Pepperstone Minimum Deposit Review

A Minimum Deposit of AU$10 is required to open a Pepperstone account. Pepperstone offers access to 2 live trading accounts, Standard and Razor.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Tailored Trading Accounts and Tools

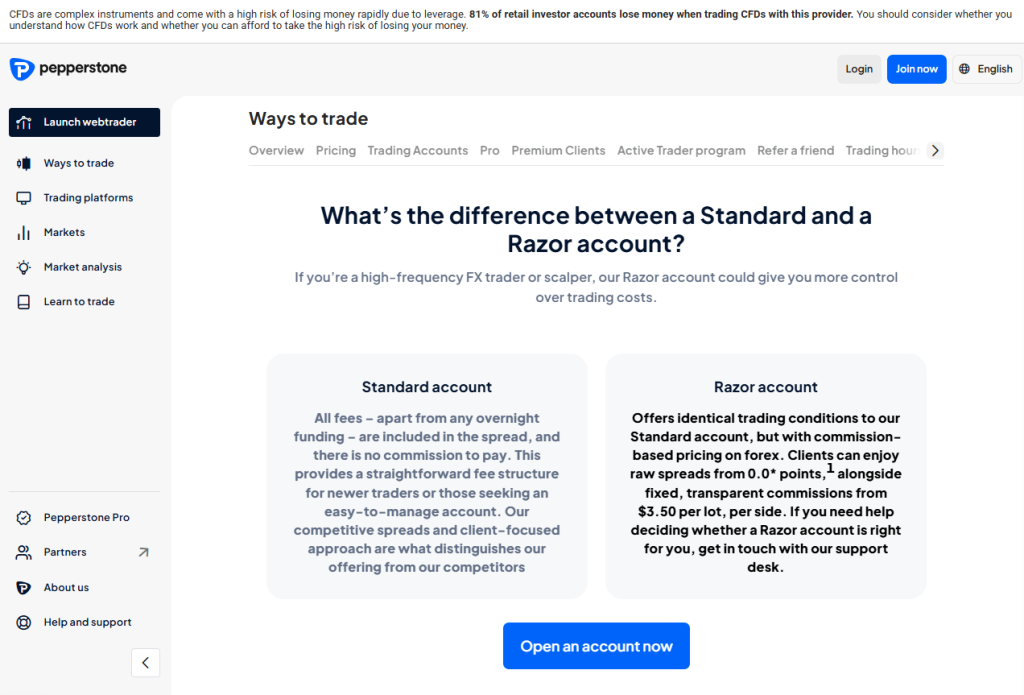

Pepperstone offers customized trading accounts designed for different strategies and skill levels. With ultra-competitive spreads, low minimum deposits, and access to five top-tier platforms, traders can choose between the simplicity of Standard accounts or the precision of Razor accounts.

Bolstered by risk management tools and 24/5 customer support, the platform ensures a smooth and efficient trading experience.

Frequently Asked Questions

What are the main differences between Pepperstone’s Standard and Razor accounts?

The Standard account is perfect for beginners, featuring no commissions and spreads starting from 0.4 pips. The Razor account caters to high-frequency traders and scalpers, with raw spreads from 0.0 pips and low, fixed commissions starting at $2.96 per lot, per side. Both account types provide access to the same markets and platforms.

Can I trade all available instruments on any Pepperstone account?

Yes, regardless of whether you choose Standard or Razor, you’ll have access to a wide range of 1,444 instruments, including 93 forex pairs, 26 indices, 40 commodities, 1,162 shares, and 95 ETFs.

Both account types support trading on MetaTrader 4/5, cTrader, TradingView, and Pepperstone’s proprietary platform.

Our Insights

Pepperstone offers versatile account types that cater to both beginner and experienced traders. With clear pricing, advanced platform choices, and institutional-grade spreads, traders enjoy a strong infrastructure and global support.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

How to Open a Pepperstone Account

1. Step 1: Register Online

Visit the Pepperstone website and click “Join Now.” Sign up using your email address and create a secure password. You can also explore the platform first using a free demo account.

2. Step 2: Complete the Application

Answer a few questions about your trading experience and financial background. This is to assess your suitability for trading leveraged products and ensure compliance with regulatory requirements.

3. Step 3: Verify Your Identity

Upload valid identification documents (such as a passport or national ID) and proof of address. Pepperstone prioritizes your safety and complies with international financial security standards.

4. Step 4: Choose an Account Type

Select between the Standard and Razor CFD accounts:

- Standard: No commission, all fees built into the spread – ideal for beginners.

- Razor: Raw spreads from 0.0 pips with low commissions – designed for scalpers and high-frequency traders.

5. Step 5: Fund Your Account

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the Pepperstone minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open a Pepperstone account? – Lucas, Brazil

A: Pepperstone requires a minimum deposit of 200 USD (or equivalent in other currencies), providing an accessible entry point for new traders to access both Standard and Razor account types across multiple platforms.

Q: How quickly can I withdraw funds from Pepperstone? – Aisha, UAE

A: Withdrawal requests are typically processed within 1–2 business days. E-wallets and card transfers are often completed within hours, while bank wire transfers may take 1–5 business days, depending on your bank and location.

Q: Does Pepperstone charge fees for deposits or withdrawals? – Mark, Canada

A: Pepperstone does not charge any fees on deposits or withdrawals. However, third-party payment providers such as banks or e-wallets may apply their own transaction or conversion fees.

Q: Can I withdraw profits to a different method than my deposit method? – Priya, India

A: Anti-money laundering regulations require that deposits be returned to the same funding method. Profits exceeding the deposited amount can be withdrawn using another previously registered method in your name.

Q: What perks come with signing up at Pepperstone? – John, UK

A: Pepperstone offers ultra-tight spreads, fast execution via Equinix servers, multiple platforms including MT4, MT5, and cTrader, Islamic accounts, leverage up to 1:500, commission-free Standard accounts, low-cost Razor accounts, and demo accounts, providing excellent value for beginners and professional traders alike.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| There is no initial minimum deposit to register an account | Pepperstone charges currency conversion fees |

| Various deposit methods can be used to fund accounts | There are limited crypto payment options compared to competitors |

| Pepperstone accepts several major currencies for deposits | Bank wire transfers can take up to 7 days |

References:

In Conclusion

Pepperstone allows traders to start with a 200 USD minimum deposit across Standard and Razor accounts. With fast withdrawals, zero deposit fees, multiple platforms, and competitive spreads, the broker provides flexible options for both new and experienced traders seeking reliable and efficient Forex and CFD trading.

Faq

Pepperstone’s $0 minimum deposit does not directly influence leverage choices, as regulatory regulations and account types govern them.

No. Although Pepperstone accepts several currencies, each account is usually denominated in a single base currency. You can deposit in various currencies, but they will be translated to your account’s base currency, which may result in conversion costs.

While Pepperstone provides flexible deposit options with no minimum balance, withdrawals may be subject to more severe verification procedures and costs. Withdrawals are normally returned to the original funding source wherever feasible.

No. Pepperstone does not normally set maximum deposit limitations for accounts. However, significant deposits may necessitate additional anti-money laundering (AML) compliance documents and may be subject to scrutiny.