seeking a cost-effective, swap-free option. With no minimum deposit, market execution, and spreads from just 1.2 pips, it offers a powerful yet straightforward entry into live trading.

What are the advantages of the Premium Account?

The Premium Account offers swap-free trading, no commissions, spreads from 1.2 pips, and access to all major platforms, without requiring a minimum deposit. It’s a great fit for traders who want simplicity and flexibility without sacrificing features.

What is the minimum deposit for the Premium Account?

There’s no minimum deposit required to open a Premium Account. Traders can start with any amount, making this account one of the most accessible live trading options for beginners and budget-conscious retail traders.

★★★★★ | Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes |

How to Open an HFM Account

1. Step 1: Click “Register”

Start by visiting the HFM homepage and clicking on the “Register” button at the top right. You will be prompted to enter your details.

2. Step 2: Complete Your Account Profile

Fill in all the required fields in your account profile to proceed with the registration process.

3. Step 3: Upload Required Documents

After completing your profile, you’ll need to upload the necessary documents for verification.

Once your account is verified, typically within minutes, you will receive an email confirmation. You can then choose your preferred trading platform to begin trading.

★★★★★ | Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes |

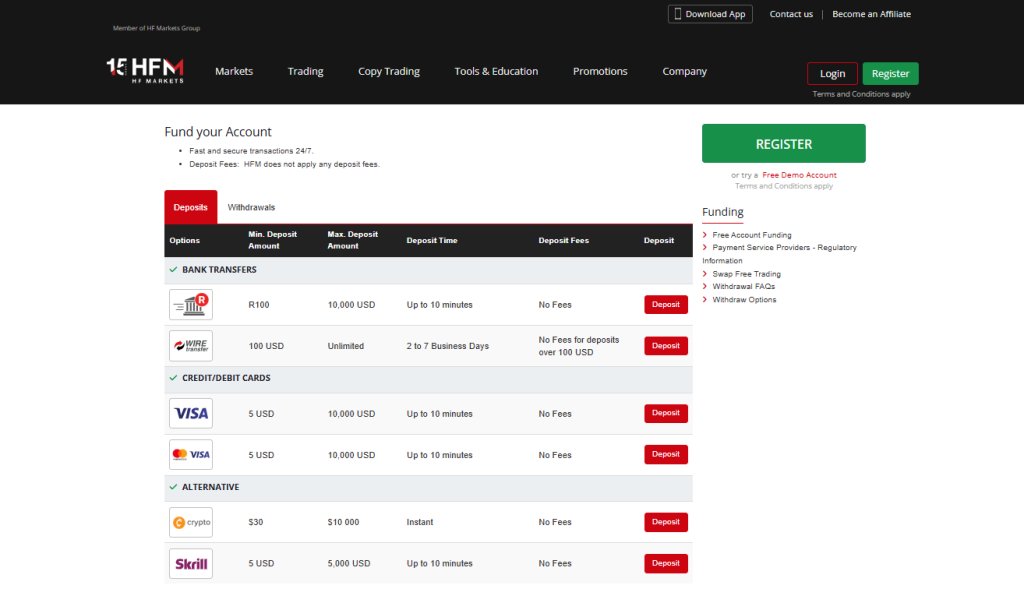

Deposits and Withdrawals

HFM ensures a seamless funding experience with 24/7 deposits and withdrawals, zero internal fees, and multiple trusted methods. Traders benefit from fast transaction times, transparent terms, and high-level payment security across local and international options.

Frequently Asked Questions

What deposit options does HFM offer?

HFM supports bank transfers, credit/debit cards, and alternative methods. Most deposits are instant or within 10 minutes, and the broker charges no deposit fees regardless of the method or amount used.

Are there fees or delays with HFM withdrawals?

HFM charges no withdrawal fees. Processing times vary: card withdrawals can take up to 10 days, bank transfers 1–10 business days, and alternative methods may complete within minutes to 24 hours, depending on the provider.

Our Insights

HFM offers reliable and fee-free funding options with fast processing times. Whether using local bank transfers or digital wallets, clients enjoy flexibility, strong security standards, and 24/7 access to manage their funds efficiently.

★★★★★ | Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the HFM minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open an HFM account? – Thabo, South Africa

A: HFM’s minimum deposit depends on the account type. Cent, Zero, and Premium accounts have no fixed minimum deposit, allowing you to start trading with as little as USD 5 or the equivalent in your local currency. The Pro Account typically requires around USD 100.

Q: How quickly can I withdraw funds from HFM? – Amina, Durban, South Africa

A: Withdrawal times vary depending on the method. E-wallets such as Skrill or Neteller are usually processed instantly or within 24 hours. Credit and debit card withdrawals can take between 2 and 10 business days, while bank or wire transfers generally take between 2 and 10 business days, sometimes as quickly as 1 to 3 days for local transfers.

Q: Does HFM charge fees for deposits or withdrawals? – Oliver, Germany

A: HFM does not charge any fees on deposits or withdrawals. However, third-party institutions such as banks or payment processors may apply their own transaction or conversion fees.

Q: Can I withdraw profits to a different method than my deposit method? – Fatima, UAE

A: Yes, but anti-money laundering regulations require that your original deposit amount be returned to the same method used to fund the account. Profits exceeding the deposit amount can be withdrawn using an alternative registered payment method in your name.

★★★★★ | Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-regulated and globally trusted | No U.S. clients accepted |

| Tight spreads from 0.0 pips | Limited bonus availability in some regions |

| Free VPS and Copy Trading options | Withdrawal processing may vary by method |

| Beginner-friendly with Cent and Demo accounts | No crypto deposits supported |

| 24/5 multilingual customer support | Some advanced tools limited to MT5 |

You might also like:

In Conclusion

HFM offers flexible minimum deposit options, starting from 0 USD up to 250 USD, depending on the account type. With five diverse live account choices, traders of all levels can enjoy tailored features, competitive conditions, and seamless funding, making HFM a versatile and accessible broker for global markets.

Faq

HFM has a specialized compliance staff that handles deposit issues. The card issuer normally handles credit card disputes; extra documents may be required to resolve the dispute.

HFM’s low or no minimum deposit might be advantageous for scalpers starting off with low capital. However, ensure your account type and deposit method are compatible with scalping’s high-frequency trading.

Yes, you can change your deposit method from the HFM account dashboard at any moment. This flexibility lets you adjust to shifting objectives or take advantage of various deposit specials.